- Per QCP Capital, BTC might stay range-bound in January.

- BTC offered off after the December choices expiry amid low buying and selling volumes.

Bitcoin [BTC] closed the yr muted, regardless of rallying 120% YTD (year-to-date). Since December nineteenth, the cryptocurrency has remained beneath $100K.

Based on Chris Burniske, ex-ARK Make investments crypto lead and associate at crypto VC Placeholder, low buying and selling quantity as massive gamers consolidated their books led to end-year poor BTC efficiency.

BTC: January 2025 projection

Crypto buying and selling agency, QCP Capital, echoed Burniske’s sentiment. The agency added that an end-year sell-off was anticipated based mostly on historic developments after main choices expiry. It said,

“As anticipated, we noticed the standard quarter-end post-expiry vol selloff as vols are 2-3 vols decrease since Friday’s record-breaking expiry.”

Almost $14B in BTC choices, the most important in Deribit change historical past, expired on the twenty seventh of December. The decrease volatility (vols) after the expiry indicated possible muted worth motion into January.

QCP additionally famous that BTC might stay range-bound in January earlier than recovering in February.

“January’s common returns (+3.3%) are comparatively just like December’s (+4.8%), and we might anticipate spot to stay on this vary within the near-term earlier than issues begin to decide from Feb onwards.”

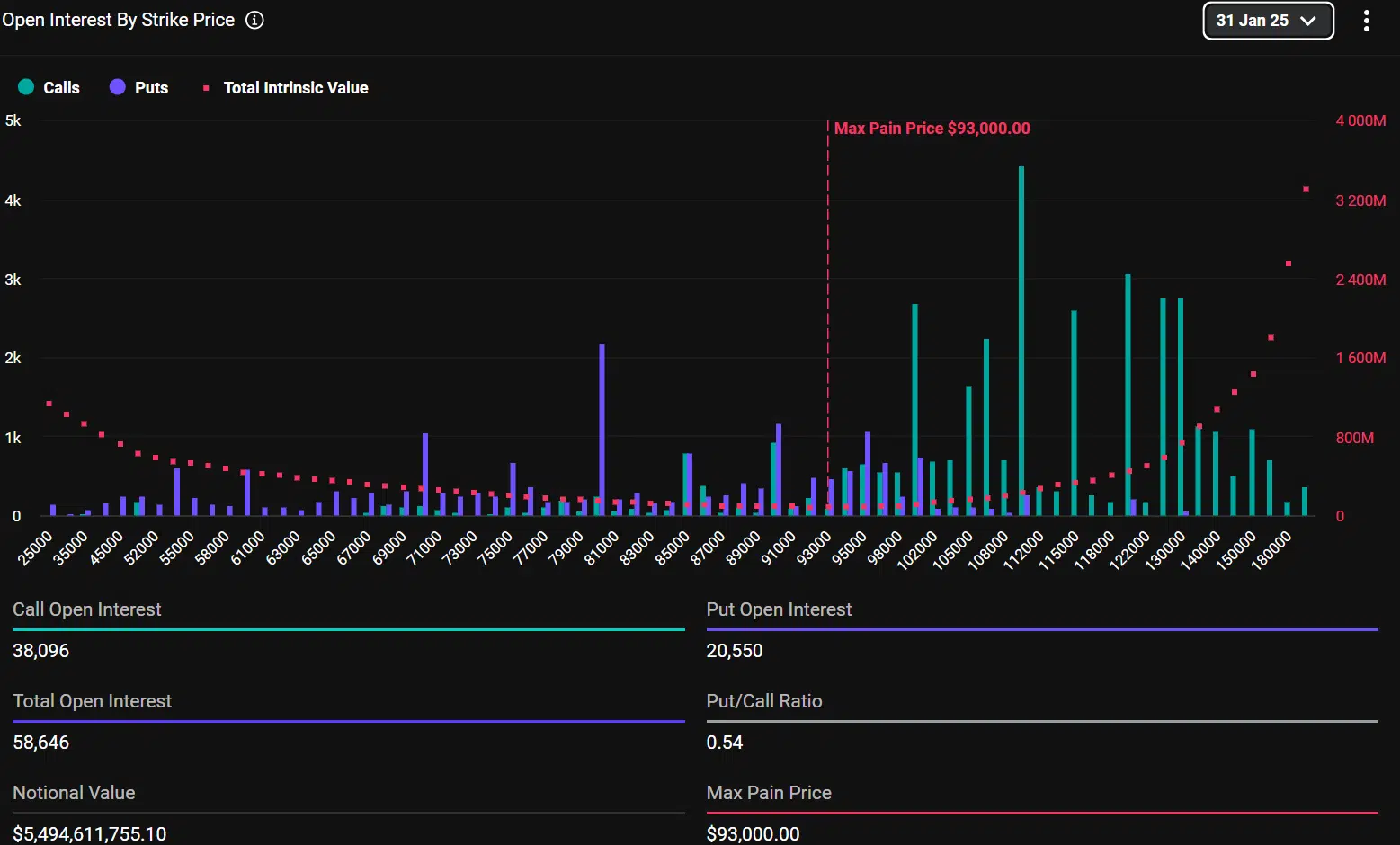

Supply: Coinglass

Coinglass knowledge exhibits that Q1 is often among the finest intervals for BTC, with a mean achieve of 56%. Nevertheless, QCP notes that January isn’t BTC’s strongest month.

As a substitute, February and March have traditionally been BTC’s finest performers, with common positive factors of 15% and 13%, respectively.

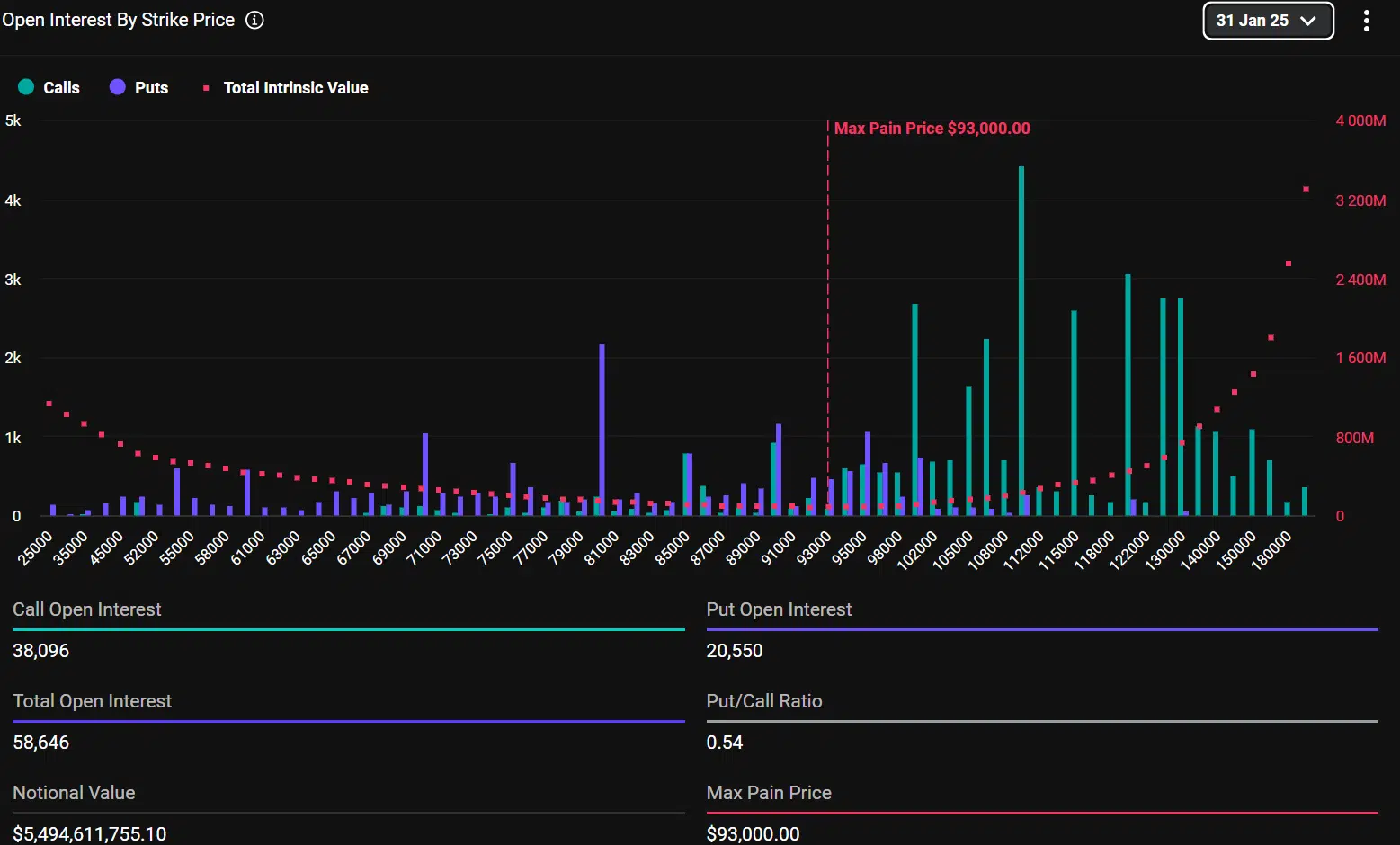

For the January-end expiry, choices merchants have positioned the best bullish bets (calls) at $110K and bearish bets (places) at $80K. The max ache stage, the place most choice contracts might expire nugatory, is $93K.

Supply: Deribit

Put in another way, merchants anticipated BTC to climb to $110K or slide as little as $80K. However the March expiry noticed large targets of $120K and $130K.

In brief, BTC choice merchants anticipated extra traction in February and March than in January.