Pudgy Penguins (PENGU) worth has surged over 9% within the final 24 hours, with buying and selling quantity hovering 150% to succeed in $907 million. Now the second-largest Solana meme coin behind BONK, PENGU is attracting vital consideration as its market cap climbs to $2 billion.

Regardless of a current RSI surge and bullish momentum mirrored within the DMI, the development power stays modest, signaling cautious optimism amongst merchants. The altcoin s approaching crucial resistance at $0.043, with potential for additional positive factors or a pointy correction relying on whether or not the present momentum sustains or reverses.

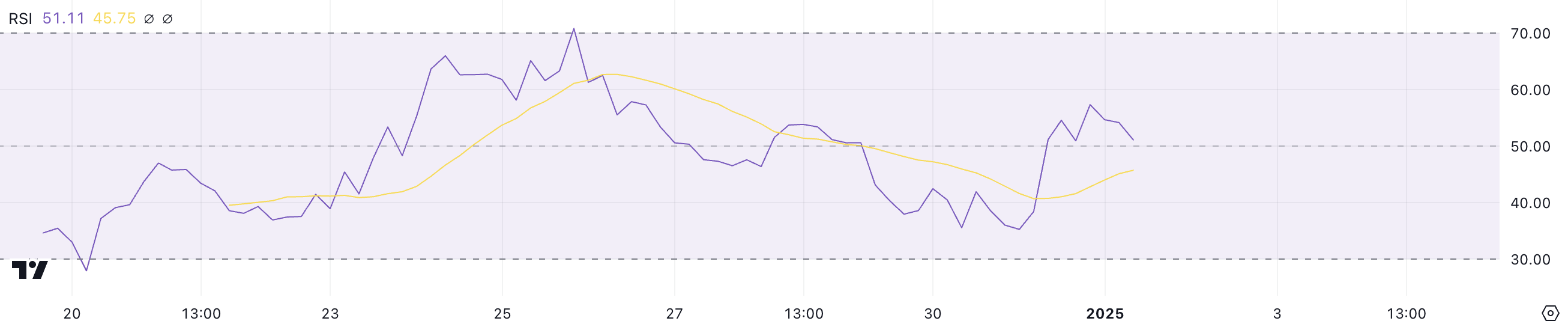

PENGU RSI Spikes however Stays in Impartial Zone

PENGU Relative Energy Index (RSI) is presently at 51, reflecting a slight decline from yesterday’s 57 after surging from 35 in lower than a day. This motion signifies that whereas shopping for stress has diminished considerably, the RSI nonetheless stays within the impartial zone.

The fast surge from oversold ranges suggests a current restoration section, however the stabilization round 51 hints at a market pause as merchants assess the following route for PENGU worth.

The RSI is a momentum indicator that measures the power and pace of worth actions on a scale from 0 to 100. Readings above 70 point out overbought circumstances, typically signaling a possible pullback, whereas readings beneath 30 recommend oversold circumstances and a potential worth restoration.

With PENGU’s RSI at 51, the indicator alerts neither robust bullish nor bearish momentum, reflecting market indecision. Within the quick time period, this impartial RSI means that PENGU worth could consolidate until a shift in shopping for or promoting stress pushes momentum in a transparent route.

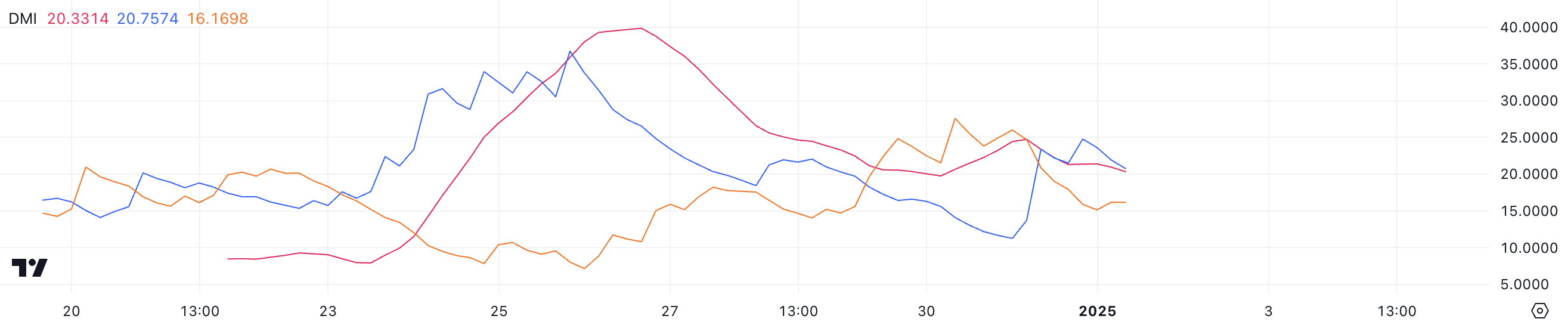

PENGU Pattern Lacks Energy

PENGU’s DMI chart exhibits its ADX presently at 20.3, barely beneath the 25 degree recorded a day in the past, indicating a weakening development power. This decline in ADX means that whereas there was current momentum, the market is now coming into a section of decreased directional power.

With the +DI (Directional Indicator) at 20.7 and the -DI at 16.1, the chart displays a bullish bias. Shopping for stress stays stronger than promoting stress, albeit with modest depth.

The Common Directional Index (ADX) measures the power of a development on a scale from 0 to 100, no matter its route. Values above 25 point out a powerful development, whereas readings beneath 20, like PENGU present 20.3, sign a weak or absent development. The marginally increased +DI in comparison with the -DI means that the bullish momentum persists, however the declining ADX factors to an absence of serious power behind the motion.

Within the quick time period, PENGU’s worth could expertise restricted volatility until the ADX rises once more to substantiate a stronger development or the directional indicators present a decisive shift in shopping for or promoting stress.

PENGU Value Prediction: Will It Attain $0.05 in January?

PENGU worth has climbed over 9% within the final 24 hours, pushing its market cap to $2 billion, making it one of many largest Solana meme cash, as robust momentum drives bullish sentiment. If this uptrend continues to strengthen, PENGU worth is prone to take a look at the $0.043 resistance degree quickly.

Breaking previous this degree may open the door for additional positive factors. With targets at $0.045 and $0.05, PENGU may strategy and even surpass its earlier all-time highs, surpassing BONK’s market cap once more.

Nevertheless, if the development reverses and bearish momentum takes maintain, PENGU worth may face a pointy correction. Its closest robust help lies at $0.025, a crucial degree that should maintain to forestall additional declines.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.