Stellar (XLM) worth is up greater than 6% within the final 24 hours as it really works to reclaim an $11 billion market cap. Technical indicators just like the DMI counsel an uptrend might be forming, with rising ADX and +DI dominance pointing to rising shopping for momentum.

In the meantime, the Chaikin Cash Stream (CMF) turning optimistic signifies bettering capital inflows, signaling a possible shift in market sentiment. XLM is now buying and selling between key ranges, with the potential to rise towards $0.47 if bullish momentum builds or retest help at $0.31 if the uptrend fails to materialize.

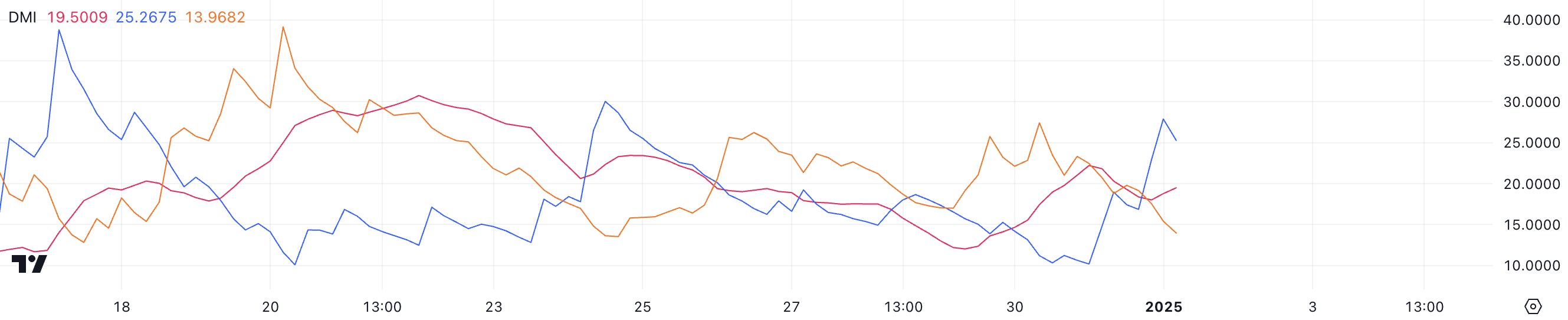

Stellar DMI Reveals an Uptrend Might Seem Quickly

XLM DMI chart reveals its ADX at the moment at 19.5, rising from beneath 15 simply three days in the past, signaling a rise in development energy. The +DI (Directional Indicator) has surged from 10 to 25.6 in simply someday, whereas the -DI has dropped to 13.9, indicating a big shift in momentum.

This crossover, with the +DI overtaking the -DI, suggests that purchasing strain is now dominating promoting strain, hinting on the early levels of a possible uptrend.

The Common Directional Index (ADX) measures the energy of a development on a scale of 0 to 100, with values above 25 indicating a powerful development and readings beneath 20 signaling weak or absent development momentum. Whereas Stellar ADX at 19.5 nonetheless displays comparatively weak development energy, its upward trajectory means that the development is gaining momentum.

Mixed with the sharp rise within the +DI, this setup signifies that XLM worth is making progress in reversing its current downtrend. If the ADX continues to rise above 20 and the +DI maintains its dominance over the -DI, XLM may see additional upward motion, signaling a possible shift right into a sustained uptrend.

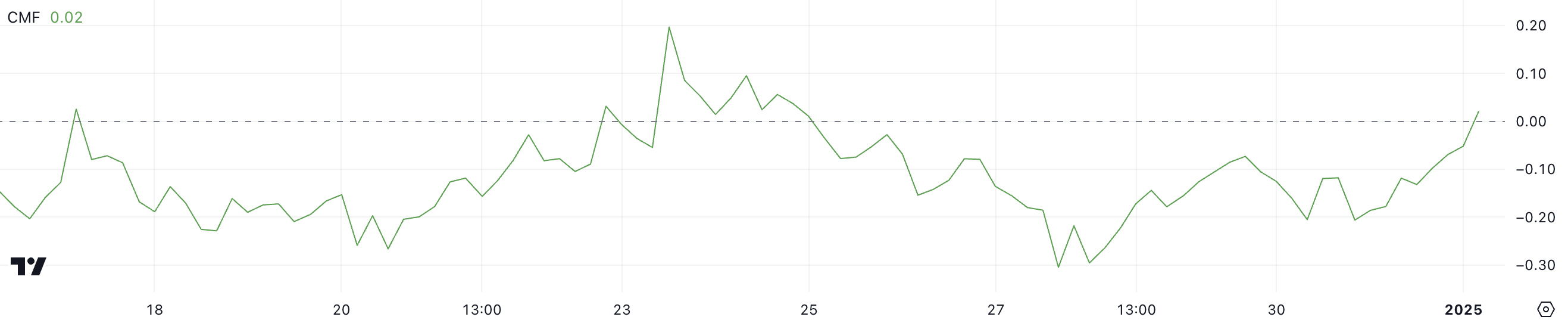

XLM CMF Is Now Optimistic

XLM’s Chaikin Cash Stream (CMF) is at the moment at 0.02, recovering after remaining damaging from December 25 to December 31. This shift into optimistic territory suggests that purchasing strain is beginning to outweigh promoting strain, albeit modestly.

The CMF’s current rise displays bettering capital inflows into XLM, signaling a gradual return of investor confidence and a possible early indication of bullish momentum constructing available in the market.

The CMF measures the stream of cash into and out of an asset based mostly on worth and quantity over a particular interval. Values above 0 point out internet shopping for strain, whereas values beneath 0 signify internet promoting strain. Though Stellar CMF at 0.02 reveals solely a slight optimistic bias, it’s a notable restoration from -0.20 simply two days in the past.

This sharp enchancment suggests a big shift in market sentiment, even when the momentum remains to be creating. If the CMF continues to rise, it may sign growing accumulation and help for additional worth development within the brief time period.

XLM Value Prediction: Will Stellar Rise 32% Within the Subsequent Few Days?

The EMA strains for XLM at the moment preserve a bearish setup, with short-term strains positioned beneath long-term ones, reflecting lingering downward momentum. Nonetheless, the short-term EMAs are starting to rise, and in the event that they cross above the long-term EMAs, it’s going to type a golden cross — a well known bullish indicator that might sign a possible development reversal.

If this upward momentum builds, Stellar worth may take a look at the resistance at $0.406, and breaking above this stage may pave the way in which for a transfer towards the subsequent resistance at $0.47.

On the draw back, if the uptrend fails to materialize and the downtrend regains energy, XLM worth may retest its closest help at $0.31. A failure to carry this stage would open the door for additional declines, with the subsequent help at $0.25 doubtlessly coming into play.

These crucial help and resistance ranges will probably outline XLM’s short-term trajectory, with the EMA setup offering key insights into whether or not bullish momentum can totally take over or if bearish strain will persist.

Disclaimer

Consistent with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.