The cryptocurrency market is seeing a wave of exchange-traded fund (ETF) functions, reflecting a push towards mainstream adoption.

Latest filings embrace Solana futures ETF and Bitcoin-linked convertible bond fund, showcasing a shift towards diversified funding choices.

Solana Futures ETF

On December 27, Volatility Shares took a major step by submitting for a futures-based Solana ETF, aiming to capitalize on the rising curiosity in altcoins.

The fund intends to reflect Solana’s worth actions by specializing in future contracts on exchanges regulated by the US Commodity Futures Buying and selling Fee (CFTC). Its technique can also embrace Solana-linked monetary devices, with the asset’s worth derived from these investments. This strategy may open the door to broader institutional curiosity in Solana.

In the meantime, market analysts have famous the daring timing of this submitting, as Solana futures should not but actively traded. Some counsel that the approval of this ETF may set the stage for a spot Solana ETF sooner or later.

“That is wild. Solana futures ETF submitting bf Solana futures even exist… most likely a very good signal Solana futures are on the best way, which arguably bodes properly for spot odds,” Bloomberg ETF analyst Eric Balchunas acknowledged.

A Wave of Bitcoin ETF Functions

In the meantime, Bitcoin-related ETFs are seeing a wave of latest functions. Nate Geraci, president of ETF Retailer, highlighted that 4 filings emerged prior to now 48 hours.

REX Shares has proposed a Bitcoin Company Treasury Convertible Bond ETF, focusing on bonds issued by corporations with Bitcoin holdings of their treasuries. Equally, Attempt Asset Administration plans to introduce a fund that invests in bonds from corporations like MicroStrategy, recognized for his or her substantial Bitcoin allocations.

Bitwise additionally joined the motion with its Bitcoin Commonplace Companies ETF. That is designed to put money into corporations holding Bitcoin as a part of their monetary reserves.

In the meantime, ProShares is searching for approval for ETFs tied to main indices just like the S&P 500 and Nasdaq-100, in addition to gold, all denominated in Bitcoin. This distinctive strategy combines conventional property with cryptocurrency publicity via Bitcoin futures.

“Principally a protracted place in underlying shares or gold & then a brief usd/lengthy btc place utilizing btc futures. I’m calling these btc hedged ETFs,” Geraci mentioned.

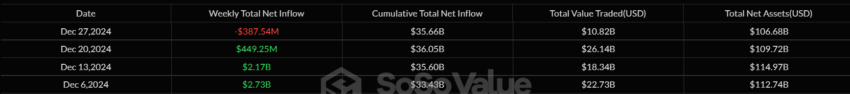

These filings underscore the rising confidence in cryptocurrency as a mainstream asset class. Trade specialists imagine that 2025 may mark a turning level, with institutional capital flowing into these modern funds. Certainly, Spot Bitcoin ETFs have already demonstrated success this 12 months, attracting over $35 billion in internet inflows and managing property exceeding $100 billion.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.