- Bitcoin’s Spot ETF section is heating up, with Bitwise’s newest software the newest instance

- Submit-festive season flows look to be adopting a optimistic shift after latest ETF outflows

2024 has arguably been one of the vital attention-grabbing years for Bitcoin in its complete historical past. May 2025 be simply nearly as good? ETFs have been the largest liquidity drivers since their approval and the most recent Bitwise growth may sign extra pleasure within the subsequent 12 months.

Bitwise has reportedly filed for a Bitcoin customary company or firm ETF. Particulars revealed that the newly filed ETF will primarily give attention to investing in firms that personal a considerable quantity of Bitcoin. In truth, preliminary particulars of the submitting revealed that firms within the ETF should maintain a minimum of 1,000 BTC.

Different particulars of the submitting embrace a marketcap of not lower than $100 million and over $1 million in day by day liquidity. Personal inventory holdings also needs to not exceed 10%.

How may such a growth have an effect on the general market and notion of Bitcoin although?

The brand new Bitwise ETF submitting underscores the speedy embrace of Bitcoin by the institutional class. Corporations holding Bitcoin may find yourself showing extra interesting and this might support in attracting extra liquidity to such companies. This might doubtlessly encourage extra institutional liquidity to stream in that course.

Bitcoin ETFs push again into optimistic after the festive season

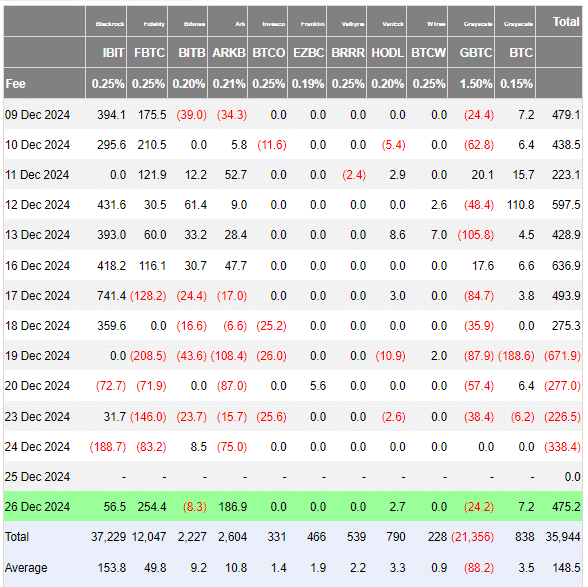

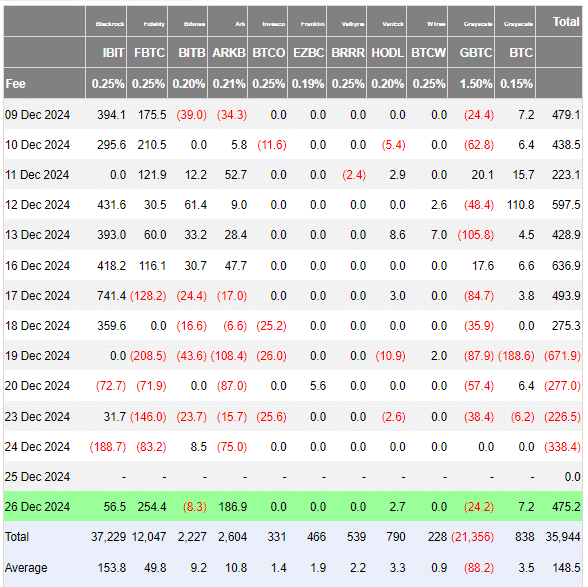

Bitcoin ETFs had a wholesome bullish begin earlier within the month, however leaned into the unfavourable facet as the vacations drew nearer. In truth, day by day flows remained within the inexperienced as much as 18 December, after which the Bitcoin ETF flows shifted to sustained outflows till 24 December.

Supply: Farside.co.ke

Bitcoin ETFs assumed optimistic flows after the festive season on 26 December. $475.2 million in inflows have been seen throughout that timeframe, doubtlessly signaling the return of demand. Constancy and Ark Make investments had contributed to the lion’s share of that demand.

Are the ETF inflows on Boxing day a mirrored image of the demand available in the market although? Effectively, a vacation sell-off was extremely possible and anticipated provided that BTC had been having fun with a sturdy rally. Vacation spending dictated that some profit-taking was sure to happen.

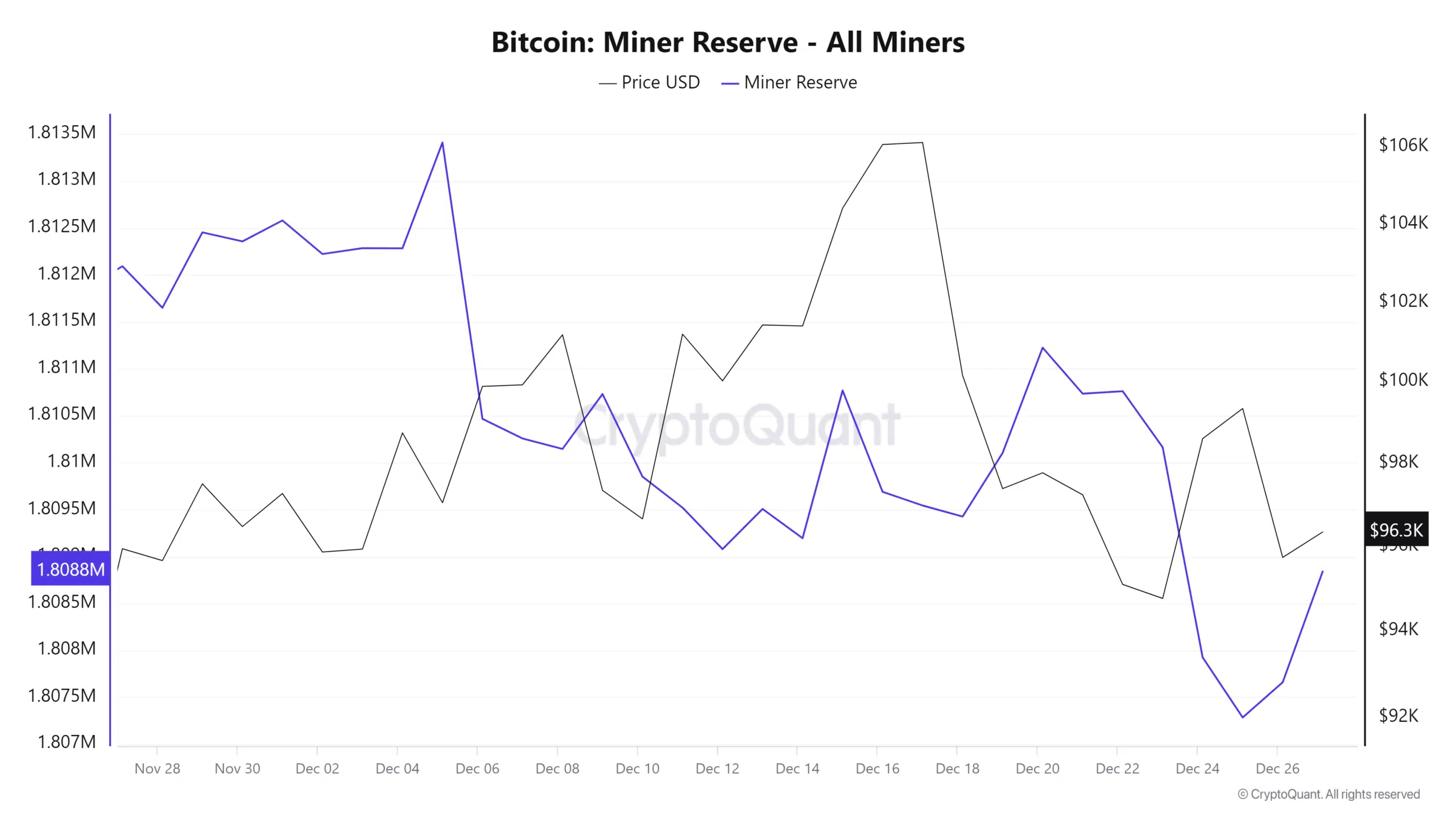

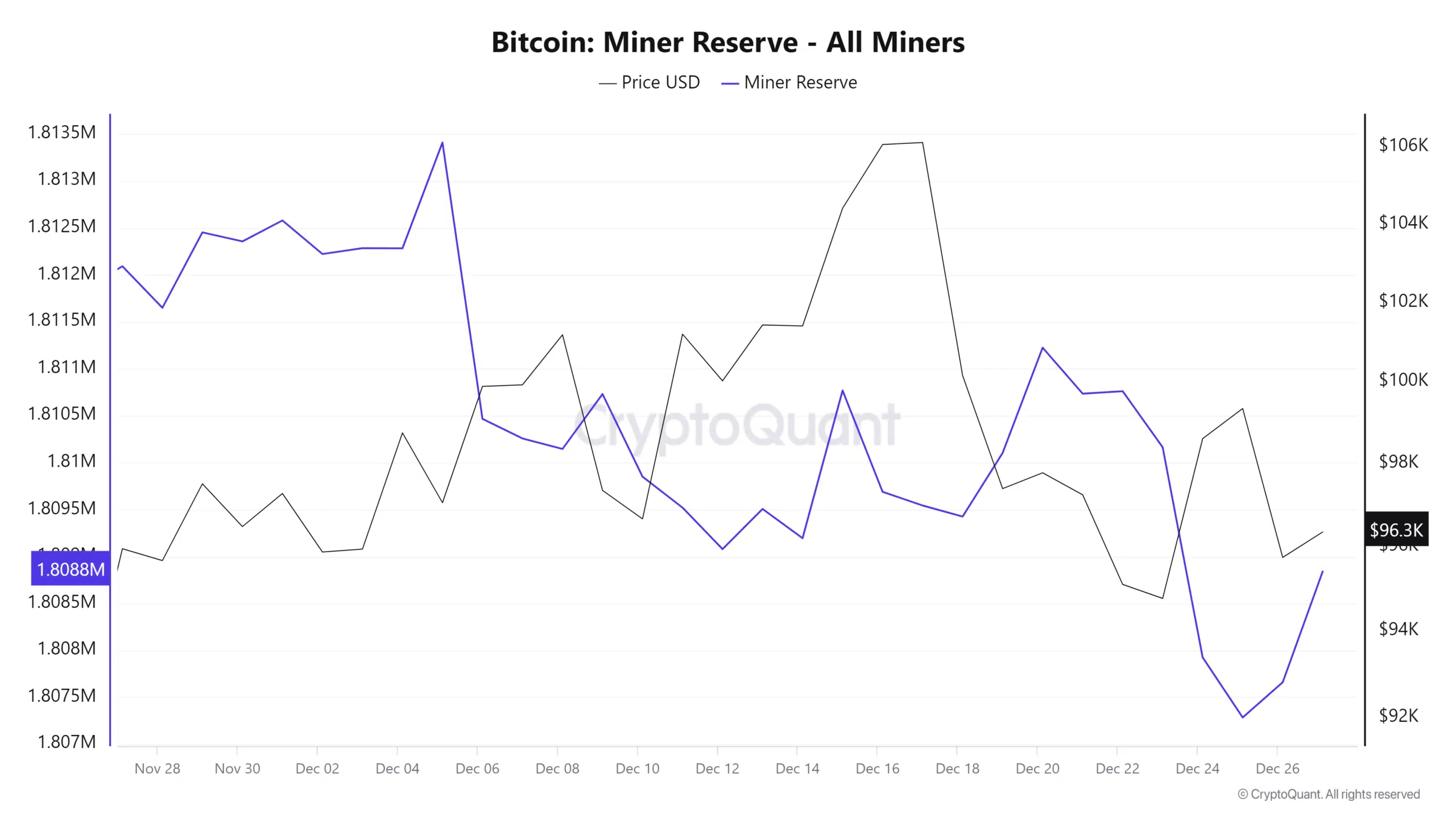

Miners play an important function within the Bitcoin ecosystem and BTC miner reserves supply some insights into the state of demand. Miner reserves have been unfavourable for the final 6 days, in step with ETF outflows.

Supply: CryptoQuant

Miner outflows turned optimistic on 25 December, leaping from 1.897 million BTC to 1.808 million BTC, as of the final 24 hours.

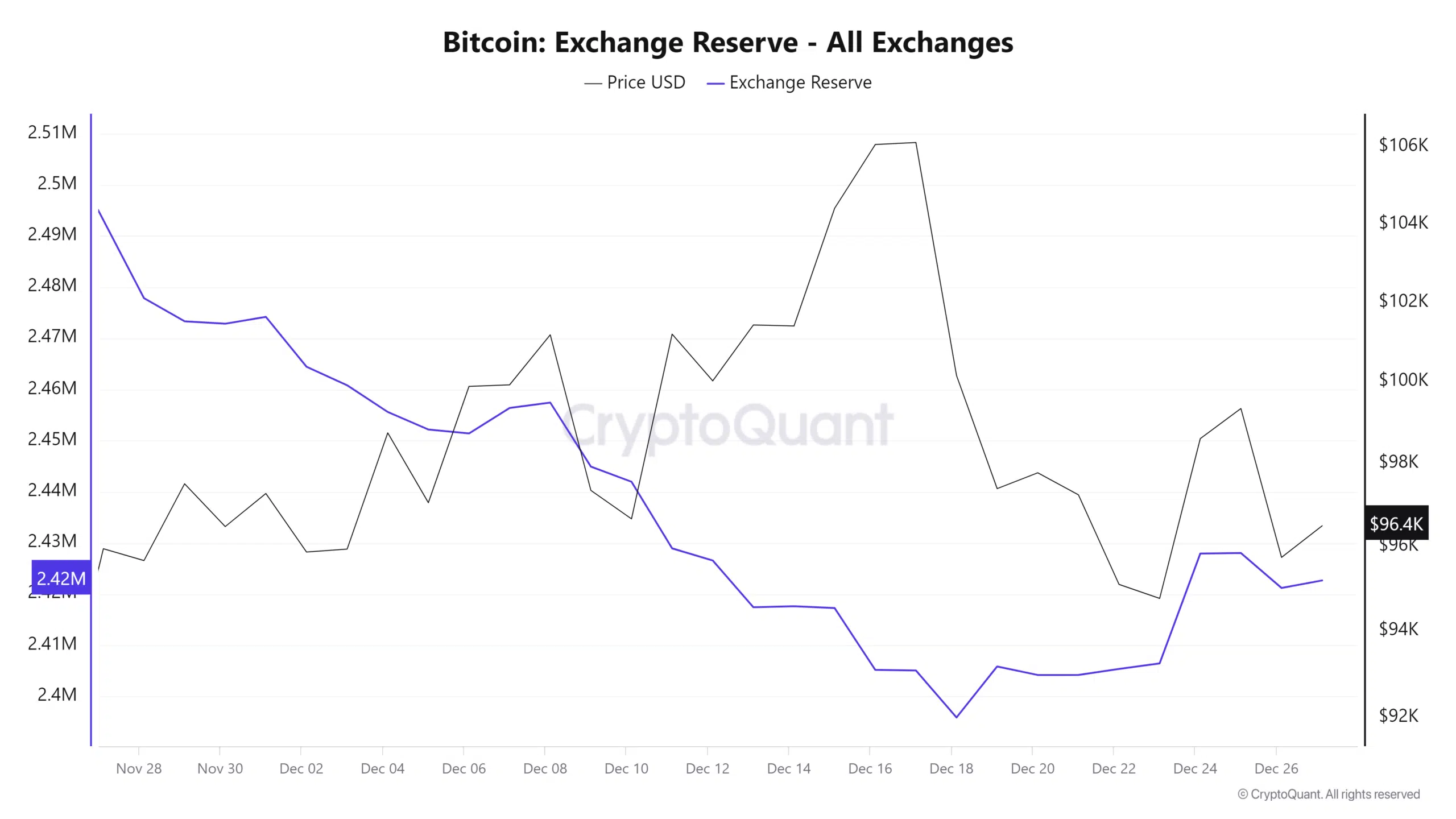

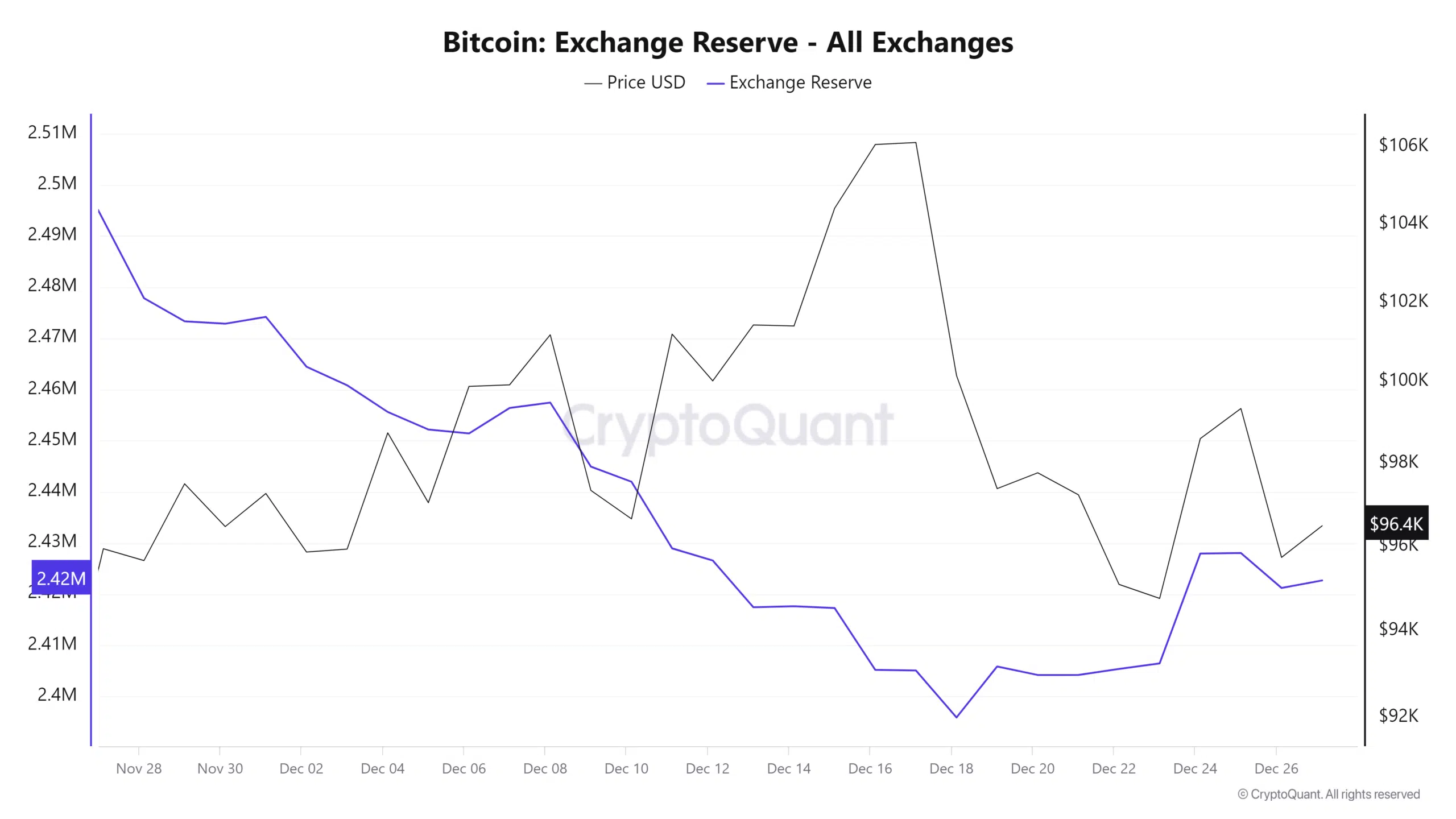

Bitcoin alternate reserves additionally painted a clearer image of the demand and promote strain that has prevailed over the previous few months. For context, alternate reserves within the final 30 days dipped from 2.493 million BTC on 27 November to a month-to-month low of two.395 million BTC on 18 December.

supply: CryptoQuant

Lastly, Bitcoin alternate reserves grew to 2.428 million on 25 December, earlier than dipping to 2.422 million BTC two days later. This confirmed that the cryptocurrency has been experiencing promote strain through the holidays. Nonetheless, that promote strain might have declined over the past 24 hours.

Briefly, vacation promote strain might have already run its course and will doubtlessly be paving the way in which for sturdy demand resurgence.