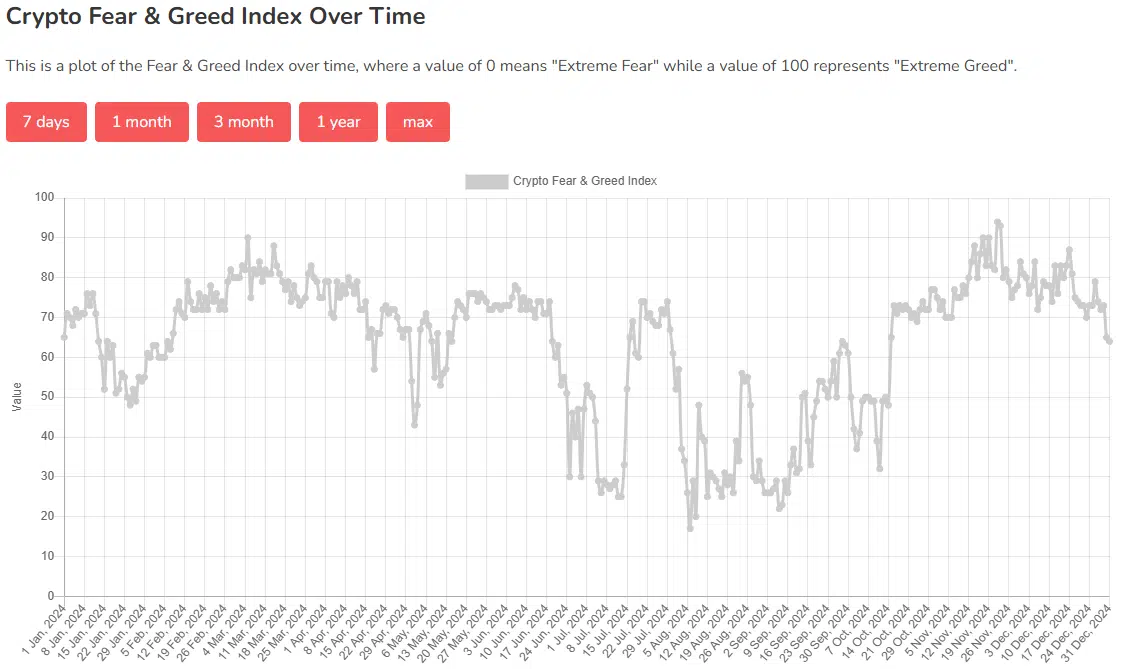

- The Bitcoin Concern and Greed Index confirmed a wholesome reset just lately.

- The value motion was firmly bullish, though a deeper retracement can’t be absolutely discounted.

Bitcoin [BTC] was buying and selling at $92.8k, at press time. This was a short-term demand zone, a bullish order block fashioned on the twenty sixth of November. Regardless of the tepid value motion in current weeks, the market sentiment remained grasping.

Supply: Different.me

The studying of 64 displays a drop from the 75+ values noticed within the second half of November when the uptrend accelerated. The correction over the previous two weeks has damage sentiment but in addition supplied a much-needed reset.

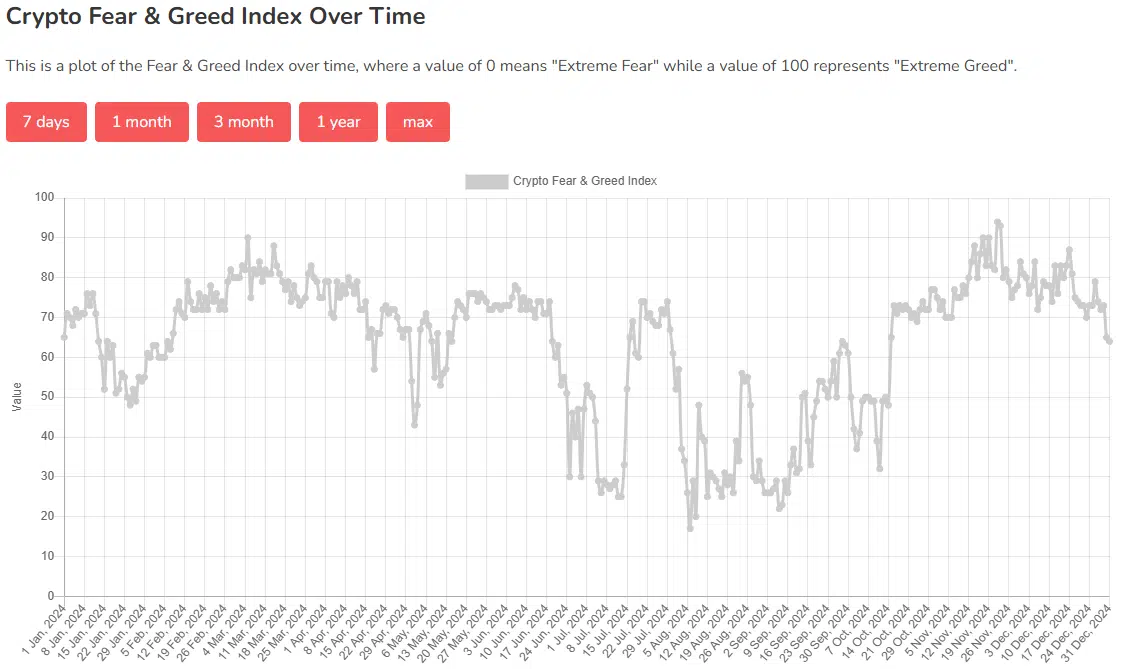

Supply: Different.me

The Bitcoin Concern and Greed readings over time confirmed that the current rejection from $100k has reset greed to 64. This worth was decrease than any that was seen because the fifteenth of October. But, the worth of Bitcoin is up by 40.57% since then.

Bitcoin Concern and Greed from the worth charts

Supply: BTC/USDT on TradingView

The value charts of any asset are additionally a gauge of sentiment. The value motion over time, throughout completely different timeframes, represents concern and greed within the type of candles. With that in thoughts, the weekly value chart of BTC additionally mirrored robust greed or bullishness.

A retracement to $77k, the 20-week shifting common, wouldn’t quell this perception. At press time, it was unclear if such a drop ought to be anticipated. Evaluation of on-chain metrics elsewhere confirmed {that a} value surge was extra possible than additional losses.

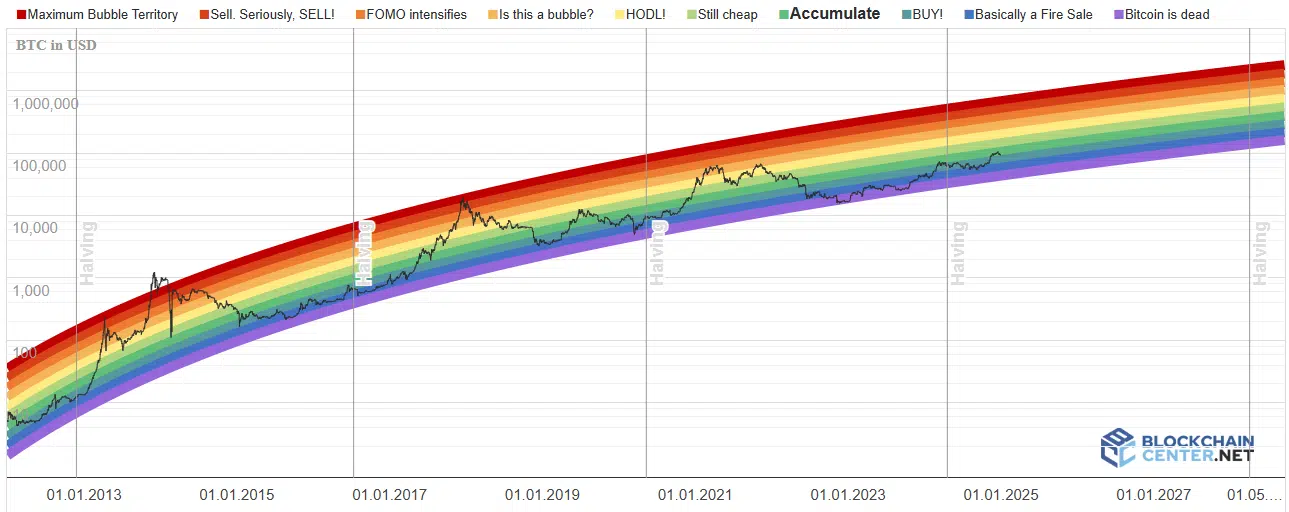

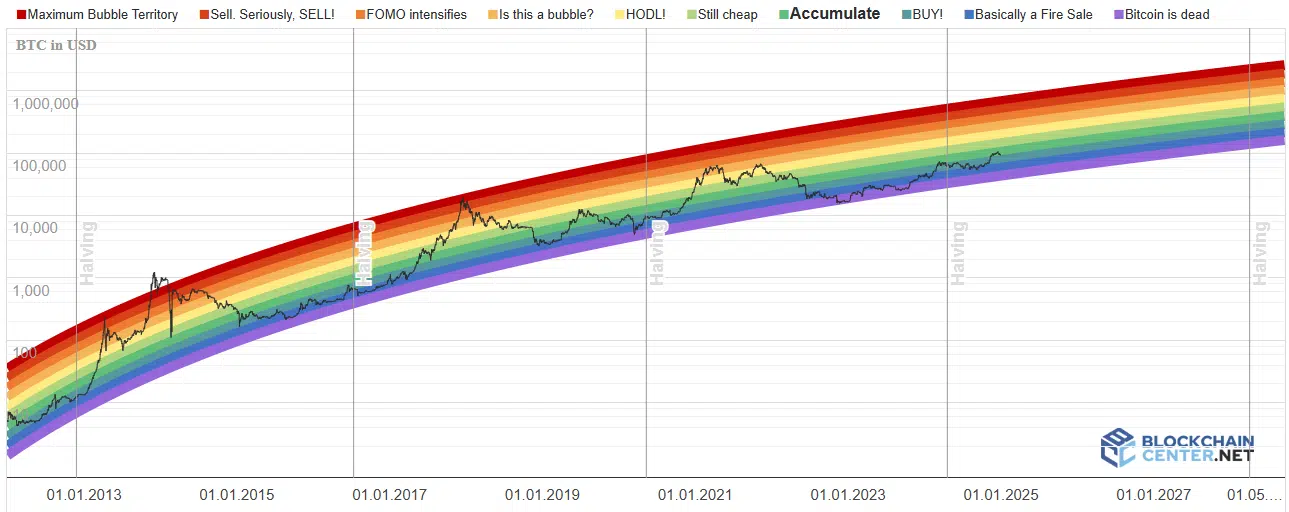

Supply: Blockchain Heart

The Bitcoin Rainbow chart confirmed a bullish pattern. Regardless of Bitcoin surpassing $100k earlier this month, the Rainbow chart nonetheless signaled “Accumulate.” Even when Bitcoin reaches $151k by the second week of February, the Rainbow chart would label it as “nonetheless low cost.”

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

Within the final cycle, reaching the “Is that this a bubble?” territory marked the height. If this occurs in November 2025, Bitcoin’s value can be $385k.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion