Grayscale Analysis launched a brand new report at the moment detailing its predictions for the top-performing crypto sectors in Q1 2025. The tail finish of 2024 introduced in huge success, serving to create a way of competitors and vitality within the area.

The agency’s report concludes that sensible contracts have extra potential and dynamic power than every other. Nonetheless, a number of heavy hitters like tokenization and DePin have additionally attracted Grayscale Analysis’s curiosity.

Grayscale Report Highlights Robust Competitors within the Good Contract Market

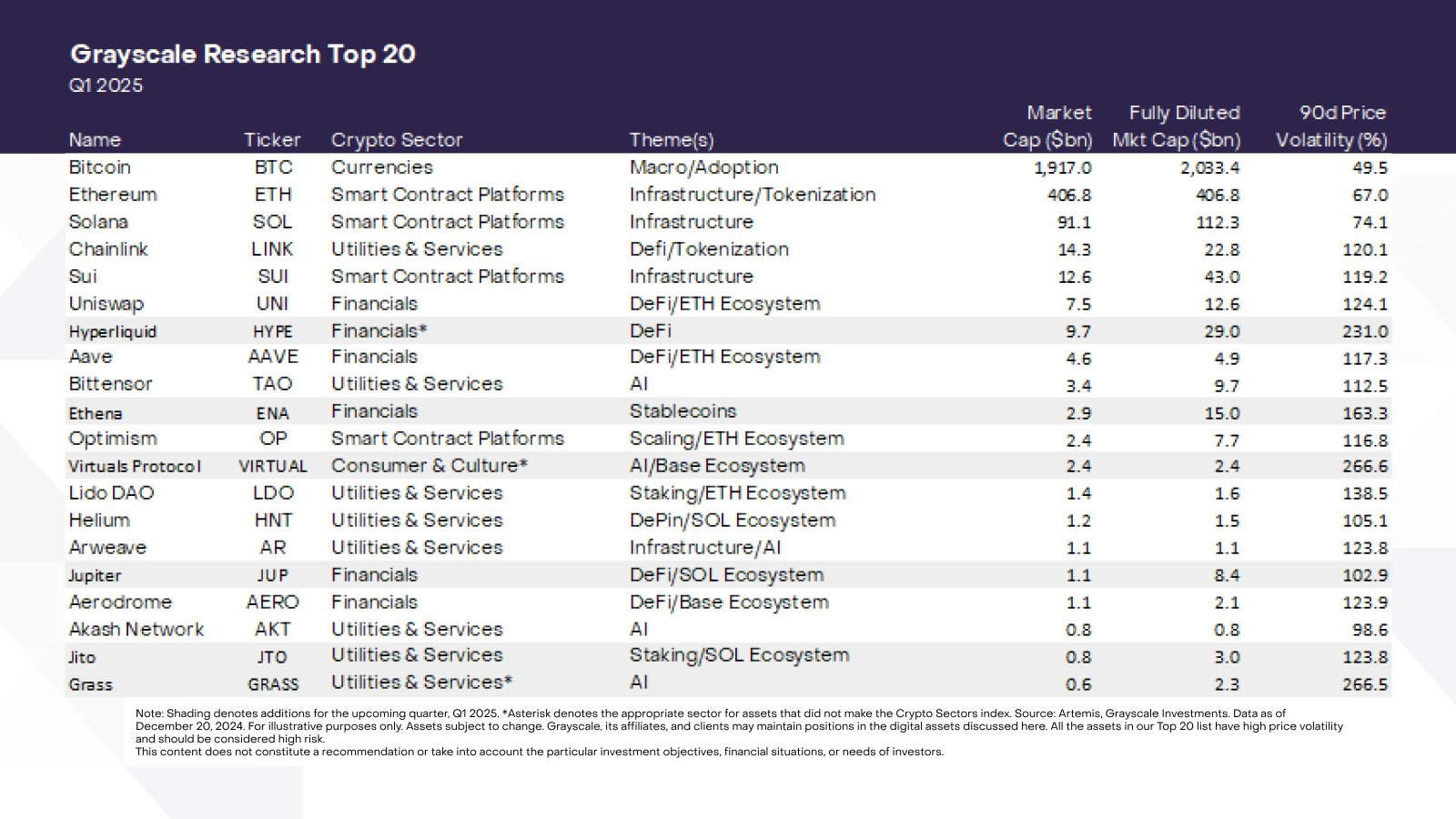

Grayscale, one of many main Bitcoin ETF issuers, launched this report with a number of feedback on its major predictions. The agency concluded that crypto markets soared in This fall 2024 and that fierce competitors between sensible contract platforms has been a serious progress facilitator. It additionally supplied a “High 20” checklist of highest-performing DeFi/Web3/crypto funding choices.

The agency referred to as sensible contracts “essentially the most aggressive market phase within the digital property business,” noting that Ethereum underperformed regardless of landmark victories just like the ETF and a considerable software program improve. As an alternative, rivals like Solana, Sui, and TON ate up their market share, highlighting the dynamic power of this sector.

Grayscale places the best expectations on sensible contracts. Nonetheless, only some of its High 20 property fall into this class, and this doesn’t even embrace the main asset. Different areas of curiosity embrace a number of that have been high-interest within the final report, equivalent to scaling options, tokenization, and DePin.

“No matter design selections and a community’s strengths and weaknesses, a method sensible contract platforms derive their worth is thru their capability to generate community charge income. The better the power of a community to generate charge income, the better the community’s capability to cross on worth to the community within the type of token burn or staking rewards. This quarter, the Grayscale Analysis High 20 options the next sensible contract platforms: ETH, SOL, SUI, and OP,” the report famous.

The corporate is a subsidiary of the Digital Forex Group (DCG), and has a protracted historical past inside the crypto area. Grayscale led the authorized effort for a Bitcoin ETF, which succeeded in January 2024, though the agency shortly misplaced dominance over the brand new market.

Regardless of this setback, it has nonetheless been a pioneer in gaining SEC approvals for Ethereum ETFs and new ETF choices buying and selling. In the end, the agency’s capability to promote a profitable ETF has little bearing on its capability to critically assess market potential.

Admittedly, although, Grayscale Analysis’s Q1 2025 report barely mentions the ETF area, presumably contemplating it tangentially related to the primary fundamentals. In any occasion, Grayscale is considerably optimistic about crypto’s future.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.