2024 has confirmed to be a landmark 12 months for the cryptocurrency business, marking vital milestones that reshaped the panorama.

From groundbreaking regulatory shifts to unprecedented market actions, this 12 months noticed crypto take main steps towards mainstream adoption. Institutional curiosity skyrocketed, governments revisited their stance on digital property, and technological developments pushed the boundaries of what blockchain can obtain. As we replicate on the 12 months, listed here are the highest 10 tales that outlined the crypto world in 2024.

The SEC Approves Spot Bitcoin ETFs

By January 2024, the SEC had accepted 12 Spot Bitcoin ETFs, ushering Bitcoin into the US retail funding panorama for the primary time.

The launch of those ETFs sparked unprecedented curiosity, with retail buyers pouring tens of millions into the funds. Bitcoin ETFs grew to become the fastest-growing ETFs in historical past, propelling Bitcoin to surpass its 2021 all-time excessive inside two months of approval. By March, the cryptocurrency shattered the $70,000 barrier, setting off a ripple impact that prompted different markets, such because the UK, to introduce Bitcoin-based exchange-traded merchandise (ETPs).

By the top of 2024, US Spot Bitcoin ETFs had amassed over $105 billion in internet property, accounting for practically 5.7% of Bitcoin’s complete provide. Notably, these ETFs surpassed Gold ETFs in property underneath administration (AUM), highlighting the speedy institutional embrace of crypto. Constructing on this momentum, Ethereum ETFs gained approval, with comparable purposes for different altcoins in progress, signaling a brand new period of mainstream adoption for digital property.

The Surge of Solana Meme Cash

The 12 months 2024 marked a rare chapter for Solana, as its ecosystem grew to become a hub for the meme coin phenomenon. Whereas these playful tokens had already existed inside the community, platforms like Pump.enjoyable considerably boosted their visibility and attraction, turning them into a significant pattern.

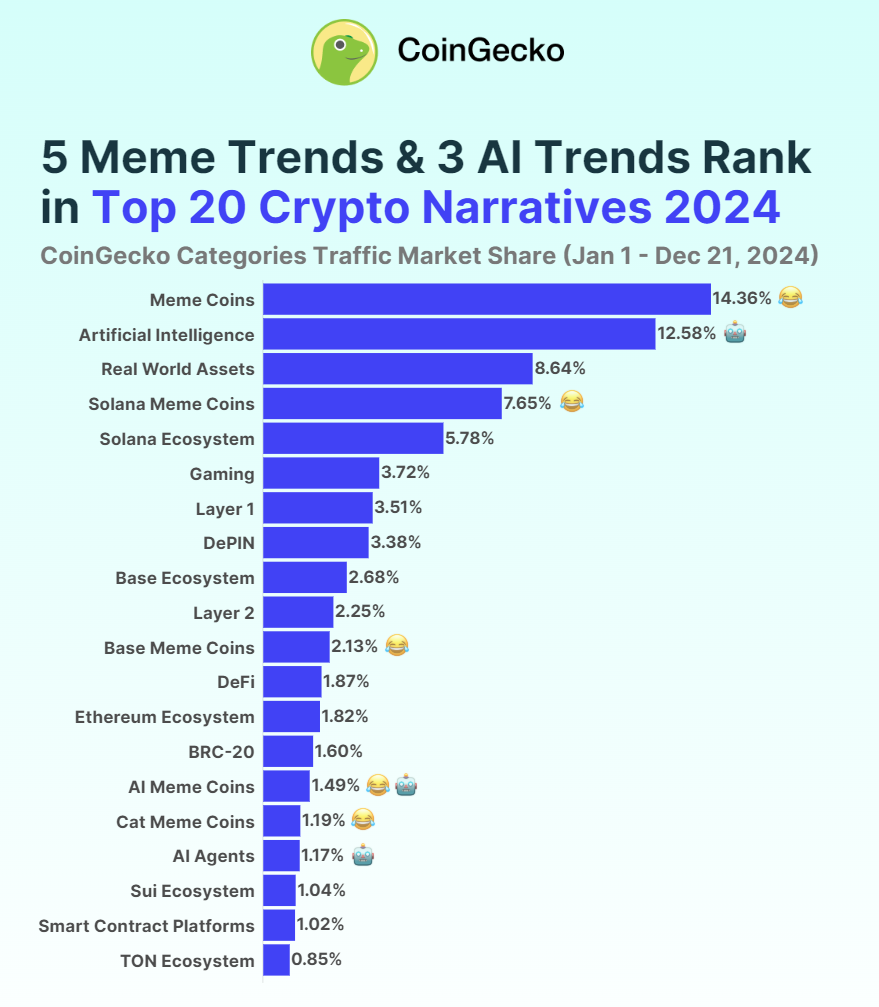

Solana’s meme cash climbed to the fourth spot in investor curiosity, dominating 7.65% of discussions throughout crypto narratives, as famous by CoinGecko. Collectively, these tokens achieved a market cap surpassing $16 billion. Among the many most distinguished have been Dogwifhat (WIF) and BONK, two of the highest 5 meme cash globally. WIF skilled an astonishing 1,100% surge this 12 months, whereas BONK’s development skyrocketed by 38,000% over the previous two years.

This surge in meme coin exercise additionally propelled Solana to new heights, establishing it because the second-largest blockchain behind Ethereum. The community’s complete worth locked (TVL) exceeded $8.6 billion, and SOL itself hit a record-breaking value of $263 in November. With minimal transaction charges encouraging widespread participation, Solana seamlessly merged humor with monetary alternative, solidifying its place on the middle of the meme coin increase in 2024.

Ethereum ETF approval

In a growth that has caught many abruptly, the U.S. Securities and Change Fee (SEC) gave the inexperienced gentle for the launch of spot Ethereum Change-Traded Funds (ETFs) again in July. This choice adopted a sequence of joint proposals from main exchanges, together with Nasdaq, NYSE, and CBOE, which requested modifications to present laws to allow Ethereum-based Change-Traded Merchandise (ETPs) and ETFs.

This transfer comes shortly after the SEC accepted Bitcoin ETFs and ETPs in January, a call that performed a task in driving Bitcoin to achieve new value heights. Now, with the approval of spot Ether ETFs, Ethereum’s market presence is predicted to expertise vital development, much like Bitcoin’s current surge.

Donald Trump’s Election Victory

Donald Trump’s 2024 election victory has injected new optimism into the crypto business. His pro-crypto stance has already triggered vital developments, together with a $1 trillion market surge, Bitcoin reaching $100,000, and XRP hitting a six-year excessive amid guarantees to overtake the SEC.

Trump’s appointments of crypto-friendly figures like Paul Atkins, David Sacks, and Elon Musk sign a shift in the direction of supportive insurance policies. Plans for a nationwide Bitcoin reserve additional spotlight his administration’s dedication to digital property.

Globally, crypto adoption is accelerating, with a 683% improve in customers aged 18–25 and substantial inflows into European crypto exchange-traded merchandise. These shifts point out rising legitimacy and institutional curiosity worldwide.

Bitcoin Reached $100,000

Probably the most defining moments of 2024 was Bitcoin crossing the $100,000 mark, a big psychological threshold for each the cryptocurrency and its world group. This milestone highlighted Bitcoin’s evolution right into a mature monetary asset, inspiring higher confidence amongst institutional and retail buyers alike. Bitcoin even managed to surpass silver’s market cap alongside the way in which.

For advocates like MicroStrategy, which adopted a Bitcoin-centric technique early on, the achievement validated their imaginative and prescient. This confidence was mirrored within the surge of MSTR’s inventory worth and its current inclusion within the Nasdaq-100 index.

The $100,000 breakthrough additionally spurred a shift in notion amongst governments, with some beforehand skeptical nations, together with Russia and Japan, now exploring the opportunity of adopting Bitcoin as a reserve asset. In the meantime, company giants like Amazon are reportedly investigating Bitcoin investments, hinting on the rising integration of cryptocurrencies into mainstream enterprise practices. Such developments are anticipated to speed up adoption and gasoline innovation throughout the crypto panorama.

Gary Genslar’s Resignation

Gary Gensler’s time as SEC Chair marked a turbulent interval for the U.S. crypto business, outlined by strict oversight and enforcement actions. Nonetheless, with Trump’s re-election, the SEC is now present process a significant shift in management and course.

In November, Gensler introduced his resignation, abandoning a legacy of controversy. Identified for his powerful stance, he maintained that the majority cryptocurrencies needs to be handled as unregistered securities, requiring adherence to securities legal guidelines. This viewpoint led to high-profile authorized actions in opposition to main exchanges like Binance and Coinbase for failing to register their operations.

Critics argue that Gensler’s enforcement-driven method stifled innovation and created widespread regulatory uncertainty. In a big transfer, Trump has already tapped Paul Atkins, a well known supporter of digital property, to succeed him.

This management change has been welcomed by the crypto group, which hopes the brand new administration will foster a extra supportive regulatory framework, encouraging development and innovation within the sector.

Sam Bankman-Fried sentenced to 25 years in jail

In March, Sam Bankman-Fried, the previous CEO of FTX, obtained a 25-year jail sentence and was ordered to pay $11 billion in restitution for his involvement in one of the vital vital monetary frauds in U.S. historical past.

By September, Bankman-Fried had filed an attraction, requesting a brand new trial and alleging misconduct in how Decide Lewis Kaplan presided over the proceedings.

In the meantime, Ryan Salame, who served as co-CEO of FTX Digital Markets, started his seven-and-a-half-year jail time period in October for his function within the collapse. In distinction, Caroline Ellison, the ex-CEO of Alameda Analysis, obtained a decreased sentence of two years. Nishad Singh, FTX’s former engineering director, and co-founder Gary Wang prevented jail altogether after cooperating extensively with investigators.

Bitcoin ushers in fourth halving

In April, Bitcoin underwent its fourth halving, an occasion that lower miners’ block rewards from 6.25 BTC to three.125 BTC, ushering in a big shift for the community.

Happening at block 840,000, this halving decreased Bitcoin’s day by day manufacturing to roughly 450 BTC, down from 900 BTC. These periodic reductions, which happen roughly each 4 years, will proceed till the complete Bitcoin provide is mined—an occasion projected for 2140. At that time, miners will rely solely on transaction charges for earnings.

Mt. Gox Extends Compensation Timeline to 2025

October noticed yet one more delay within the long-awaited reimbursement course of for collectors of the collapsed cryptocurrency alternate, Mt. Gox. The brand new deadline has been pushed to October 31, 2025, a 12 months past the beforehand revised date of October 31, 2024.

This extension has briefly alleviated fears of a sudden inflow of promoting stress on Bitcoin. Earlier within the 12 months, Mt. Gox transferred 47,229 BTC and accomplished different transactions with accepted crypto exchanges as a part of its plan to redistribute over $9 billion in Bitcoin, Bitcoin Money, and fiat forex to collectors.

Established in 2010, Mt. Gox rapidly rose to prominence as the most important Bitcoin buying and selling platform. Nonetheless, its dramatic downfall got here in 2014 when the platform was hacked, ensuing within the lack of 850,000 BTC and leaving collectors in limbo for practically a decade.

MicroStrategy’s Yr of Bitcoin Accumulation

All through 2024, MicroStrategy, the enterprise intelligence agency that has embraced Bitcoin as its major treasury reserve, continued its aggressive acquisition technique. Between November 18 and 24, the corporate made its largest buy but, buying a further 55,500 BTC for round $5.4 billion, averaging $97,862 per Bitcoin. On December 30 the corporate introduced its final purchase for the 12 months – 2,000 BTC for round $209 million.

With this buy, MicroStrategy’s complete holdings in Bitcoin have surged to 446,400 BTC, curently valued at over $42.7 billion. The corporate has been steadily buying Bitcoin since 2020, with a median buy value of $58,219 per Bitcoin, leading to a complete funding of roughly $27.7 billion, together with transaction charges.

In October, the agency revealed plans to lift as much as $42 billion by means of a mixture of fairness and debt choices, aiming to broaden its Bitcoin stash additional. The long-term imaginative and prescient is for MicroStrategy to evolve into a number one “Bitcoin financial institution,” doubtlessly reaching a trillion-dollar market valuation.