From Trey Walsh, Govt Director of The Progressive Bitcoiner

I’ll begin off by saying I’ve many reservations about america pursuing a Strategic Bitcoin reserve, with the main plans I’ve noticed together with laws proposed by Senator Lummis and a draft Govt order from the Bitcoin Coverage Institute (this doesn’t embrace these proposed state-by-state, which is a distinct focus and a bit extra straight ahead given they maintain some bitcoin to diversify their property). My reservations embrace timing, political (polarizing) ramifications, mechanisms/value of acquiring Bitcoin, why the U.S. would pursue this as a nation already main because the world reserve forex, authorities getting extra concerned with Bitcoin might result in extra involvement/affect with Bitcoin’s improvement, and ramifications on Bitcoin as cash for U.S. residents (would privateness, medium of alternate, self-custody be at larger threat?). I feel Nic Carter wrote a superb piece questioning the SBR and advocating in opposition to the U.S. pursuing this which I’d extremely encourage you to learn.

Whereas I’ve seen help for the SBR from Bitcoin proponents, principally GOP politicians and Trump (in equity Democratic Rep. Ro Khanna has mentioned he’s supportive in idea I consider), there has but to be any consideration paid to this in a optimistic method from progressives. In truth, actually solely criticism. Whereas I’ve my reservations and criticisms as I’ve clearly acknowledged to be clear right here, I’d wish to deal with some methods wherein a U.S. Strategic Bitcoin Reserve might really be a optimistic factor for People, from a progressive’s lens and values with an emphasis on social security web spending. This has but to be mentioned at any scale, and I’d like to supply some ideas, and a few precise social good this might do in addition to simply “strengthen america as a worldwide energy and strengthen the greenback.” Okay, however what might this do for precise, day by day folks in America? That’s what I care about, and possibly you too.

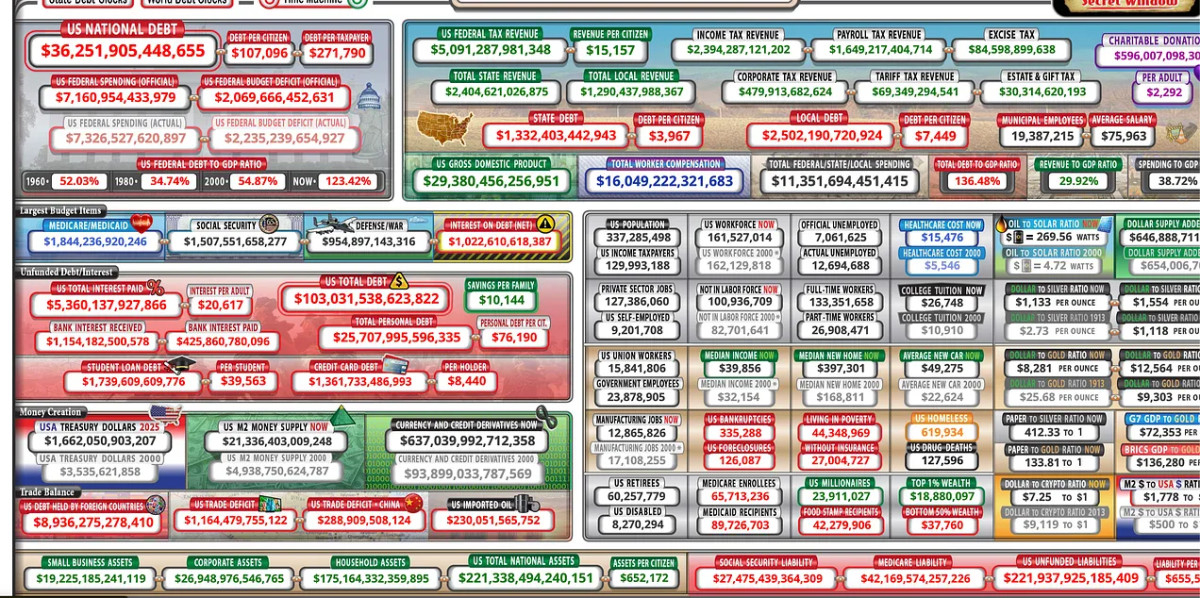

This overwhelming picture was captured right this moment from https://www.usdebtclock.org/. What the U.S. doesn’t have a stable reply for is how we’re going to pay for the important companies wanted and anticipated from residents at this level when dealing with a debt and spending crises in comparison with our price range/tax receipts. Relying on who you ask and which financial theories you subscribe to, there are other ways for dealing with this—however the subject stays: the U.S. is kicking the can down the highway relating to debt, spending and refusing to both increase taxes or reduce spending dramatically and catastrophically. I needed to set the stage first, after which provide some strategic use circumstances of a SBR towards social security web spending, the price range deficit, and a authorities by the folks, for the folks with Bitcoin.

1. Hedge In opposition to Inflation to Shield Public Applications

- Stability for Social Spending: Inflation and forex devaluation erode the buying energy of presidency budgets, decreasing the effectiveness of social security web packages. A Bitcoin reserve, as a deflationary asset, might function a hedge in opposition to such financial dangers, making certain secure funding for packages like Medicare, Medicaid, and Social Safety. As issues get dearer in fiat phrases (salaries, healthcare payments, important hospital expertise, medicines, therapies, and so forth) they get cheaper in Bitcoin phrases.

- Future-Proofing Advantages: Bitcoin’s restricted provide might defend in opposition to long-term depreciation of fiat forex, making certain that entitlement packages keep their worth and profit recipients within the a long time to return.

2. Income Technology for Security Nets

- Asset Appreciation: Bitcoin has proven vital value appreciation over the long run. A government-held Bitcoin reserve may very well be leveraged throughout occasions of monetary have to generate further income for funding social packages. The important thing here’s a long-term view, not brief time period buying and selling.

- Managed Liquidation: Below a progressive framework, the federal government might design strict protocols for promoting parts of the reserve throughout financial downturns or crises to keep away from undermining the reserve’s long-term worth whereas supporting public welfare.

3. Various to Taxpayer Burden

- Decreasing Taxpayer Reliance: Historically, funding for social security nets comes from taxes, which may disproportionately influence middle- and lower-income households. A Bitcoin reserve might present another funding supply, decreasing the reliance on direct taxation for security web packages.

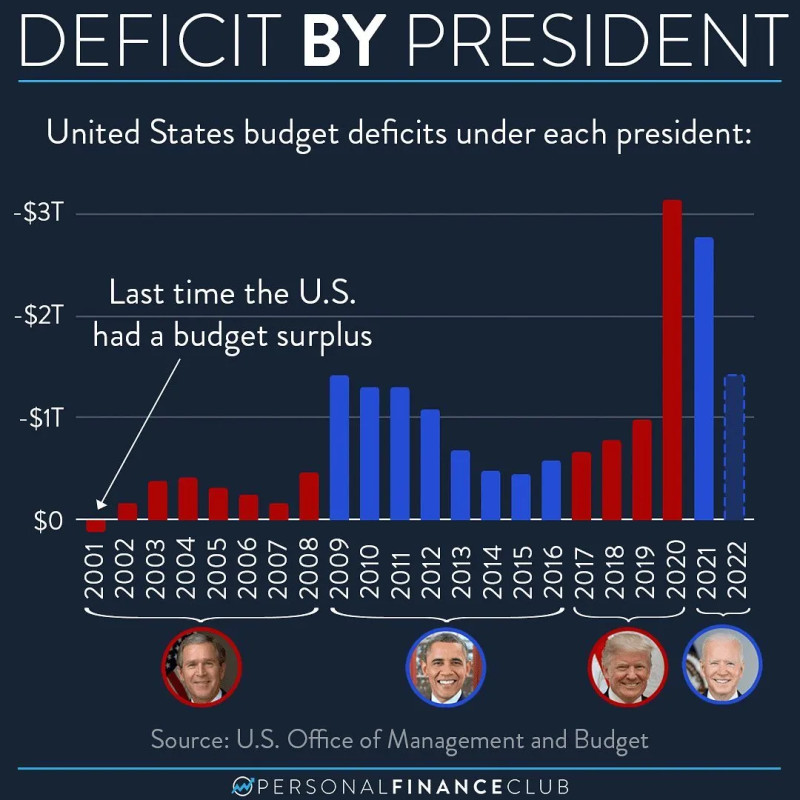

- Decreasing deficit spending: One of many main circumstances of inflation is deficit spending by way of cash printing mechanisms from the Fed, Treasury and Congress passing laws effectively past our property and tax receipts. A SBR may very well be used to assist us rely much less on the cash printing that’s accountable for overwhelming inflation on the decrease and center class that’s typically use to fund our authorities and social security web packages. By together with Bitcoin alongside conventional reserves like gold, the federal government might improve its fiscal capability to maintain welfare packages with out counting on deficit spending.

4. Emergency Monetary Help

- Disaster Mitigation Fund: Throughout monetary crises, the federal government typically struggles to quickly mobilize assets for security web expansions. Bitcoin, being extremely liquid and accessible globally, might act as an emergency reserve for direct money transfers or funding unemployment advantages in occasions of financial misery.

- International Remittance Effectivity: Bitcoin’s borderless nature might streamline the supply of worldwide assist or remittances to help diaspora communities or weak populations overseas, aligning with progressive values of worldwide fairness.

5. Selling Monetary Inclusion for Susceptible Populations

- Bridging the Wealth Hole: A Strategic Bitcoin Reserve may very well be paired with insurance policies that encourage public possession of Bitcoin, providing people and communities the power to take part in a monetary system that’s much less depending on conventional banking constructions. Look to packages such because the Alaska Everlasting Fund which pays dividends based mostly on Alaska’s oil reserve and manufacturing

- Direct Redistribution Mechanisms: The federal government might use positive aspects from Bitcoin reserves to fund Common Primary Earnings (UBI) packages or focused help for low-income households. Margot and I mentioned this chance with Scott Santens, a number one knowledgeable on UBI on our podcast.

Whereas indirectly related to the SBR, the acceptance of Bitcoin at this stage might open the door for extra prospects relating to Bitcoin mining and the neighborhood.

6. Incentivizing Inexperienced Bitcoin Mining for Job Creation

- Jobs for At-Danger Communities: Bitcoin mining operations, if incentivized to make use of renewable vitality, might create jobs in underserved areas, offering a twin advantage of financial revitalization and environmental progress.

- Income for Native Governments: Tax revenues generated from sustainable Bitcoin mining operations may very well be redirected to strengthen native security nets, akin to inexpensive housing or neighborhood healthcare initiatives.

7. Financial Resilience to Fund Lengthy-Time period Applications

- Buffer In opposition to Financial Crises: In occasions of financial downturns or geopolitical instability, Bitcoin’s independence from fiat forex methods might present a monetary buffer. This might be sure that crucial security web packages proceed to function with out disruption.

- Strengthening the Social Contract: By sustaining a reserve that safeguards nationwide financial safety, the federal government reinforces its dedication to defending weak populations, which is a core progressive precept.

8. Enhancing Public Belief in Social Applications

- Clear Funding Mechanism: Bitcoin’s blockchain expertise ensures a clear ledger. Utilizing a Bitcoin reserve to partially fund social packages might enhance public belief in how assets are allotted and managed, decreasing skepticism about authorities waste or corruption. The SBR bitcoin addresses can be made public (like El Salvador does)

- Public Possession: Progressives might suggest allocating a small portion of Bitcoin positive aspects on to residents by means of rebates or credit tied to social packages, making a tangible connection between nationwide reserves and public profit. Once more, again to a dividend or UBI strategy

That is simply the tip of the iceberg for a way progressives would possibly theoretically strategy a Strategic Bitcoin Reserve. Whereas that is extra of an mental train at this level, and my focus continues to be on grassroots adoption of Bitcoin and the way this will rework particular person’s lives and communities world wide, it raises an essential level — what social good might we think about Bitcoin offering in our ever evolving, altering, and fiscally difficult world? Past simply quantity go up, crypto merchants, and wall road getting richer, what function can Bitcoin play in bettering the lives of on a regular basis folks at a deep, structural degree? We’ll proceed to discover these questions right here at The Progressive Bitcoiner.

It is a visitor put up by Trey Walsh. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.