Tether has transferred 7,629 BTC, valued at roughly $700 million, to its Bitcoin reserve deal with. The transaction originated from Bitfinex’s sizzling pockets on the morning of December 30.

This marks the most important addition to Tether’s strategic Bitcoin reserve since March 2024, when 8,888.88 BTC have been moved.

Tether’s Bitcoin Reserves Proceed to Develop

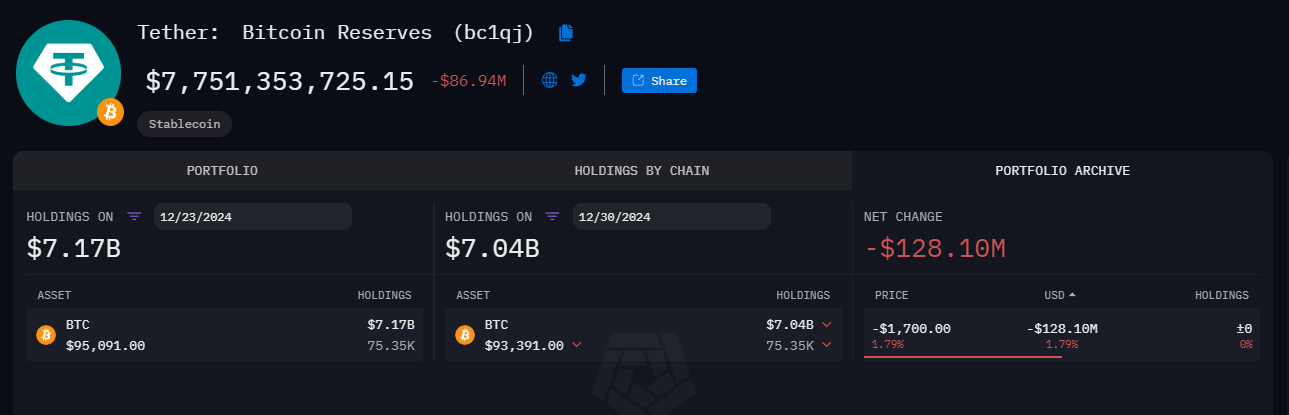

One other an identical switch occurred on December 31, 2023, based mostly on on-chain information. In keeping with Arkham information, Tether’s reserves now maintain 82,983 BTC, acquired for $2.99 billion at a mean value of round $36,125 per coin.

The transfer aligns with Tether’s determination in 2023 to allocate as much as 15% of its earnings to Bitcoin. The corporate at present holds over $7.6 billion in BTC, and its Bitcoin purchases function a part of a diversification technique amid durations of elevated USDT issuance.

Tether’s flagship stablecoin, USDT, stays primarily backed by US Treasury bonds and cash-equivalent property. Yield generated from these holdings has fueled investments in rising sectors, together with AI, Bitcoin mining, and decentralized communications.

In 2024, the corporate additionally expanded into renewable power and telecommunications, reflecting its broad funding focus.

A Robust Monetary Yr Amid Regulatory Hurdles

Tether has seen vital monetary success in 2024, supported by a powerful crypto market. The corporate’s complete property reached $134.4 billion in Q3, with $120 billion in circulating USDT.

Additionally, on December 6, Tether minted a further 2 billion USDT, contributing to a complete of 19 billion minted since November. This mirrored the rising demand for USDT all through the bull market.

Nonetheless, Tether is going through challenges within the European Union as MiCA rules take impact. EU exchanges have delisted USDT in current weeks in making ready for the regulation.

“Bear in mind, Tether holds $102 billion in US Treasuries – by not recognizing this collatoral the EU has despatched a powerful sign of lack of belief in US debt. The EU have explicitely demanded stablecoin issuers again EU regulated stablecoins with 60% fiat in EU banks. IMO: There are political motivs behind this charade. It ends badly for the EU,” influencer Martin Folb wrote on X (previously Twitter).

Additionally, the corporate has ceased issuing its euro-backed EURT stablecoin, providing holders a yr to redeem their property. Elevated competitors has additional examined Tether’s dominance.

Most lately, Ripple launched its RLUSD stablecoin in world markets, whereas USDC issuer Circle introduced a number of partnerships geared toward leveraging Tether’s regulatory hurdles.

Regardless of these challenges, Tether stays targeted on strengthening its reserves and exploring new sectors, sustaining its place as a key participant within the stablecoin market.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.