- 2025 might be the yr that proves if Saylor’s daring technique works or not

- MicroStrategy’s shrinking profitability might put a severe dampener on its Bitcoin shopping for spree

Michael Saylor, Co-founder of MicroStrategy, is continuous to display his dedication to Bitcoin [BTC]. From huge acquisitions to daring guarantees of steady shopping for, and intelligent methods to fund his rising Bitcoin stash, he’s at all times within the headlines.

Now, in his newest submit, Saylor has sparked recent hypothesis about his subsequent BTC buy. Will it’s a much-needed ‘New 12 months’ increase for anxious traders, or simply one other daring threat he’s prepared to take?

Both manner, the stakes are increased than you would possibly assume – So, control this.

Michael Saylor – The savior of Bitcoin or MSTR?

Michael Saylor’s enterprise mannequin is as clear as day – It’s all about Bitcoin. With a staggering 444,262 Bitcoins in its treasury, it’s no surprise that even a ‘sell-the-news’ occasion involving MicroStrategy might ship shockwaves by the market.

Nonetheless, right here’s the true story – It’s not simply speak. In 2024 alone, MicroStrategy made 13 Bitcoin purchases, with the most important bombshell dropping in mid-November. That’s when the corporate scooped up a staggering 55,000 BTC in a single transaction, pouring $5.4 billion into the digital asset.

Supply : Bitcoin Treasuries by BitBo

Coincidence or not, this huge accumulation occurred simply as Bitcoin’s worth took a pointy dive – Posting a 5% every day drop. However make no mistake, Microstrategy knew precisely what it was doing.

MSTR, the publicly traded inventory of MicroStrategy, was driving excessive on the “Trump pump,” after Microstrategy executed three enormous BTC buys in three consecutive weeks following the election.

The end result? Its inventory skyrocketed to an all-time excessive of $504 on 20 November, its peak for the month. Clearly, it’s protected to say that MicroStrategy’s Bitcoin purchases have had a direct affect on MSTR’s inventory valuation.

Alas, right here’s the twist – Bitcoin hasn’t been sort recently. After crashing from $108k per BTC to $93k at press time, MSTR has felt the affect. Now buying and selling at $330, MSTR has fallen by a staggering 34% in simply two weeks.

This would possibly simply be the beginning of one thing larger

Technically, when a inventory worth falls, the corporate’s market cap takes successful, and the income from its shares begins to shrink. This ripple impact can rapidly drain the enterprise’s total income stream, creating an actual monetary pressure.

To show the tide, Michael Saylor has a couple of daring choices. He might attempt to manipulate Bitcoin’s worth to provide MSTR a lift, or he might lean on exterior sources, like taking over extra debt.

And, he’s already making strikes. In his current SEC submitting, Saylor revealed plans to boost a whopping $10 billion by issuing further shares. So, what’s subsequent? That current submit from Saylor might very nicely be a glimpse into his subsequent huge play.

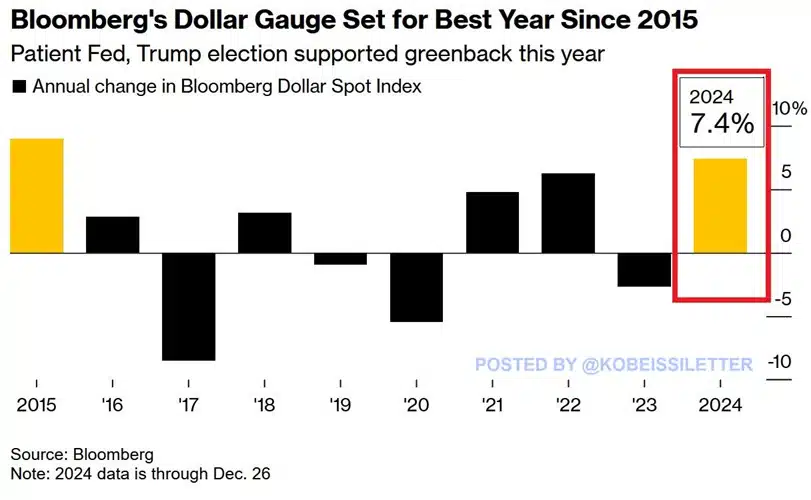

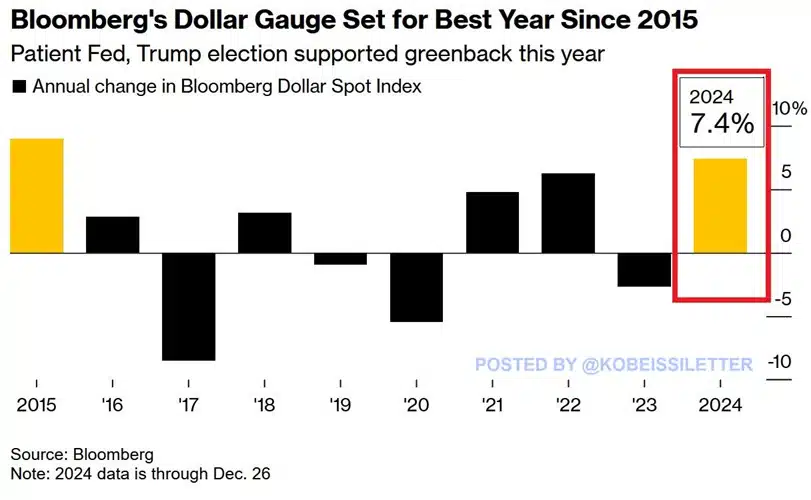

However, right here’s the place it will get much more fascinating. Zooming out, the U.S inventory market is on observe for back-to-back losses, whereas the U.S greenback is continuous to surge.

The Bloomberg Greenback Spot Index has gained by 7.4% in 2024, on tempo for its finest annual efficiency in 9 years. In truth, the index has jumped 6.9% in simply the final 3 months, hitting its highest stage since November 2022.

Supply : Bloomberg

Why does this matter? The inventory market is heading into uneven waters, with the U.S financial system dealing with heightened volatility in 2025 – and MSTR just isn’t immune.

Learn Bitcoin’s [BTC] Value Prediction 2025-26

Even worse, MicroStrategy’s dwindling profitability might make it a lot more durable for the corporate to proceed its Bitcoin shopping for spree.

For Michael Saylor, usually hailed because the “savior of Bitcoin,” 2025 could be the yr to place that title to the final word take a look at.