- Bitcoin’s future has bought market makers on edge, with the king coin caught in a unstable loop.

- With each dip, the uncertainty grows, and the endgame is likely to be simply across the nook.

The New 12 months is right here, however Bitcoin [BTC] continues to be caught in a high-FUD zone, dropping practically 5% within the final week.

Regardless of a formidable 140% surge in 2024, making many buyers wildly rich, the surge in liquidity is elevating purple flags a few potential Bitcoin ‘crash.’

Bitcoin crash regardless of HODLing?

Sometimes, a Bitcoin prime is usually signaled by a convergence of key indicators, pointing to an overextended part.

Throughout these euphoric highs, the market braces for corrections. However December took an sudden flip.

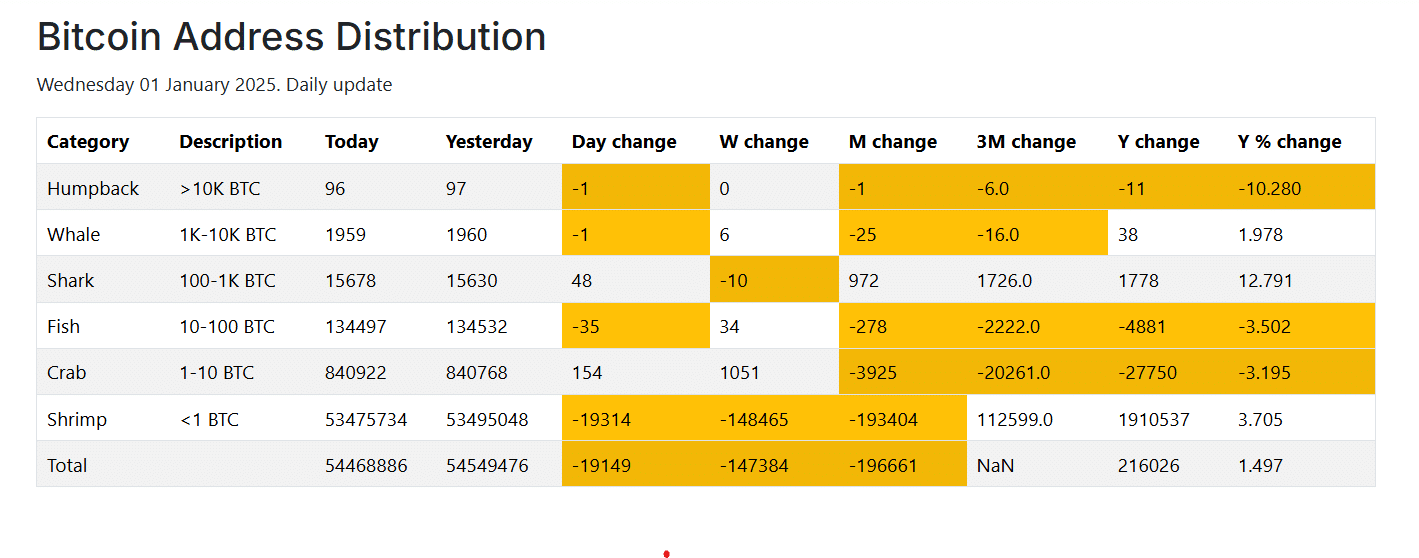

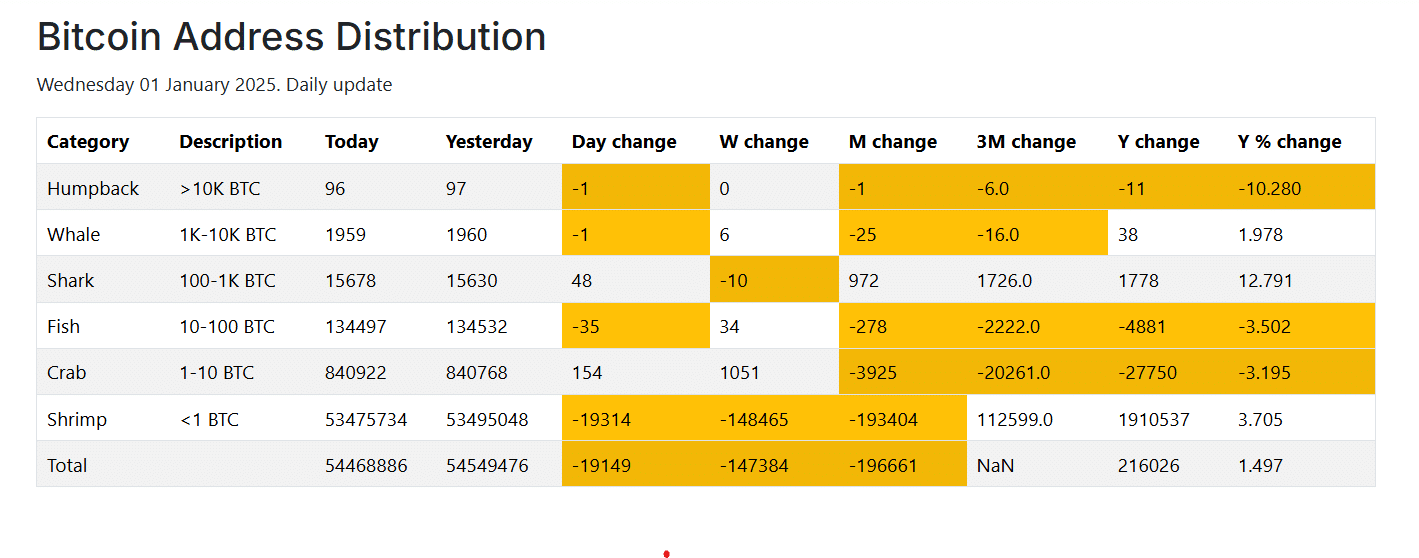

Even with the RSI in a average zone and greed ranges under 90, round 194K shrimp wallets (holding <1 BTC) exited as BTC hit its $108K ATH.

It’s clear—these small holders took their earnings off the desk.

Supply: BGeometrics

The silver lining? Shark wallets (holding 100-1K BTC) noticed a 12.791% rise year-over-year, with whales holding sturdy and new addresses rising.

Nevertheless, not like the final cycle when capital flowed into altcoins throughout Bitcoin’s consolidation, this time all the market has dipped into the purple.

Some cash are even posting double-digit losses inside per week.

This shift has buyers on edge, as issues mount over the dearth of contemporary capital getting into the market whereas weak fingers shake out.

It’s changing into clear: HODLing might not be sufficient to climate this storm.

Low buying and selling alerts financial imbalance

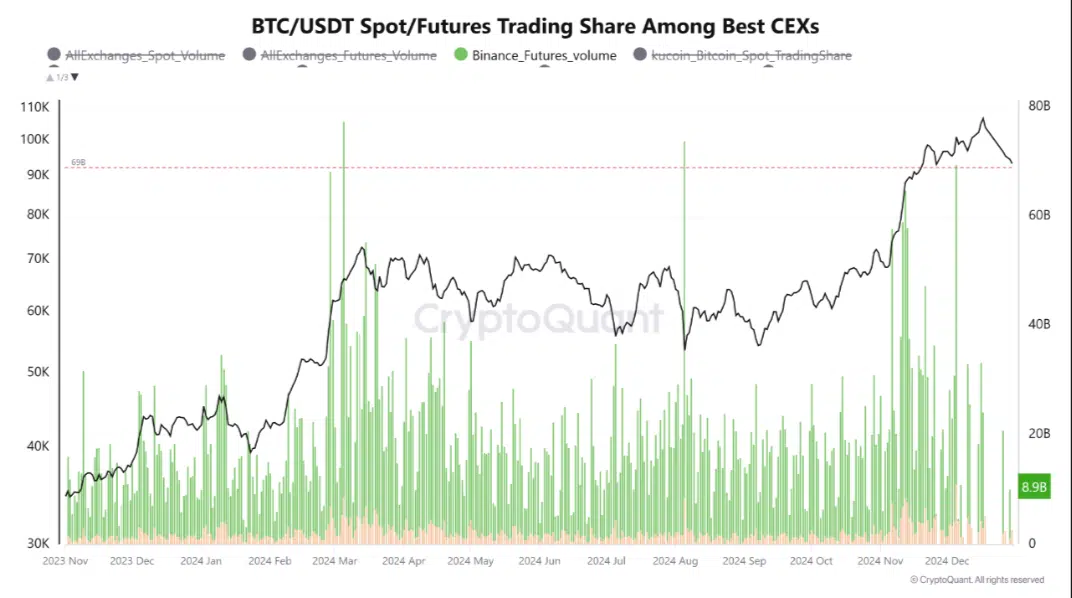

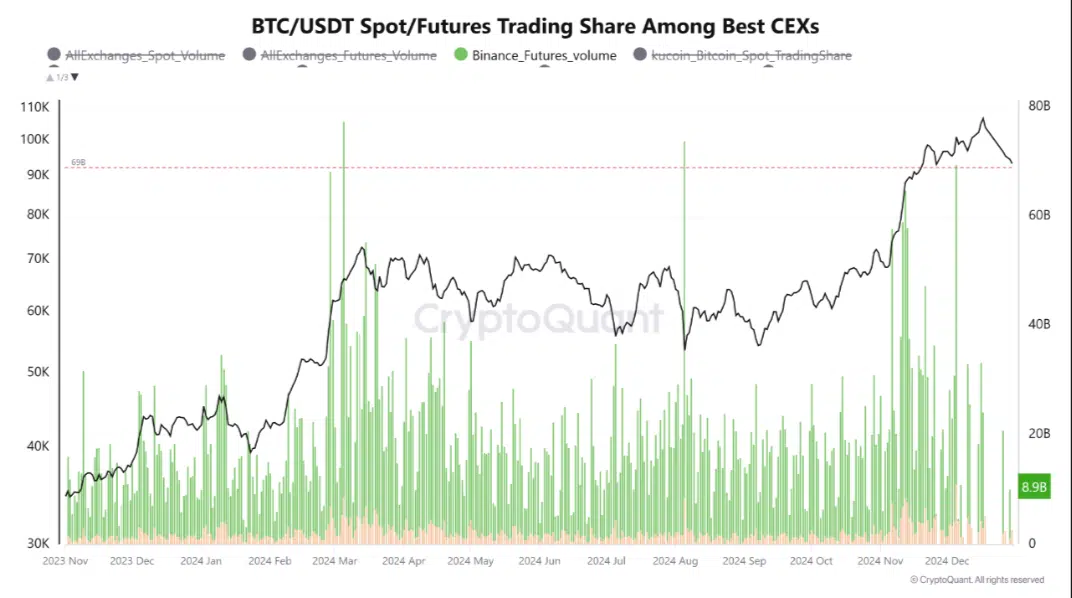

In the meantime, over the previous week, the buying and selling quantity of the BTC/USDT pair has plummeted, significantly in each the spot and futures markets, with Binance seeing the steepest decline.

Supply : CryptoQuant

Traditionally, such drops in quantity are sometimes seen at market tops, accompanied by excessive promoting strain.

With two consecutive weeks of BTC value declines, it means that buyers could also be realizing earnings whereas fearing an extra crash, with little “dip” shopping for going down.

The important thing to turning this round? Accumulation. If demand doesn’t choose up quickly, HODLers may lose their confidence to carry.

As well as, weak fingers may hold promoting off on each small uptick, pushing BTC additional right into a unstable loop. That is additional mirrored by consecutive outflows from BTC ETFs.

The market is nearing a tipping level, and Q1 may set the tone for the remainder of the 12 months.

Learn Bitcoin’s [BTC] Value Prediction 2025-26

If institutional demand doesn’t step as much as create a provide shock and restore steadiness, this might mark the start of the tip of the present BTC cycle.

Time is operating out, and every passing day is a take a look at for Bitcoin’s future.