Este artículo también está disponible en español.

On-chain information reveals the Realized Value of the Bitcoin short-term holders lies at $86,800 proper now, making the extent one to observe.

Bitcoin Is Nonetheless At A Notable Hole From Quick-Time period Holder Price Foundation

In a brand new publish on X, the on-chain analytics agency Glassnode has mentioned the pattern within the profit-loss standing of the Bitcoin short-term holders. The indicator of relevance right here is the “Market Worth to Realized Worth (MVRV) Ratio,” which retains observe of the ratio between BTC’s Market Cap and its Realized Cap.

Associated Studying

The “Realized Cap” right here refers to an on-chain capitalization mannequin for the cryptocurrency that assumes the ‘actual’ worth of every token in circulation is the worth at which it was final transacted on the blockchain.

For the reason that final switch of any coin is prone to correspond to the final occasion of it altering fingers, the worth at its time might be thought of as its present value foundation. Thus, the Realized Cap is nothing, however the sum of the capital that the buyers as an entire have used to buy the cryptocurrency.

In distinction, the Market Cap represents the worth that the holders are carrying proper now. Because the MVRV Ratio compares these two fashions, its worth tells us in regards to the profit-loss state of affairs of the community.

The standard MVRV Ratio measures this for your complete market, however the model of the metric that’s of curiosity within the present matter is that particularly for the short-term holders (STHs), buyers who bought their cash inside the previous 155 days.

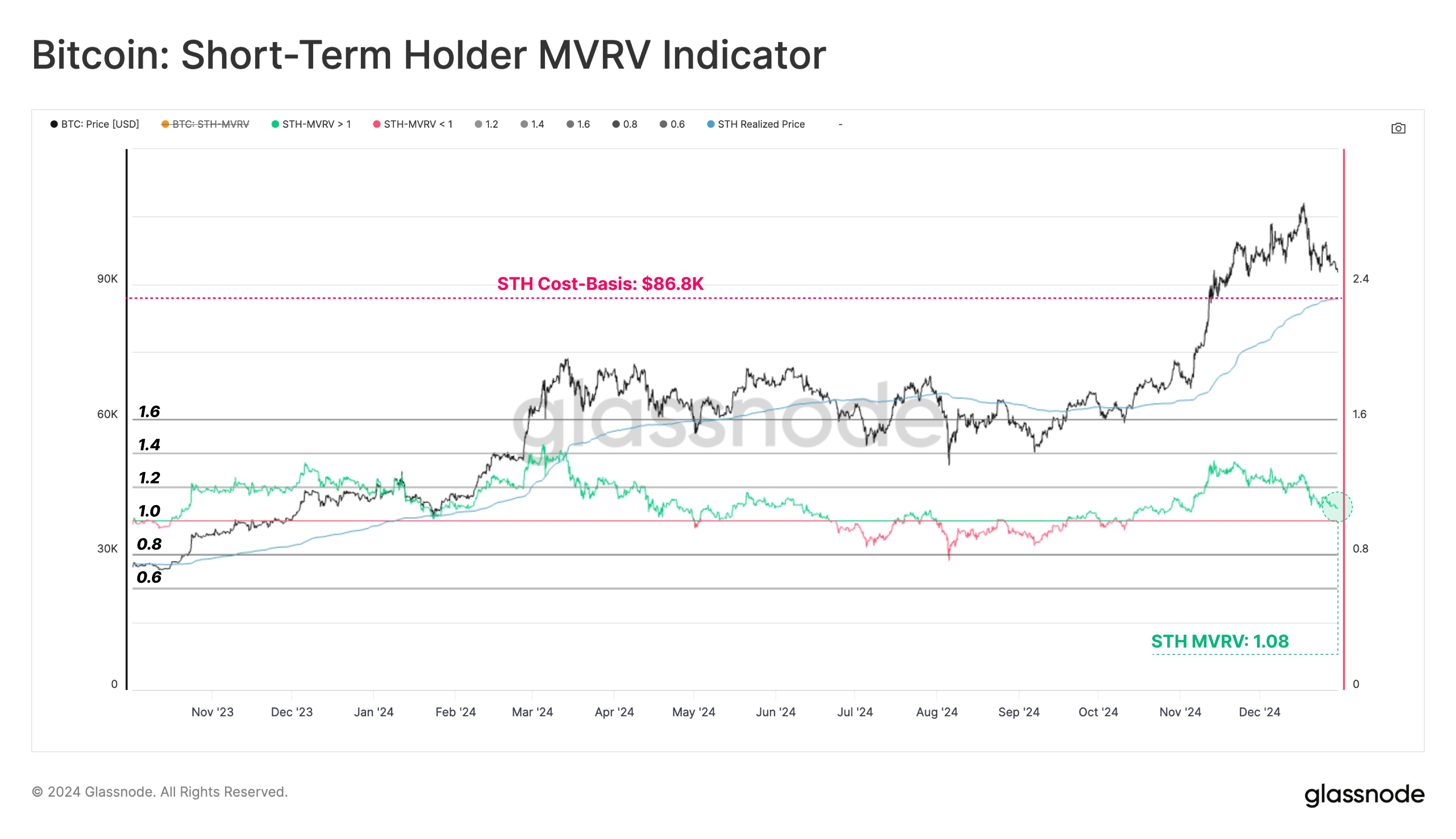

Under is the chart shared by the analytics agency that reveals the pattern within the Bitcoin STH MVRV Ratio over the previous yr or so:

As displayed within the graph, the Bitcoin STH MVRV Ratio spiked to notable ranges above the 1 mark when the latest leg up within the BTC rally occurred. The indicator being above this worth implies the Market Cap of the group is bigger than its Realized Cap, and so, the common member is in a state of revenue.

Not too long ago, because the decline within the cryptocurrency’s worth has occurred, the indicator has naturally gone down. Its worth nonetheless stays above the 1 stage, although, suggesting earnings held by the cohort nonetheless outweigh the losses.

At current, the STH MVRV Ratio is sitting at 1.08, which corresponds to the group holding unrealized good points of round 8%. Traditionally, the STHs have proven to signify the fickle-minded aspect of the market that simply participates in selloffs, so their being in giant earnings has tended to be a hazard signal for the worth.

The cohort is now not making important earnings after the drawdown, however maybe a cooldown could must occur if the chance of profit-taking has to go away. A metric that makes it handy to trace when this might occur is the “Realized Value,” which is derived from the Realized Cap by dividing it with the whole variety of tokens in circulation.

Associated Studying

From the chart, it’s seen that the STH Realized Value has a price of $86,800 proper now, which implies the group can be simply breaking-even on its funding if Bitcoin falls to this stage.

BTC Value

Bitcoin briefly fell below the $92,000 stage yesterday, however the coin has discovered a small rebound as its worth is now buying and selling round $94,500.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com