Solana (SOL) worth has confronted important challenges lately, dropping 21% over the past 30 days. Regardless of this decline, SOL stays the sixth largest cryptocurrency out there, with a market capitalization of roughly $90.8 billion.

Technical indicators similar to BBTrend, DMI, and EMA traces recommend that whereas the downtrend persists, its energy has diminished, and the value is at the moment consolidating. Whether or not SOL worth continues its bearish trajectory or begins a restoration will depend on key assist and resistance ranges and shifts in market momentum.

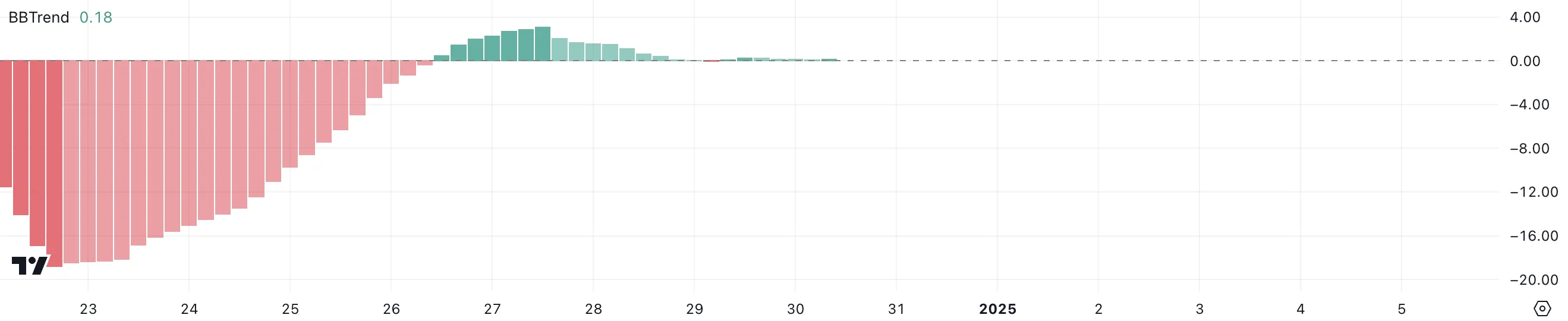

SOL BBTrend Is Nearing Zero

SOL BBTrend is at the moment at 0.18, indicating a impartial stance after recovering from deep detrimental ranges starting on December 23.

The indicator briefly peaked at a optimistic worth of three.09 on December 27, signaling short-term bullish momentum. Nevertheless, it has since declined and stabilized round 0.18, suggesting the absence of a robust directional bias within the present worth motion.

The BBTrend is a technical indicator derived from Bollinger Bands that measures the energy and path of a pattern. Constructive BBTrend values sometimes point out upward momentum, whereas detrimental values recommend downward momentum. When the BBTrend is close to zero, because it at the moment is for SOL, it displays a impartial or range-bound market, with no sturdy pattern dominance.

Within the quick time period, Solana BBTrend at 0.18 suggests a possible consolidation section, the place worth volatility could lower till a clearer pattern emerges.

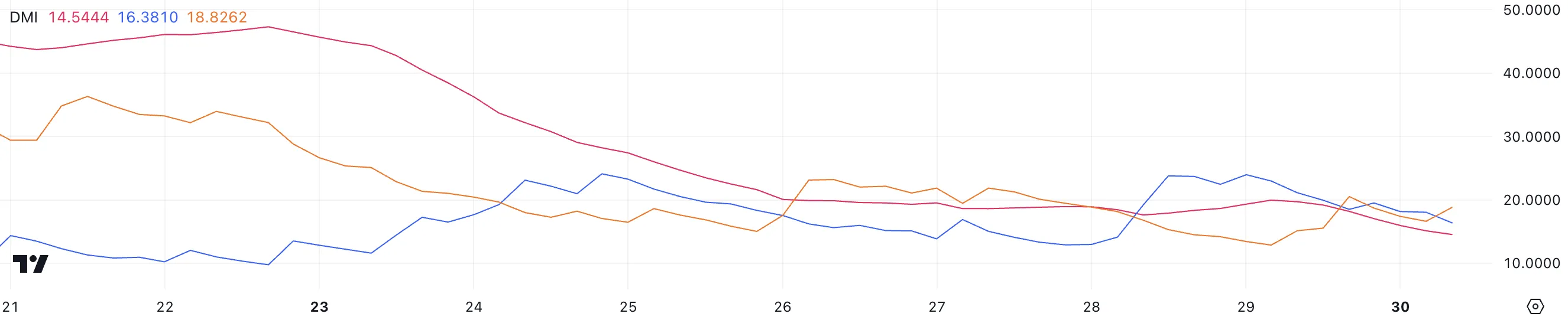

Solana Bears Are Nonetheless Right here

Solana DMI chart exhibits that its ADX is at the moment at 14.5, declining from almost 20 only a day in the past. This drop displays a weakening pattern energy, indicating that the latest market momentum is dropping steam.

In the meantime, the +DI (Directional Indicator) is at 16.2, and the -DI is at 19.7, suggesting that bearish strain stays barely dominant because the -DI is increased than the +DI. This configuration highlights that SOL worth remains to be struggling to reverse its downtrend totally.

The Common Directional Index (ADX) measures the energy of a pattern, no matter its path, on a scale of 0 to 100. Values above 25 point out a robust pattern, whereas readings beneath 20, like SOL present 14.5, sign weak or absent pattern energy. With the +DI beneath the -DI, the bearish pattern nonetheless holds, however the declining ADX means that this pattern lacks important momentum.

Within the quick time period, SOL could proceed to consolidate or transfer sideways until there’s a shift in momentum that pushes the +DI above the -DI, accompanied by a rising ADX to point a stronger pattern

SOL Worth Prediction: Will the Downtrend Persist?

Solana EMA traces proceed to indicate a bearish setup, because the short-term EMAs stay beneath the long-term EMAs. This alignment displays ongoing downward momentum, with no fast indicators of a bullish reversal.

The bearish EMA configuration means that promoting strain is more likely to persist, particularly if the value approaches the following sturdy assist stage at $182. Ought to this assist fail, the downtrend may intensify, doubtlessly pushing Solana worth right down to $176.

Then again, if SOL worth manages to reverse its present pattern and set up an uptrend, it may take a look at the resistance at $201. Breaking above this stage would point out rising bullish momentum and will pave the best way for additional upward motion.

Nevertheless, for such a shift to happen, the EMA traces would want to start converging and ultimately flip right into a bullish setup, with short-term EMAs crossing above the long-term ones. Till then, the bearish EMA construction continues to sign warning for the quick time period.

Disclaimer

Consistent with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.