Michael Saylor, co-founder of MicroStrategy, has reignited hypothesis in regards to the firm’s subsequent huge Bitcoin acquisition.

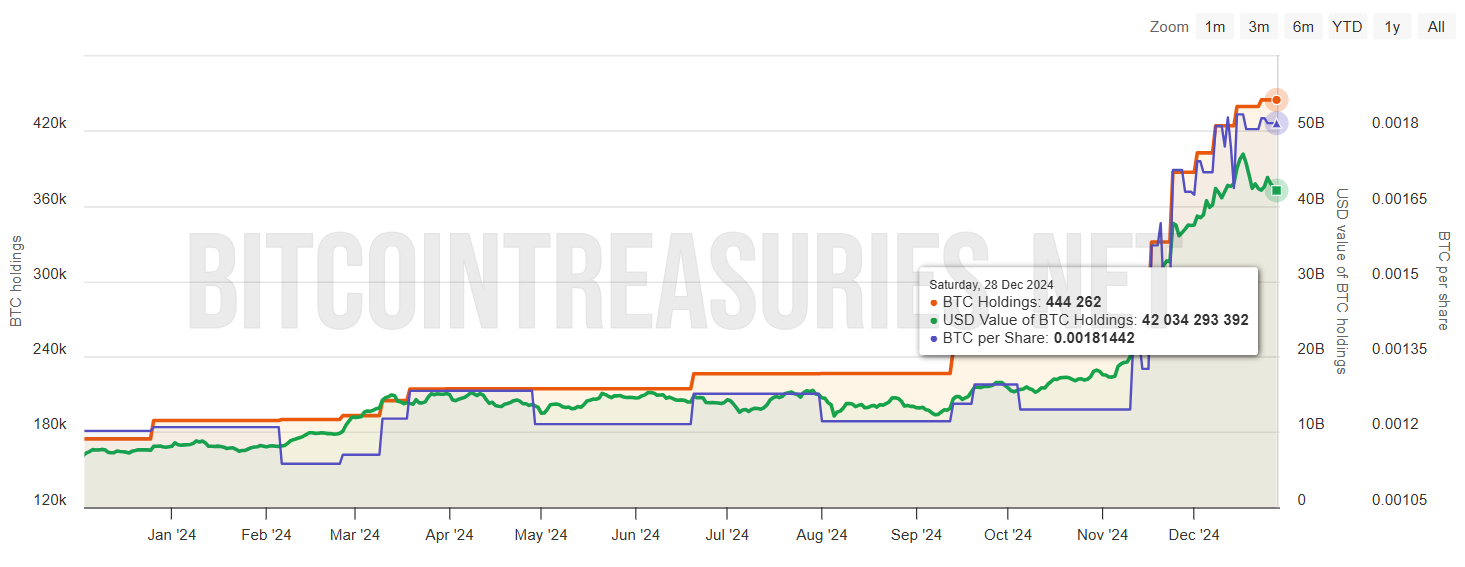

On December 28, Saylor took to social media platform X to share cryptic insights in regards to the SaylorTracker portfolio, which displays MicroStrategy’s Bitcoin purchases.

A Trace of Extra Bitcoin Forward?

In his put up, Saylor acknowledged that the marker had “disconcerting blue traces,” which led to speculations that one other large-scale purchase could also be imminent. Over latest weeks, related hints from Saylor have preceded official bulletins of main Bitcoin investments.

“Disconcerting blue traces on SaylorTracker,” Saylor acknowledged.

MicroStrategy has been on a Bitcoin shopping for spree, accumulating over 192,042 BTC at an estimated value of $18 billion. Throughout this time, Bitcoin’s worth climbed from $67,000 to $108,000, whereas MicroStrategy’s inventory worth surged greater than fivefold this 12 months, now buying and selling round $360 — up 400% on the year-to-date metrics.

MicroStrategy’s inventory efficiency and inclusion within the Nasdaq-100 have been exceptional. The corporate’s shift from its core enterprise of enterprise knowledge analytics to a heavy give attention to Bitcoin accumulation has positioned it as the biggest public holder of the cryptocurrency. Nonetheless, this aggressive technique has confronted its share of criticism.

Some market individuals argue that Saylor’s bulletins of Bitcoin buys create volatility. Critics declare that after the purchases are disclosed, day merchants quick Bitcoin, resulting in a worth retracement and a drop in MicroStrategy’s inventory worth.

“The issue with Saylor purchases is that he proclaims them, then Day-traders instantly begin shorting BTC as a result of they know the big-buyer buyer is finished shopping for. Then Bitcoin retraces, and $MSTR inventory goes down, not up,” one crypto dealer stated.

Furthermore, some have prompt that the acquisition sample was reportedly influenced by its plan for a blackout interval in January, throughout which it can pause Bitcoin acquisitions.

Nonetheless, early indications counsel that Bitcoin buys won’t be stopping anytime quickly. As a substitute, MicroStrategy prepares for its subsequent steps, which embrace rising its licensed shares of Class A standard inventory and most popular inventory. The proposal seeks to broaden Class A inventory from 330 million to over 10 billion shares and most popular inventory from 5 million to 1 billion.

Market observers consider this transfer will considerably enhance its capability to situation shares sooner or later, permitting it to allocate extra funds for Bitcoin purchases.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.