Bitcoin (BTC) hit a file excessive on December 17 however has since dropped under $100,000. Key indicators, such because the ADX, alongside cautious whale exercise, counsel a weakening downtrend.

As BTC approaches vital resistance and help ranges, its subsequent strikes may considerably affect its worth route within the coming days.

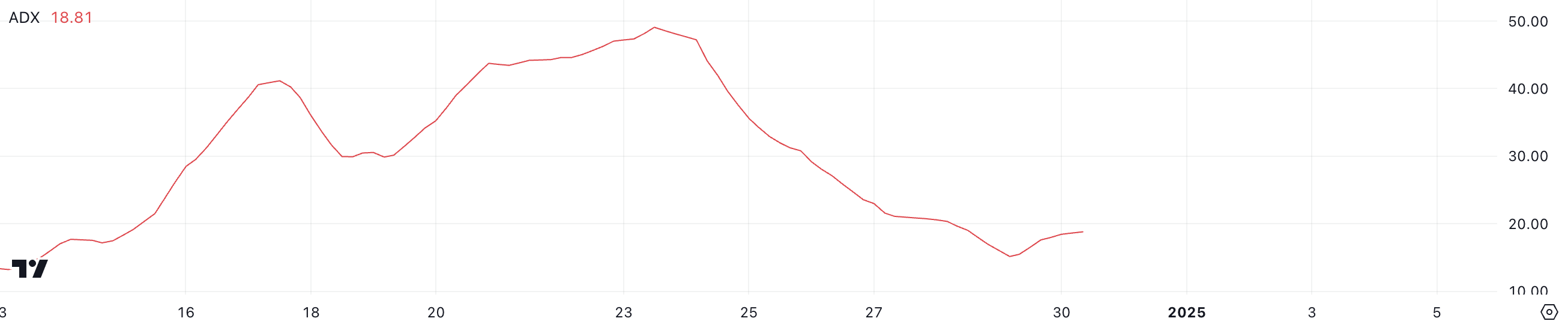

BTC ADX Exhibits the Downtrend Is Weakening

BTC’s ADX at present stands at 18.81, down sharply from practically 50 simply seven days in the past. This decline highlights a marked weakening within the energy of Bitcoin’s ongoing downtrend.

The speedy lower in ADX means that the momentum driving BTC latest worth actions is fading, leaving the market in a state of lowered directional power.

The Common Directional Index (ADX) measures the energy of a development, whether or not upward or downward, on a scale from 0 to 100. Values above 25 usually point out a powerful development, whereas readings under 20 signify a weak or non-existent development. With BTC’s ADX at 18.81, this low studying implies that the present downtrend could also be shedding momentum.

Consequently, Bitcoin may enter a short-term consolidation part characterised by lowered volatility and sideways worth motion.

Bitcoin Whales Began Accumulating Once more

The variety of Bitcoin addresses holding no less than 1,000 BTC skilled a big decline between December 16 and December 17, dropping from 2,108 to 2,061. This discount highlights a notable sell-off or redistribution of holdings amongst large-scale traders.

The metric then stabilized till December 24, when it declined additional to 2,049. Such modifications in whale exercise can have vital implications for Bitcoin, as these addresses usually symbolize entities with substantial affect over worth actions resulting from their means to make giant trades.

Monitoring these so-called Bitcoin whales is essential as a result of their shopping for and promoting behaviors usually function main indicators for broader market traits. When whales accumulate, it suggests confidence in Bitcoin’s potential worth development, whereas large-scale promoting can point out warning or profit-taking, probably triggering market declines.

After the steep declines in whale numbers, the metric started to rise modestly, with the present depend at 2,056. This enhance, although not occurring at a excessive tempo, suggests a cautious return of confidence amongst main holders. This gradual accumulation might level to a stabilization in Bitcoin worth within the brief time period.

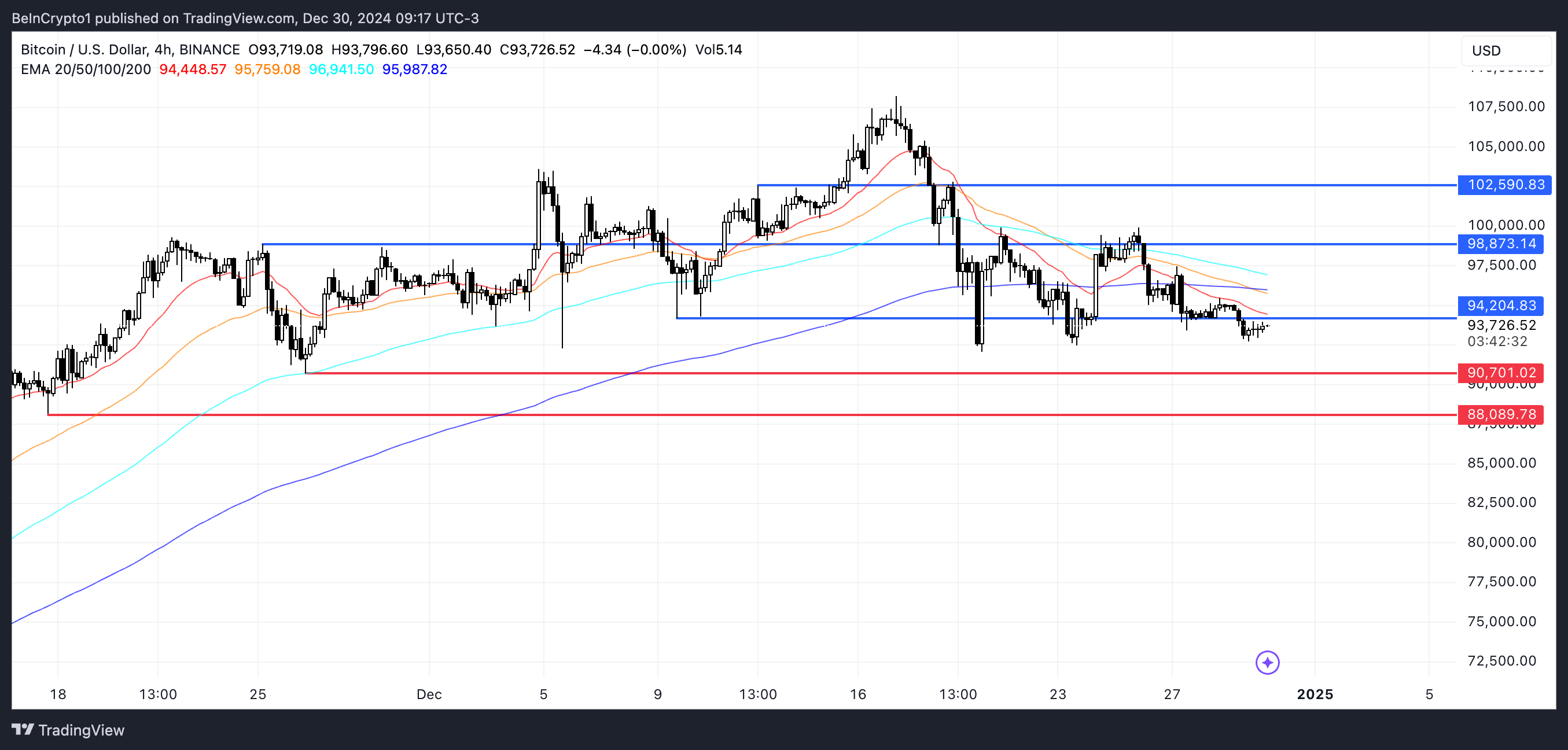

BTC Worth Prediction: Can It Go Again to $100,000?

Bitcoin worth is at present approaching a vital resistance stage at $94,200. If this stage is breached, it may open the door for additional upward momentum, with potential assessments of $98,700 after which $102,500 if the uptrend strengthens.

Regardless of the potential of upward motion, the BTC EMA strains nonetheless point out a bearish setup, with short-term EMAs positioned under long-term ones.

This configuration displays lingering bearish sentiment out there. Ought to the downtrend regain energy, BTC may retest the help at $90,700. If this help fails to carry, the subsequent draw back goal could possibly be $88,089.

Disclaimer

According to the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.