The Bitcoin (BTC) ‘kimchi premium’ has returned to South Korea’s cryptocurrency market because the nation grapples with political instability. This has led to a weakened Korean gained (KRW) and the next worth for the main cryptocurrency.

Bitcoin Kimchi Premium Surges In South Korea

In line with CryptoQuant CEO Ki Younger Ju, the KRW-USD buying and selling pair has reached a 15-year low, reflecting dwindling confidence amongst South Koreans of their fiat forex. The depreciating gained has pushed South Koreans to put money into rising belongings like Bitcoin to safeguard the buying energy of their KRW throughout instances of financial uncertainty.

In a put up on X, Ju defined that South Korean crypto merchants are more and more changing KRW into cryptocurrencies akin to Bitcoin and USD-pegged stablecoin USDT on the Upbit change, the place BTC is buying and selling at a premium of 3-5%. This worth distinction, generally known as the Bitcoin ‘kimchi premium,’ happens when BTC trades at the next worth on South Korean exchanges in comparison with world platforms.

Sometimes, the so-called kimchi premium arises on account of excessive native demand, rising regulatory obstacles, and restricted arbitrage alternatives in South Korea’s cryptocurrency market. Nevertheless, on this occasion the premium is primarily pushed by the weakening KRW on account of rising political turmoil within the nation.

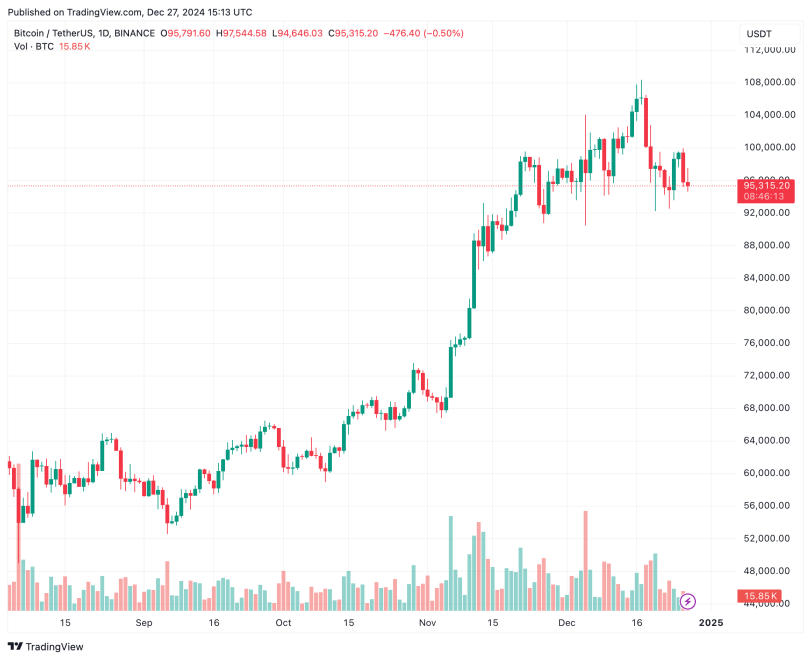

On the time of writing, Bitcoin is buying and selling in South Korea for 145,000,000 KRW or roughly $98,600, whereas on a world change like Binance, BTC is buying and selling at $95,315. The distinction between these platforms highlights the influence of the kimchi premium.

What’s Inflicting The KRW Decline?

The South Korean gained’s decline may be attributed to ongoing political unrest, which has intensified since December 3. On this date, the now-impeached, former president Yoon Suk Yeol declared martial legislation for six hours earlier than reversing the choice. Following this, South Korea’s parliament impeached Han Duck-soo, the nation’s prime minister and appearing president.

These dramatic developments have despatched shockwaves by way of world markets, undermining confidence in South Korea’s democratic establishments and elevating fears of the nation going through its worst political disaster in a long time. The month-to-month chart under illustrates how the KRW has plunged to its lowest worth in opposition to the USD since March 2009.

In a separate put up on X, Jeff Park, head of alpha methods at funding supervisor Bitwise, highlighted that South Korea’s political turmoil facilities on allegations of election fraud and a lack of belief within the nation’s Nationwide Election Fee (NEC). Park commented:

Using impeachment as a political device, mixed with allegations of international election interference, underscores the fragility of democracy within the face of disinformation. This isn’t only a Korean story; it’s a warning for democracies worldwide.

The political unrest in South Korea has despatched its cryptocurrency market right into a frenzy, resulting in record-breaking buying and selling volumes. At press time, BTC trades at $95,315, down 0.2% up to now 24 hours.

Featured Picture from Unsplash.com, Charts from X and TradingView.com