Bitcoin continues to grapple with the psychological $100,000 milestone, failing to interrupt above this vital resistance after a retrace from all-time highs. This extended stagnation has sparked discussions a few potential correction or deeper retrace because the market awaits affirmation of Bitcoin’s subsequent main transfer. Each analysts and traders are intently monitoring the scenario, desirous to discern whether or not the cryptocurrency will rally to new heights or succumb to promoting stress.

Associated Studying

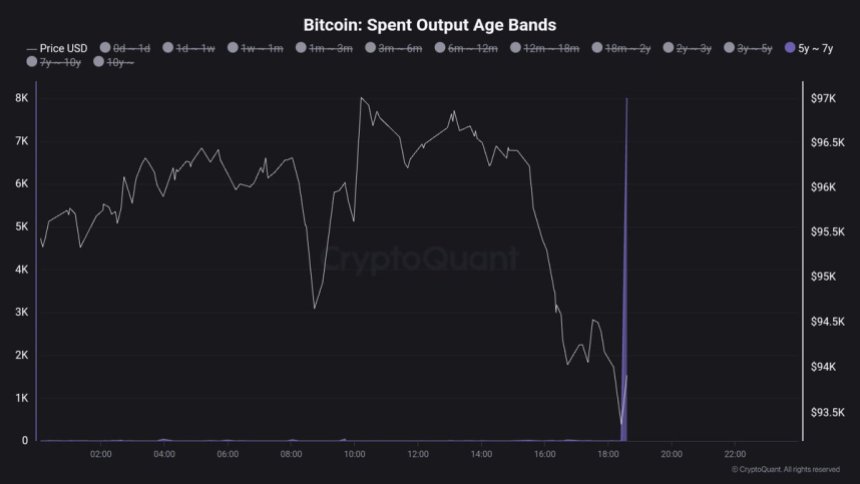

Including gas to those considerations, famend analyst Maartunn lately highlighted alarming on-chain exercise. Over 8,000 BTC, aged between 5 and 7 years, have moved on-chain, elevating questions on long-term holders’ intentions. Traditionally, such actions have typically preceded market shifts, with elevated promoting stress signaling potential weak point.

The exercise from these seasoned wallets may mirror fading confidence or profit-taking, conserving Bitcoin subdued underneath the $100K threshold. Whereas bulls and bears stay locked in a battle for dominance, this important metric underscores the rising uncertainty. As Bitcoin’s trajectory hangs within the stability, market individuals brace for readability on whether or not this pivotal degree will ultimately remodel into strong help—or mark the beginning of a downward correction.

Sensible Cash Shifting Bitcoin

Since early December, Bitcoin has entered a chronic consolidation section, struggling to determine clear momentum in both route. Latest on-chain knowledge means that whale exercise is taking part in a pivotal function in conserving the value suppressed. In accordance with high analyst Maartunn, a well-known entity—an outdated Bitcoin whale—has resurfaced, making important strikes that might affect the market’s trajectory.

Maartunn emphasizes that the motion of greater than 8,000 BTC echoes a sample seen simply 10 days in the past. At the moment, the identical whale reportedly shifted greater than 72,000 BTC in whole because the consolidation section started. This whale, sometimes called “good cash,” has been lively like by no means earlier than, signaling strategic positioning reasonably than impulsive promoting.

The implications of this exercise are profound. So long as this whale continues to dump BTC, the promoting stress may maintain Bitcoin under key psychological ranges, extending the present consolidation interval for a number of extra weeks. Nevertheless, this accumulation and redistribution section may set the stage for a large rally as soon as the exercise subsides.

Associated Studying

Analysts interpret this as a interval of preparation by seasoned market individuals, suggesting that when the mud settles, Bitcoin may expertise a strong upward breakout.

BTC Above Key Demand Stage

Bitcoin is at the moment buying and selling at $95,000 after managing to carry above the vital $92,000 help degree. Regardless of bears sustaining management over the market in current weeks, they’ve been unable to interrupt via the important thing demand zones at $92,000 and $90,000. These ranges have acted as a powerful base, stopping additional draw back and signaling resilience amongst consumers.

If Bitcoin continues to defend these essential ranges, it may pave the best way for a swift problem to its all-time excessive (ATH). Holding above $92,000 would reinforce bullish sentiment and entice renewed curiosity from merchants and institutional traders eyeing the psychological $100,000 milestone.

Nevertheless, the trail forward is way from assured. A failed try to reclaim $100,000 may sign exhaustion amongst consumers, probably triggering a deeper correction. Such a state of affairs may see Bitcoin revisiting decrease help zones as market individuals reassess their methods.

Associated Studying

The approaching weeks will probably be vital for Bitcoin’s trajectory. Whether or not it rallies to new heights or faces a major retrace will depend upon its capacity to carry key ranges and overcome the psychological obstacles which have stored it under $100K. Traders are watching intently, anticipating Bitcoin’s subsequent decisive transfer.

Featured picture from Dall-E, chart from TradingView