XRP value is down 6% over the past seven days however has managed to get better 3% prior to now 24 hours, signaling potential stabilization. The RSI has risen to 46.5, shifting out of oversold territory, whereas whale exercise stays secure after a short accumulation section throughout Christmas.

These indicators counsel cautious market sentiment, with XRP buying and selling between resistance at $2.13 and help at $1.96. Whether or not XRP can keep its restoration or face additional declines will depend upon breaking key resistance ranges or avoiding a possible dying cross on its EMA strains.

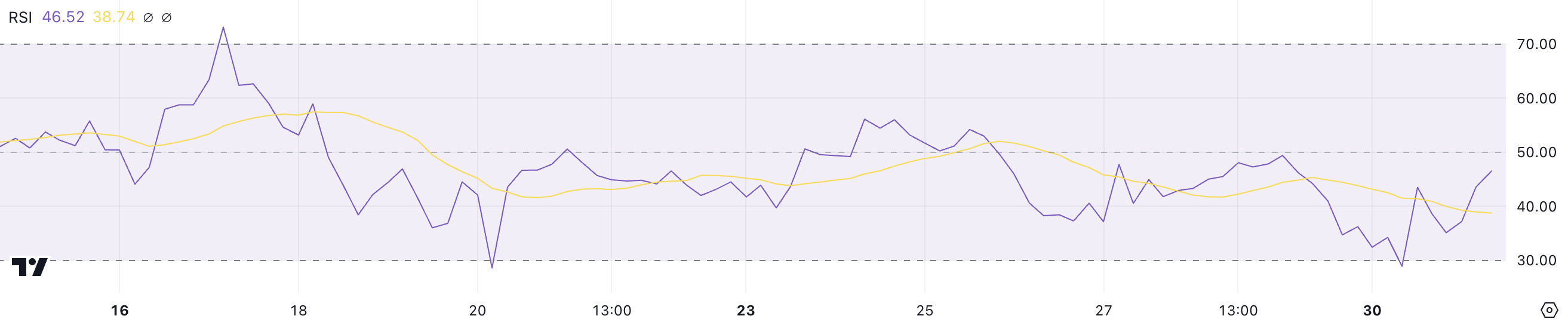

XRP RSI Recovered From an Oversold Zone

XRP Relative Power Index (RSI) is presently at 46.5, recovering from an oversold stage of 30 that it touched between December 30 and December 31. This rebound means that promoting stress has eased, and the worth is trying to stabilize.

An RSI of 46.5 signifies that momentum stays barely bearish however is shifting towards a impartial zone, signaling potential indecision amongst merchants as XRP value tries to take care of its place above $2.

The RSI is a momentum indicator that measures the velocity and magnitude of value actions on a scale of 0 to 100. Readings above 70 point out overbought situations, typically signaling a possible value pullback, whereas readings beneath 30 counsel oversold situations and the opportunity of a value restoration.

With XRP RSI at 46.5, it sits in a impartial vary, neither signaling sturdy upward nor downward momentum. Within the brief time period, this might imply that XRP is in a consolidation section, the place it might hover close to present ranges except a big shift in shopping for or promoting stress happens.

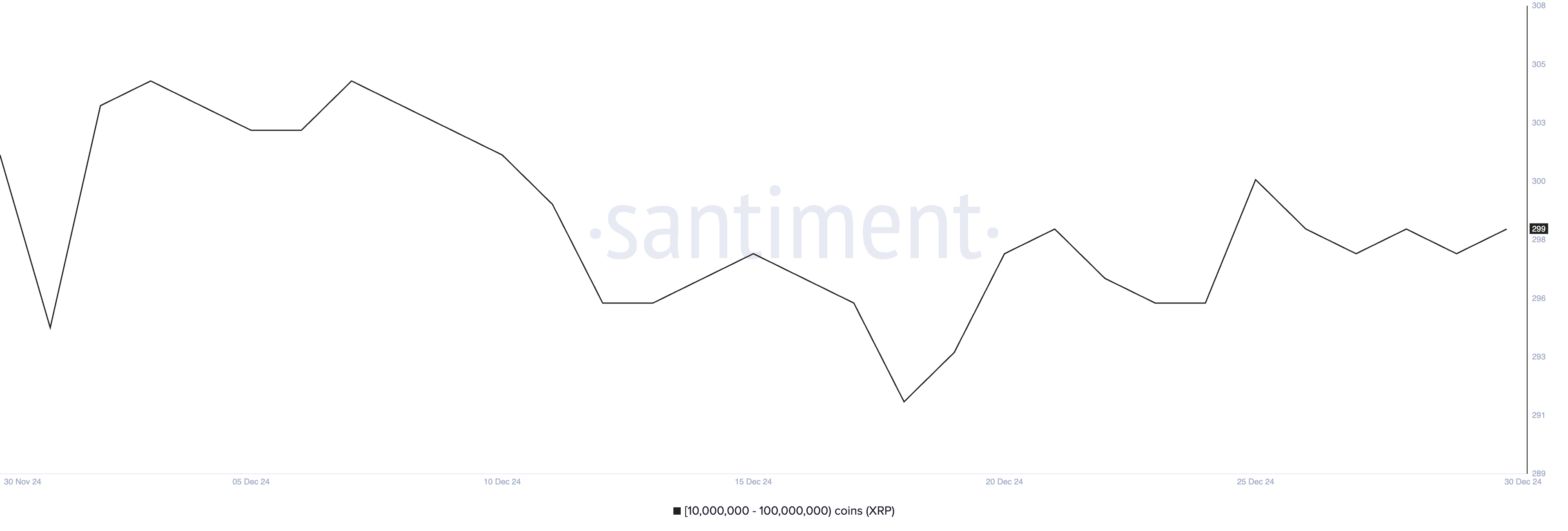

Whales Amassed XRP Throughout Christmas

The variety of XRP whales—addresses holding between 10 million and 100 million XRP—has remained secure in current days. These addresses noticed a short enhance from 296 to 301 between December 24 and December 25, signaling a short-term accumulation section.

Nevertheless, the quantity declined barely and has hovered round 298 to 299 since December 26, indicating a interval of stabilization in whale exercise. This regular conduct suggests that enormous buyers are neither aggressively accumulating nor promoting XRP in the intervening time.

Monitoring whale exercise is essential as a result of these giant holders typically considerably affect market dynamics. Their shopping for can create upward momentum, whereas their promoting can apply downward stress.

The present stabilization within the variety of whales suggests a cautious strategy, reflecting a impartial sentiment amongst main buyers. Within the brief time period, this might imply that XRP value might stay range-bound, with minimal volatility, except whale exercise shifts decisively towards accumulation or distribution.

XRP Worth Prediction: Will It Keep Above $2?

XRP value is presently buying and selling inside a slender vary, with a resistance stage at $2.13 and help at $1.96, as it really works to take care of its place above $2.

If the resistance at $2.13 is examined and damaged, XRP value may see additional upward momentum, probably focusing on $2.33. Ought to the uptrend acquire extra energy, the worth may climb as excessive as $2.53, signaling a stronger bullish section.

Nevertheless, the EMA strains counsel warning, as a possible dying cross may kind quickly, indicating a bearish shift in momentum.

If this bearish setup materializes, XRP value might lose the crucial $1.96 help and take a look at $1.89. A failure to carry above this stage may push the worth down additional to $1.63, marking a big decline.

Disclaimer

According to the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.