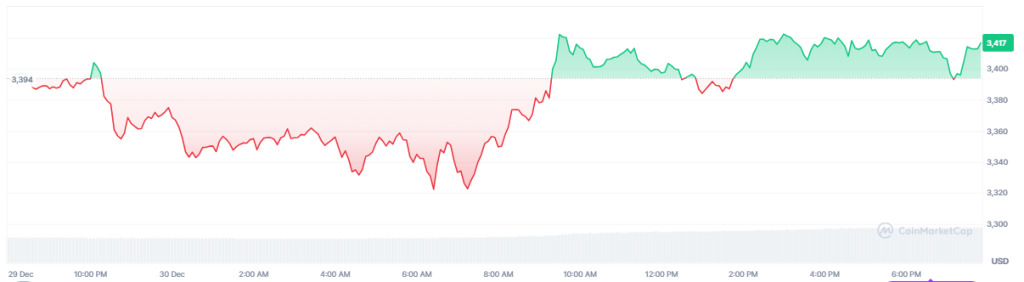

Current Ethereum market swings have revealed an fascinating disparity between worth and community exercise. Staking exercise has saved rising whereas ETH retreated to $3,400, a 16% drop from its December peak.

Resulting from buyers staking report quantities of ETH, the whole staked property have exceeded expectations. Even whereas short-term worth fluctuations have led some to doubt Ethereum’s viability, this surge in staking is an indication of rising confidence within the cryptocurrency’s long-term price.

Investor Confidence Indicated By ETF Inflows

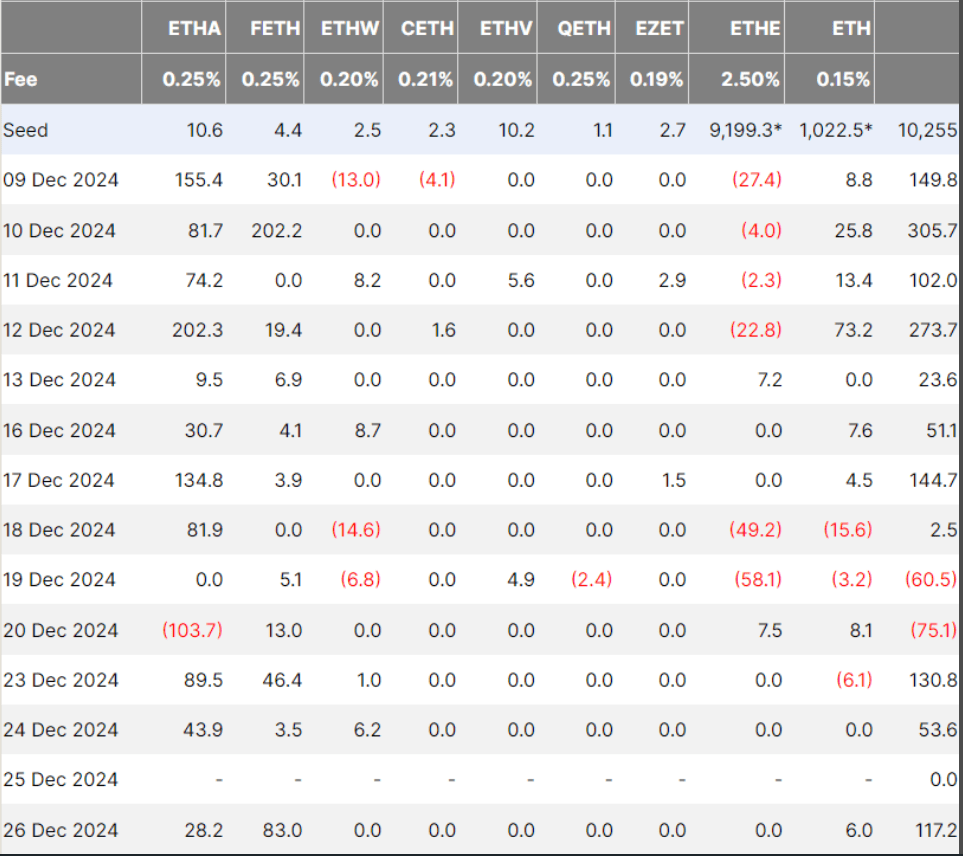

One other important improvement is the rise in exchange-traded funds (ETFs) which might be targeting Ethereum. The web whole of $2.68 billion has been amassed over the previous 25 days, with ETF inflows recorded on 23 days.

On December 27, the whole internet property of ETFs exceeded $12 billion on account of the almost $48 million in every day inflows, information from SoSoValue reveals. The Ethereum ETF supplied by BlackRock has garnered the vast majority of these investments, underscoring the institutional curiosity in ETH in defiance of the current worth decline.

The recognition of Ethereum spot ETF displays the bigger crypto market, by which ETFs are beginning to be a most well-liked selection for each institutional and unusual buyers.

Then again, important inflows of Bitcoin ETFs in current months counsel that conventional monetary markets are progressively welcoming digital property.

Worth Motion And Broader Market Dynamics

Ethereum’s worth decline, then again, illuminates another narrative. Ether’s worth drop is prone to be pushed by profit-taking following its current rally and broader macroeconomic uncertainties, because the cryptocurrency market stays unstable.

Regulatory pressures and considerations concerning the chance of one other rate of interest rise have accentuated the cautious mentality of merchants.

Regardless of the droop, some analysts see this as a time of consolidation slightly than trigger for fear. They be aware that Ethereum’s staking and ETF inflows are robust markers of long-term market confidence.

Broader Perspective

Ethereum’s most up-to-date developments happen amid an environment of optimism relating to its ecosystem. Continued consideration is being drawn to current enhancements, such because the transition to proof-of-stake and ongoing scalability enhancements. These developments are enabling Ethereum to protect its management in non-fungible tokens (NFTs) and decentralized finance (DeFi).

It’s necessary for buyers to maintain a long-term view whereas additionally having the ability to deal with short-term fluctuations. The altering nature of crypto investing could be seen within the rising use of ETFs and staking. The worth of Ethereum could go up and down, however its community and use instances are nonetheless robust.

Featured picture from Infobae, chart from TradingView