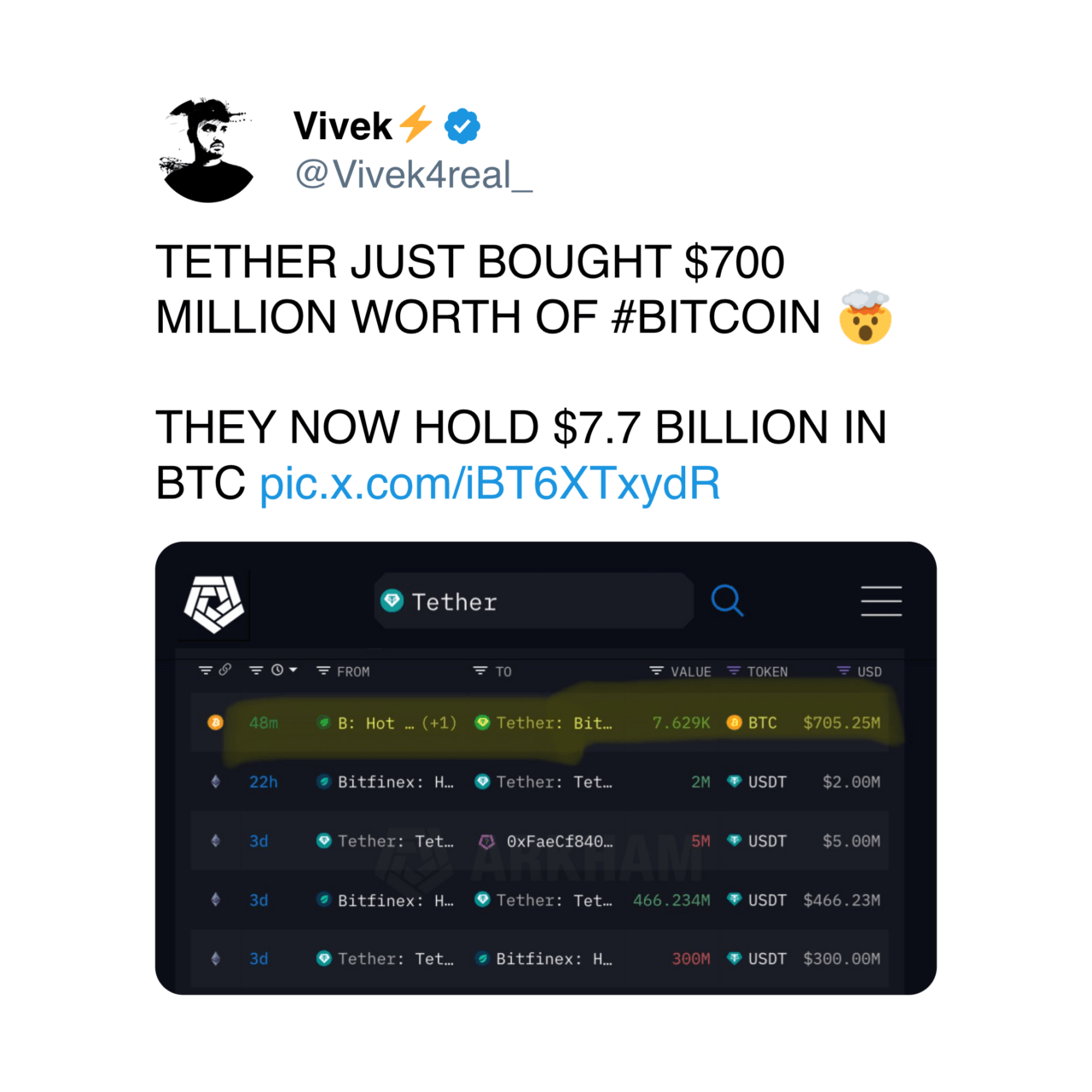

Main stablecoin issuer Tether has added an extra 7,629 bitcoin to its steadiness sheet after a nine-month hiatus from accumulating the flagship cryptocurrency. The agency’s newest transfer brings its complete holdings to 82,983 BTC price round $7.68 billion.

In keeping with knowledge from Arkham Intelligence, a pockets tagged as belonging to the main stablecoin issuer has been steadily growing its BTC holdings, to the purpose that they’re now its largest holding, above $6 billion price of the main stablecoin.

The pockets additionally holds round $210.5 million price of Tether’s gold-backed cryptocurrency XAUT, in addition to $25.6 million of its discontinued euro-backed stablecoin EURT.

The agency’s newest buy got here after Nasdaq-listed video-sharing platform Rumble revealed it signed a strategic partnership with Tether, as a part of which it might obtain $775 million from the stablecoin issuer. Tether, as a part of the deal, was buying 103.33 million shares of Rumble’s Class A standard inventory at $7.5 per share.

Rumble plans to make use of $250 million of the funds to increase its enterprise. The remainder will probably be allotted to a self-tender supply, permitting shareholders to promote as much as 70 million shares of Class A standard inventory again to the corporate at $7.50 per share.

As CryptoGlobe reported, Tether reported $2.4 billion in web income within the third quarter of the yr, with the revenue being primarily pushed by earnings from its substantial holdings in U.S. Treasuries and gold, with Treasuries contributing round $1.3 billion to the outcomes.

The stablecoin large, as reported, dedicated to utilizing 15% of its realized web working income to spend money on the flagship cryptocurrency final yr. Since then, Tether has develop into one of many largest BTC holders whereas additionally investing in cryptocurrency infrastructure, together with mining operations.

On the subject of personal corporations, based on knowledge from BitcoinTreasuries, Tether is simply behind Block.one, which holds 164,000 BTC on its steadiness sheet. The biggest company holder of the cryptocurrency, it’s price including, is Nasdaq-listed enterprise intelligence agency MicroStrategy, with 446,400 BTC.

Featured picture through Unsplash.