Bitcoin’s Kimchi Premium has surged in South Korea, reaching its highest degree since March 2009 amid the nation’s deepening political disaster and financial uncertainty.

This premium, which refers back to the value distinction between Bitcoin on South Korean exchanges corresponding to Upbit and international exchanges like Coinbase, has risen to a variety of 3-5% this week, in response to information from blockchain analytics agency CryptoQuant. An analogous development has been noticed within the premium for the stablecoin Tether, reflecting heightened demand for digital property.

The Kimchi Premium is a time period that captures the worth hole between cryptocurrencies traded on South Korean exchanges and people traded on international platforms. It emerges when demand for Bitcoin and different cryptocurrencies in South Korea exceeds the provision accessible on home exchanges. This phenomenon is pushed by components corresponding to native market isolation, strict capital controls, and excessive retail curiosity. Traditionally, the Kimchi Premium has spiked in periods of heightened uncertainty, both in monetary markets or the broader financial system.

Capital controls in South Korea make it difficult for buyers to arbitrage the distinction between home and worldwide markets. This permits the premium to persist, as merchants can not simply purchase Bitcoin at decrease costs elsewhere and promote it at increased costs in South Korea.

South Korea is presently experiencing vital political instability, which has rattled monetary markets and contributed to financial challenges. On Dec. 3, President Yoon Suk Yeol declared martial legislation, a controversial transfer that was rescinded on Dec. 4 following widespread backlash. The Nationwide Meeting responded by impeaching Yoon on Dec. 14, quickly transferring presidential powers to Prime Minister Han Duck-soo.

The political state of affairs escalated additional when, on Dec. 27, Han was additionally impeached by parliament, marking the primary time in South Korea’s historical past that an appearing president has confronted such motion. The impeachment votes have been pushed by opposition to Han’s choice to not appoint three new justices to the Constitutional Court docket, leaving the court docket with solely six members to determine on Yoon’s impeachment. Finance Minister Choi Sang-mok has now assumed the position of appearing president.

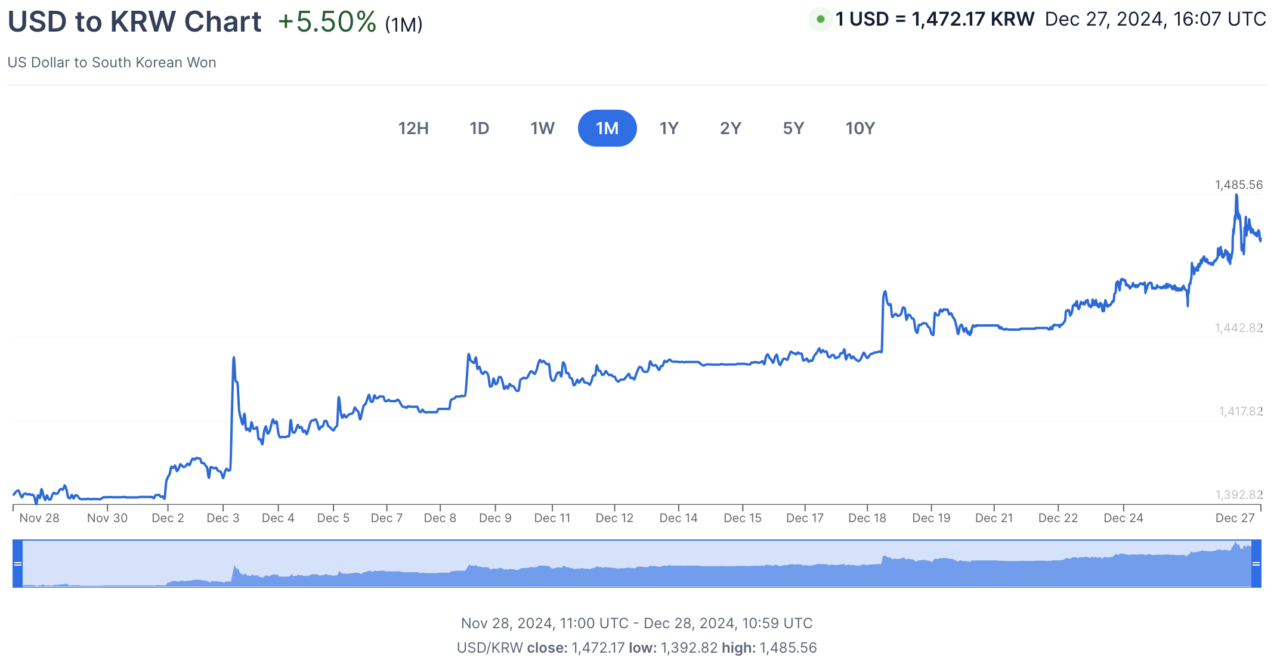

These occasions have amplified uncertainty in South Korea, with the South Korean received shedding 0.35% in opposition to the U.S. greenback this week. Because the martial legislation declaration on December 3, KRW has reportedly declined by 5% in opposition to USD. Financial challenges, together with a declining delivery fee and slowing progress, have exacerbated the state of affairs, pushing buyers towards different property.

The surge within the Kimchi Premium displays heightened demand for Bitcoin and different cryptocurrencies amongst South Korean buyers. CryptoQuant CEO Ki Younger Ju informed Bloomberg that political turmoil, inflation fears, and financial instability have led to an outflow of wealth from South Korea. Buyers are more and more changing won-denominated property into alternate options corresponding to U.S. shares, Bitcoin, gold, and {dollars}. Many South Korean crypto buyers desire exchanges over conventional banking methods, which has contributed to the elevated premiums for Bitcoin and Tether.

South Korea is acknowledged as one of the vital lively retail markets for cryptocurrencies. Crypto buying and selling volumes on native exchanges typically surpass these of inventory exchanges. Moreover, South Korean rules prohibit company accounts on home crypto exchanges, making the exercise largely retail-driven.

The Kimchi Premium is just not a brand new phenomenon. It has been noticed throughout earlier market cycles, notably when native components corresponding to financial uncertainty, geopolitical tensions, or regulatory modifications drive demand for cryptocurrencies. As an illustration, throughout Bitcoin’s bull run in late 2017, the Kimchi Premium soared to as a lot as 50%, highlighting the distinctive dynamics of South Korea’s crypto market.

Featured Picture through Pixabay