- For ADA to interrupt its cycle and develop, it wants renewed curiosity from retail traders.

- However for ADA to grab this chance, it must preserve consolidating.

A month has handed since Cardano [ADA] broke the $1 mark, however regardless of the preliminary hype, its momentum has been steadily declining.

Nonetheless, there’s a silver lining – high-cap cash are slowly turning inexperienced. It’s clear that the market is regaining its footing after being shaken by the risky hypothesis surrounding 2025.

However as we step into the ‘new yr,’ can ADA rebound? Two key elements level to a possible turnaround: the sturdy religion of whales and ADA’s ongoing consolidation, which can be setting the stage for a bullish Q1.

What are the chances?

ADA wants a surge of recent FOMO

Since 2022, ADA has confronted an uphill battle, very similar to different altcoins. The “Trump pump” provided a momentary lifeline, nevertheless it was short-lived.

In truth, the actual problem started after it hit its yearly excessive of $1.25 – a peak that prompted an enormous exodus of profit-takers.

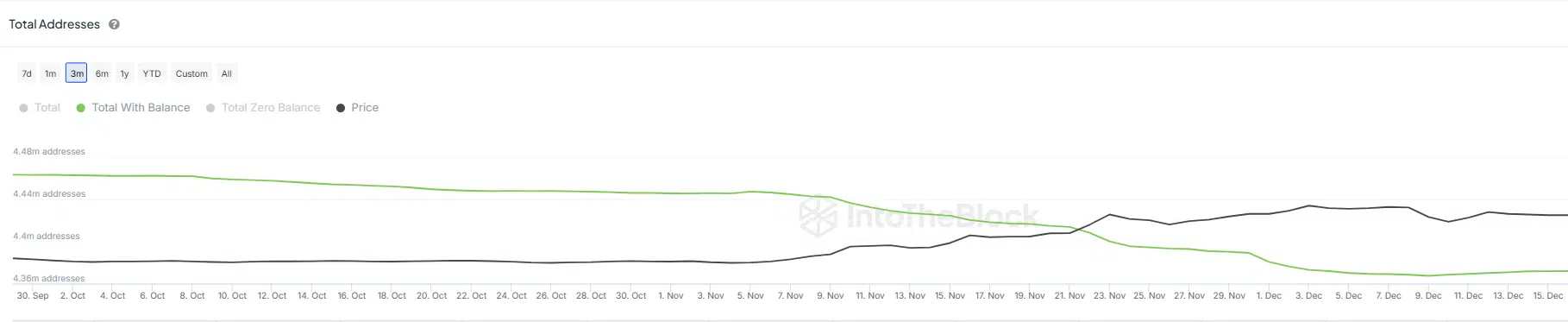

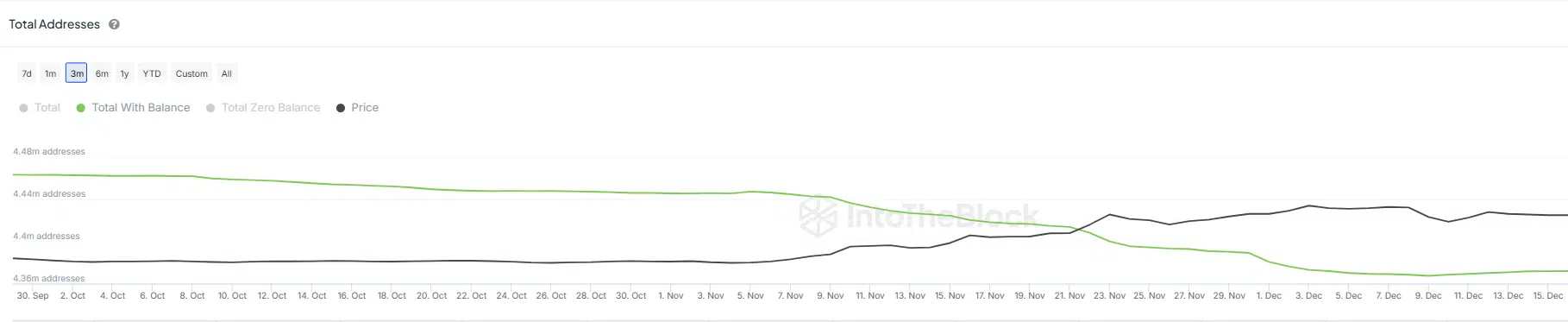

What’s stunning is the dearth of FOMO. As a substitute of gaining traction, ADA’s holder base has shrunk, slipping from 4.46 million addresses in early This autumn to 4.37 million now.

Additionally, there was a noticeable drop after crossing the $1 mark.

Supply : IntoTheBlock

Whereas affected person HODLers seized the prospect to money out, recent capital hasn’t flowed into the community. This hole has stored ADA caught within the crimson, regardless of stable whale backing.

Consequently, ADA has struggled to interrupt free from its weekly lows.

This turns into particularly regarding while you have a look at the exhausting information: 71.16% of Cardano’s whole provide was held by retail traders at press time, with 25.77 billion cash.

In the meantime, whales held simply 8% of the overall provide.

Why does this matter? On a psychological entrance, retail investments are sometimes pushed by “exterior” developments, reminiscent of social media hype or short-term hypothesis.

Merely put, their fast exits following earnings – or worry of loss – creates a risky cycle.

Regardless that whales proceed to carry, their smaller share of the provision means they’ll’t tip the market at their will. For ADA to interrupt out of this stagnation, it wants a brand new wave of retail curiosity.

But, there’s a silver lining

Regardless of the bearish on-chain indicators, there’s a silver lining for ADA. Over the previous week, whales have been accumulating, and ADA has entered a consolidation part – a key bullish signal given present market circumstances.

Why is that this vital? When retail FOMO re-enters the market, mixed with whale assist preserving ADA from a deeper pullback, the stage might be set for a serious Q1 rebound.

Proper now, with Bitcoin in a bearish part, traders are enjoying it protected and hesitant to diversify. This offers ADA room to develop, particularly with its impartial RSI.

Learn Cardano’s [ADA] Worth Prediction 2025-26

However for ADA to grab this chance, it must preserve consolidating. If it does, it may ignite the FOMO cycle, setting the stage for giant returns.

With Q1 anticipated to be risky, if the best circumstances maintain, ADA might be poised for important positive factors. Keep watch over it – it could shock us all.