Bitcoin has confronted challenges reclaiming the $100,000 assist stage over the previous few days, reflecting short-term market hesitation.

Nonetheless, the broader macro perspective signifies that BTC stays poised for vital positive aspects heading into 2025, with bullish sentiment steadily taking maintain.

Bitcoin’s New Excessive Might Not Be A Lengthy Shot

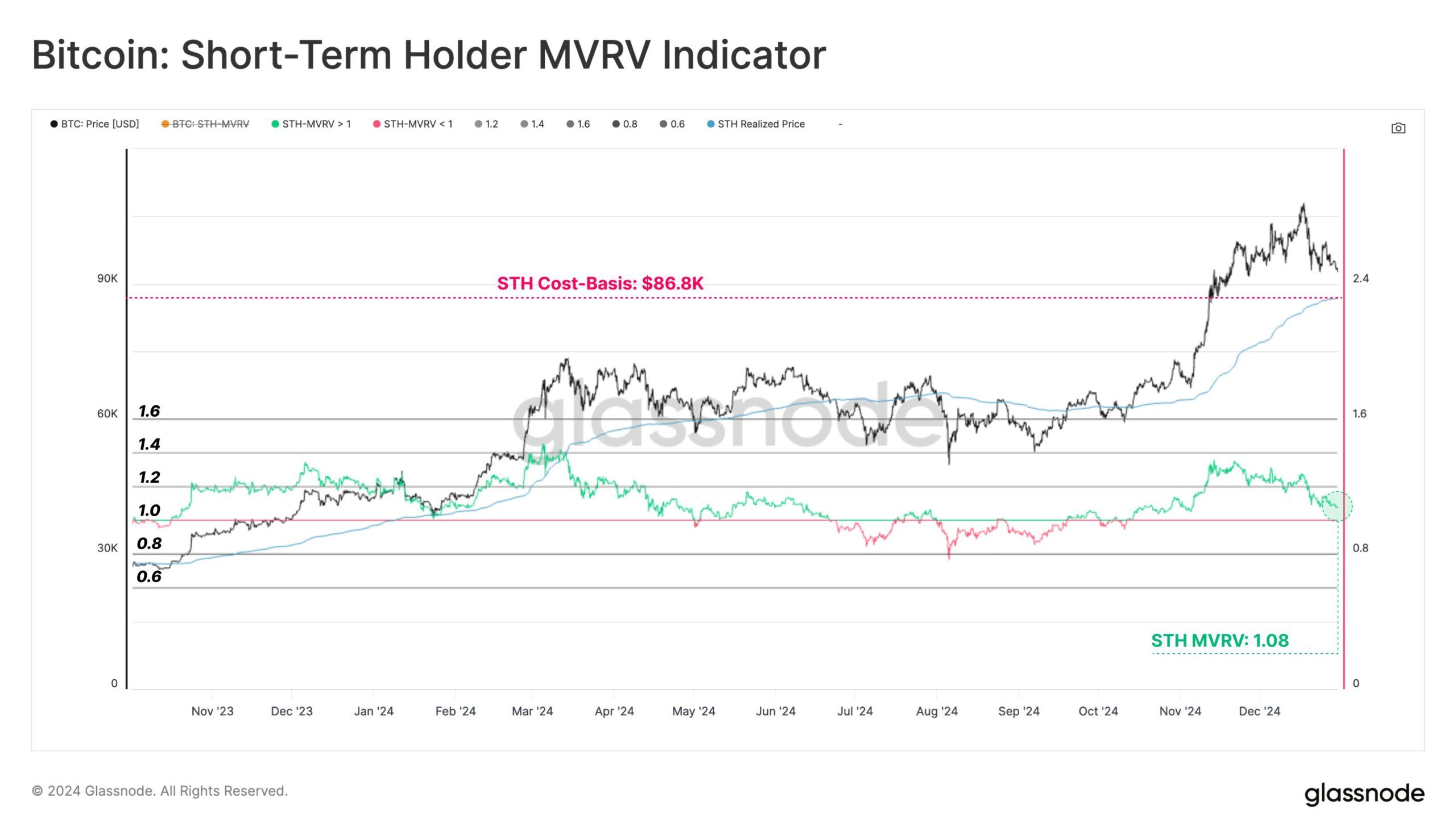

The mixture price foundation for short-term holders (STHs) at the moment resides at $86,800, a worth not removed from Bitcoin’s present value of $94,170. Traditionally, STHs are fast to promote throughout value fluctuations. Nonetheless, with these traders sitting on unrealized positive aspects of seven.9%, they’re extra more likely to maintain as market expectations lean bullish.

This cautious optimism stems from rising confidence in Bitcoin’s macro outlook. STHs, bolstered by market sentiment, seem prepared to keep up their positions. With Bitcoin nearing vital resistance ranges, the potential for increased value targets incentivizes holders to keep away from untimely exits, reinforcing the bullish case for 2025.

Analyst Crypto Rover lately tweeted that Bitcoin’s bounce from the $94,000 stage might “create new millionaires.” The resilience displayed at this value level, examined repeatedly over the previous six weeks, highlights its significance as a key assist stage.

This sustained bounce is driving predictions of an increase to $112,000 within the close to time period. Bitcoin’s capability to carry above $94,000 amidst rising shopping for stress displays sturdy macro momentum. Ought to this development proceed, BTC will shatter earlier resistance ranges and goal increased benchmarks on its upward trajectory.

BTC Worth Prediction: Noting A Rise

Bitcoin is at the moment buying and selling at $94,060, with its subsequent main goal set at $120,000. On a macro timeframe, BTC seems to be forming a parabolic curve, suggesting sustained bullish momentum. This technical formation aligns with the broader expectations for vital progress as 2025 approaches.

The weekly chart helps this outlook, exhibiting BTC established its third base between Q2 and Q3 2024. This basis is vital for propelling Bitcoin increased, probably enabling it to breach its all-time excessive (ATH) of $108,384. A continuation of this bounce might drive Bitcoin previous $120,000 within the coming months.

Nonetheless, dangers stay. If STHs select to promote their holdings, Bitcoin might retrace to search out assist at $89,586. Dropping this stage would possibly end in an extra decline to $72,569, successfully invalidating the present bullish outlook. Market situations within the brief time period will play an important position in figuring out Bitcoin’s trajectory.

Disclaimer

According to the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.