The crypto market is ending the 12 months on a powerful notice as a document $18 billion price of choices contracts are set to run out.

Choices permit merchants to invest or hedge towards worth actions. A name choice grants the precise to purchase an asset at a selected worth, whereas a put choice offers the precise to promote beneath comparable phrases.

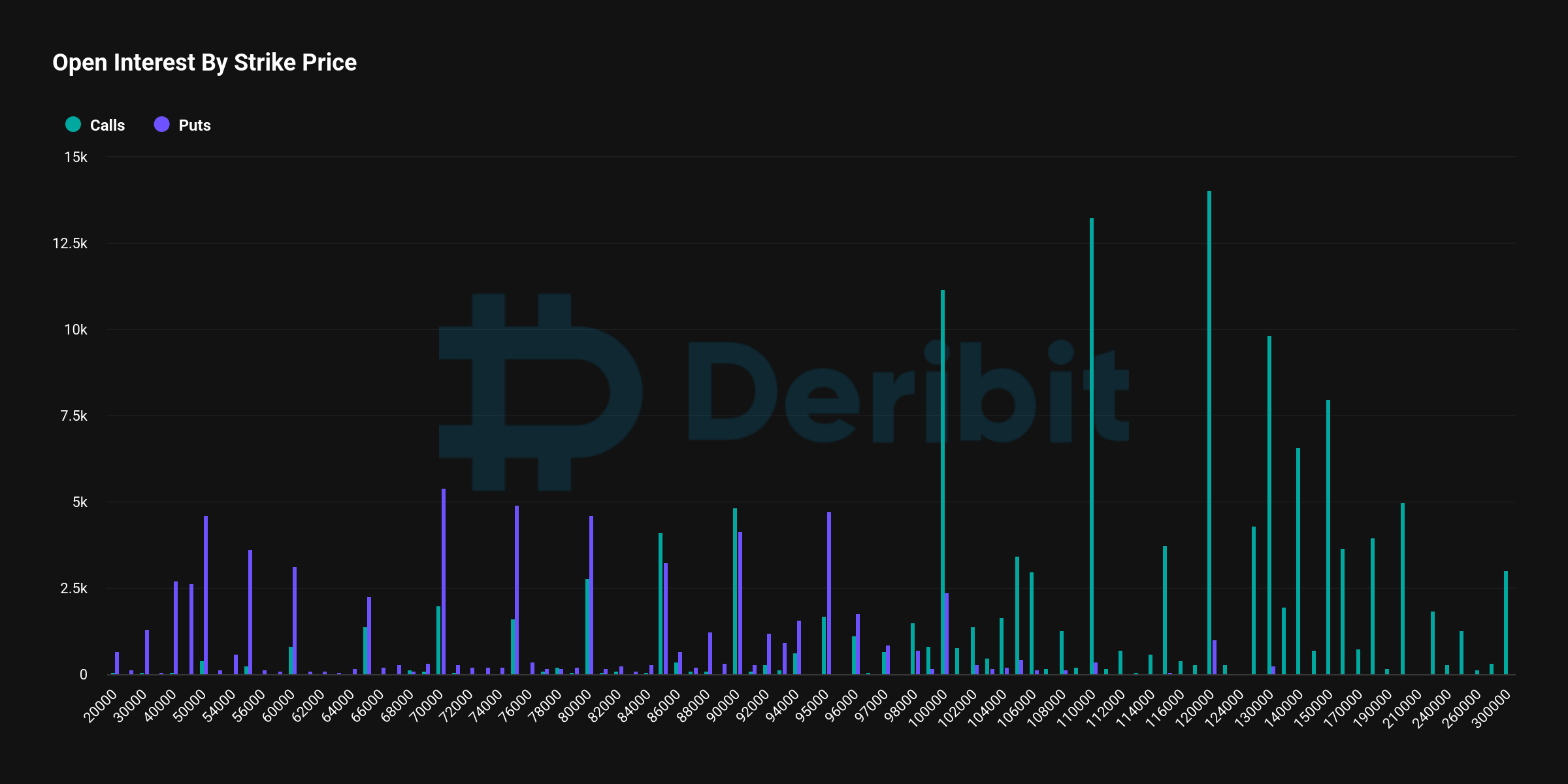

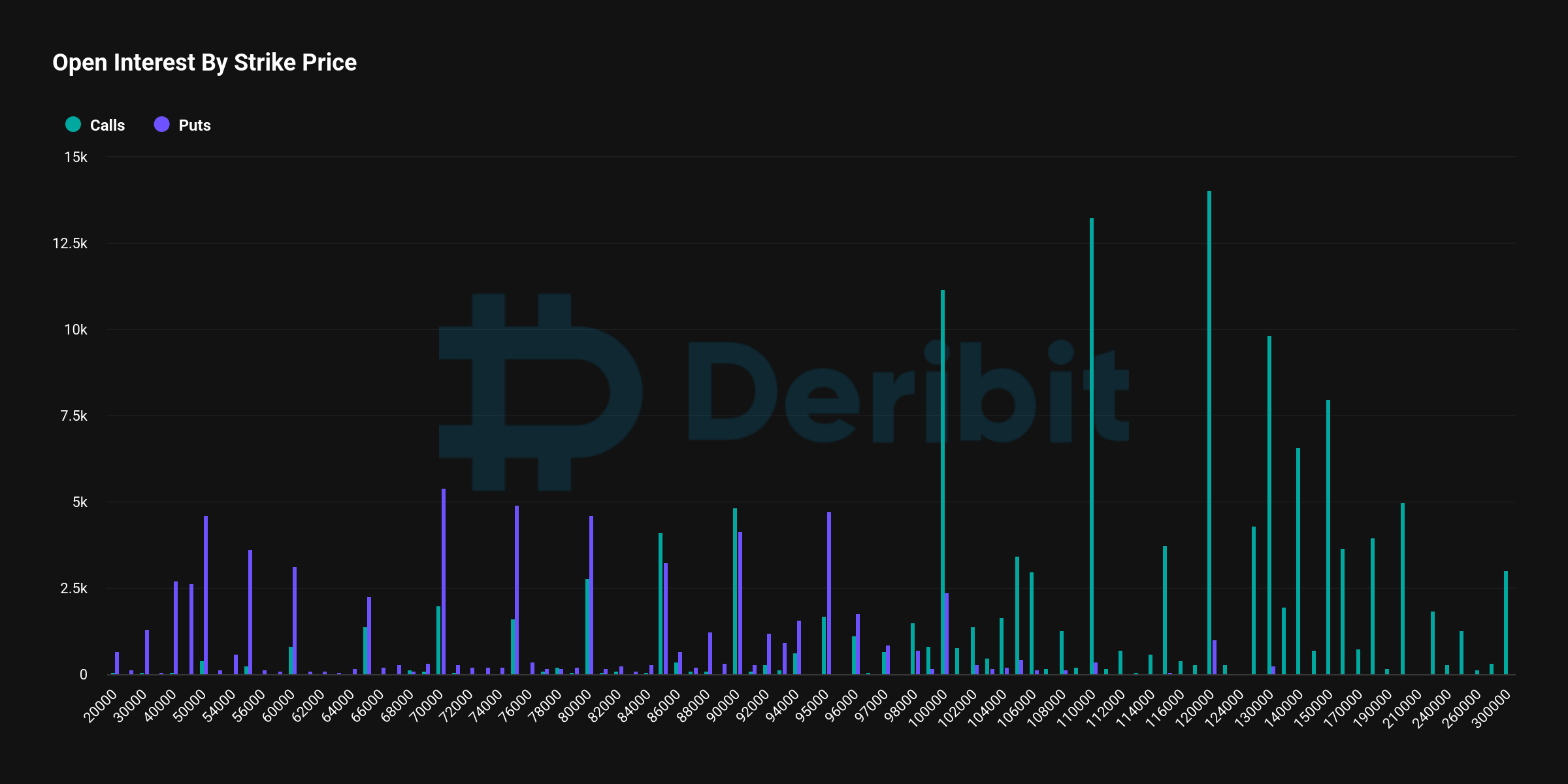

Knowledge from Deribit reveals that just about 150,000 Bitcoin (BTC) contracts—valued at $14.17 billion—are concerned on this expiry.

These contracts present a Put-Name Ratio of 0.69, that means bullish merchants dominate as they guess on increased costs. The Max Ache degree, the place most patrons face losses and sellers revenue, is $85,000.

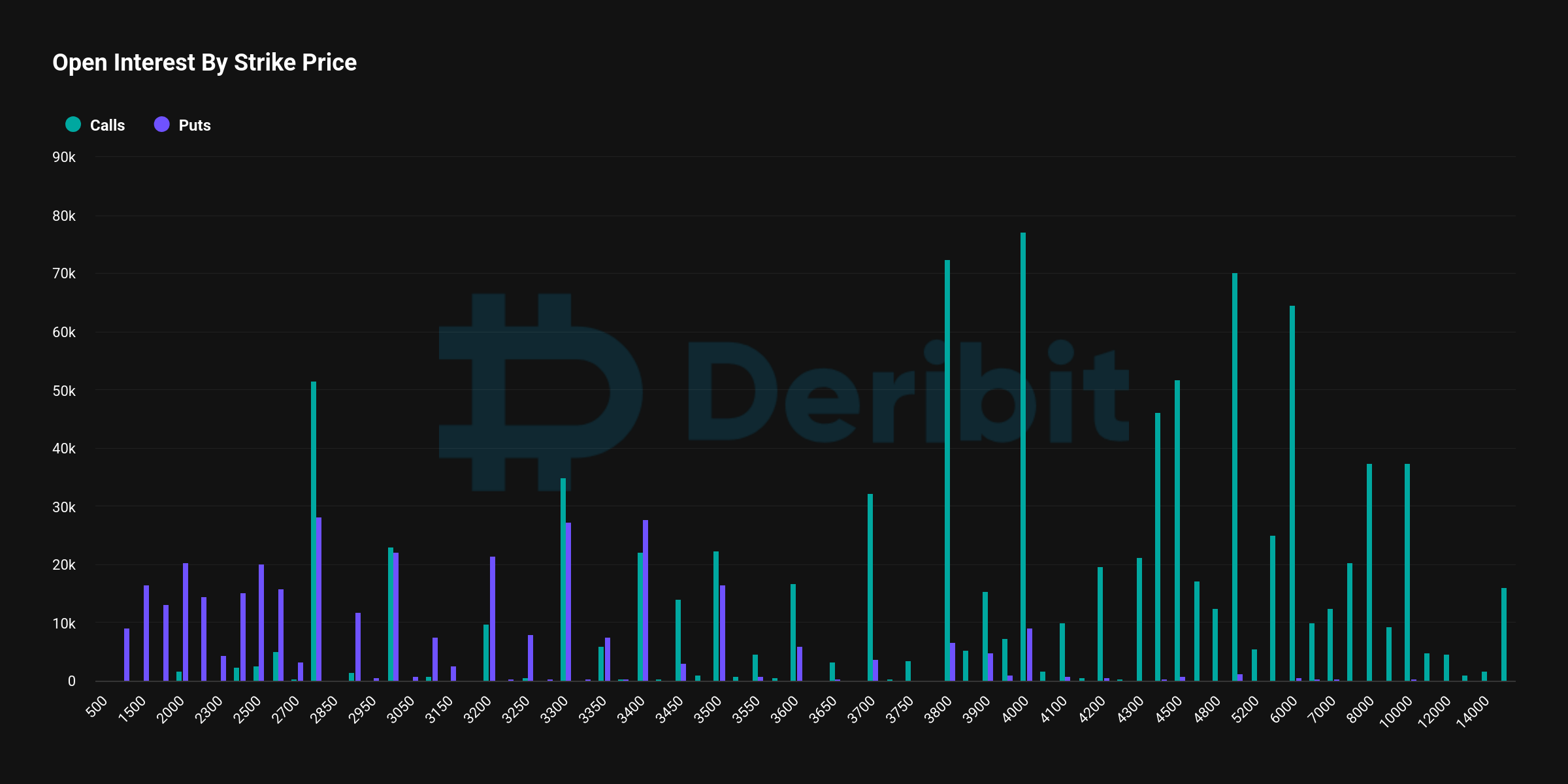

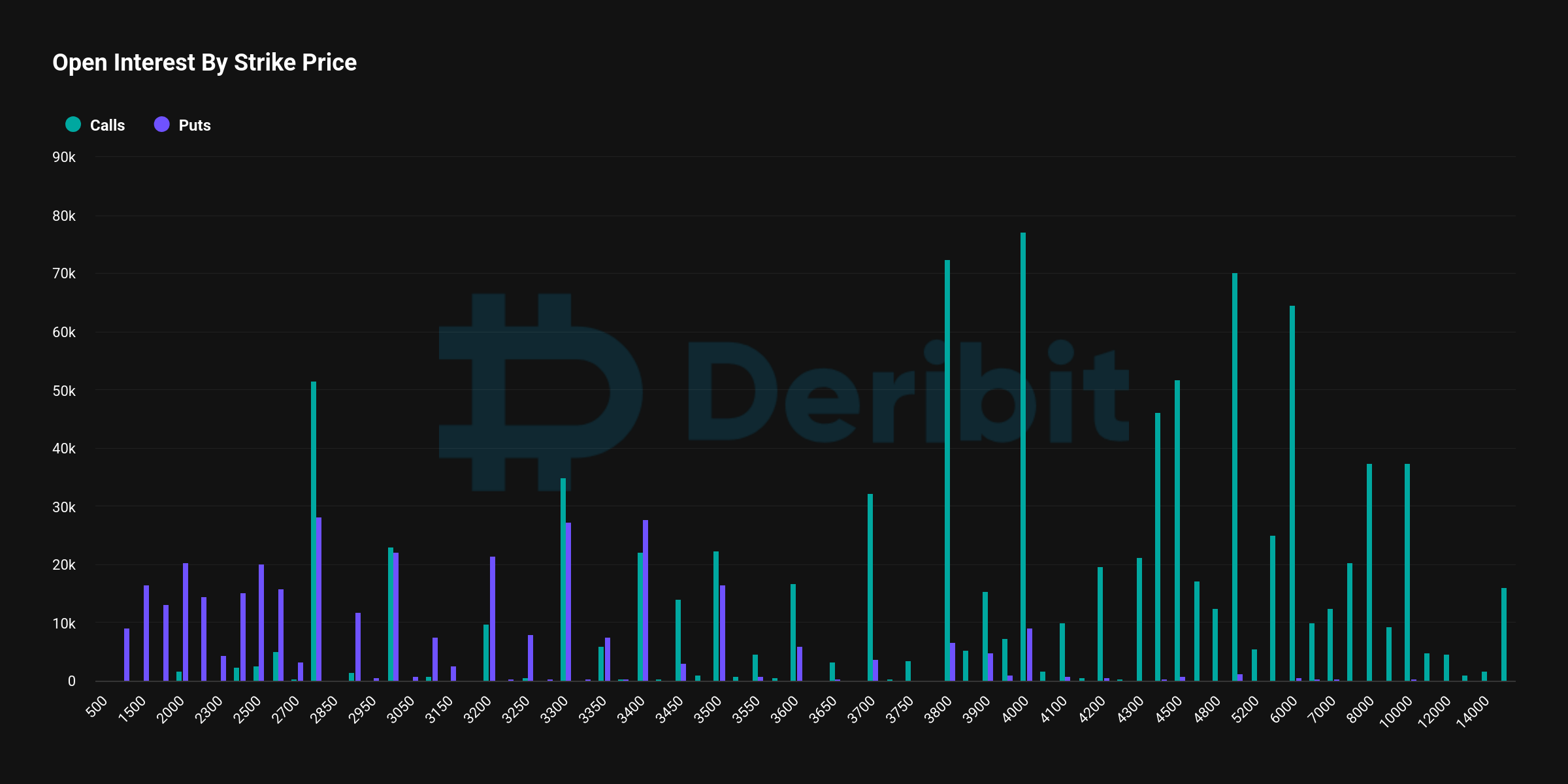

Ethereum (ETH) choices are additionally experiencing vital exercise, with 1.12 million contracts expiring. These contracts, carrying a mixed worth of over $3 billion, replicate a bullish market outlook with a Put-Name Ratio of 0.41. The utmost ache worth is $3,000.

Deribit acknowledged that this year-end occasion illustrates the bullish 12 months for crypto markets, however uncertainty stays excessive. The agency famous that fluctuations in volatility measures just like the Deribit Volatility Index (DVOL) and vol-of-vol counsel the potential for sharp worth swings.

It added:

“With the market closely leveraged to the upside, any vital draw back transfer might set off a speedy snowball impact.”