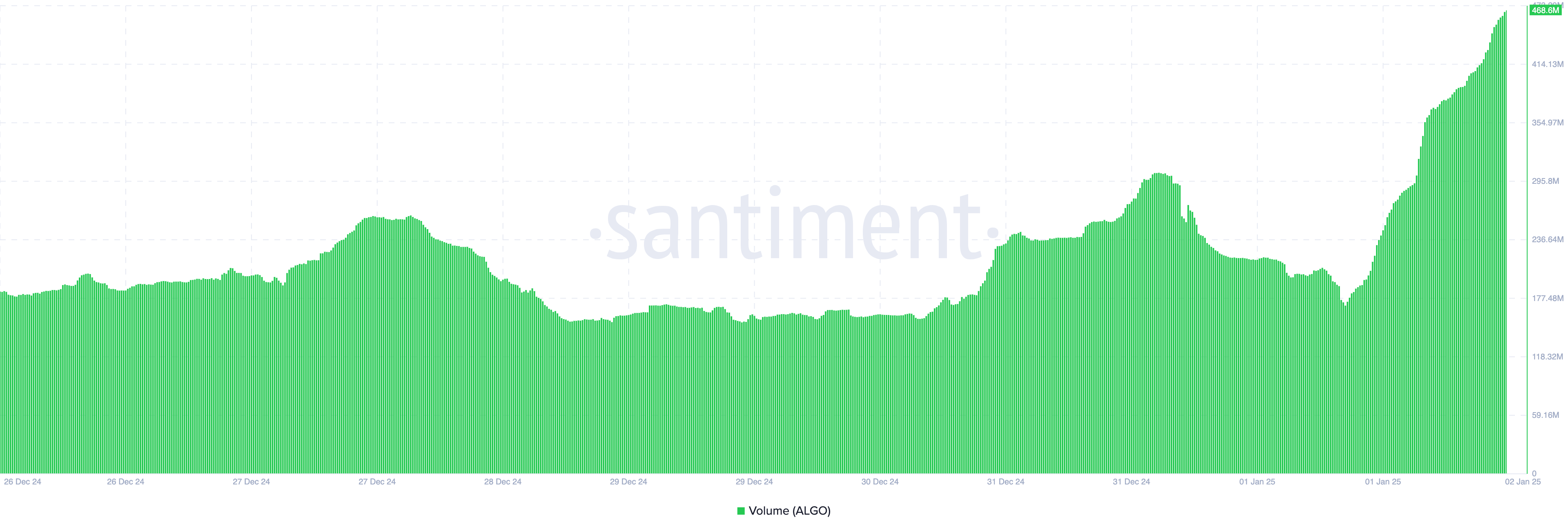

Algorand (ALGO) buying and selling quantity has spiked by 130% prior to now 24 hours, pushing the token’s worth to $0.40. This rebound has introduced 38% of ALGO holders into unrealized income.

Whereas this pattern may improve the variety of worthwhile holders, on-chain evaluation signifies that ALGO’s worth would possibly encounter a setback.

Curiosity in Algorand Rises, however Stakeholders Are Letting Go

Algorand’s worth surged from $0.33 on January 1, 2025, to $0.40 as we speak, marking a powerful begin to the 12 months. This rally positions ALGO as one of many top-performing property among the many high 50 cryptocurrencies.

Past that, Algorand’s buying and selling quantity climbed from $170.67 million to $468.60 million throughout the similar interval. The rise in quantity signifies rising curiosity within the cryptocurrency. The upward pattern in each quantity and worth signifies robust bullish momentum, suggesting the token’s worth may climb additional.

Whereas rising quantity has fueled Algorand’s current hike, a drop in quantity may point out weakening momentum. Nevertheless, key metrics now recommend that ALGO’s worth could wrestle to maintain its upswing within the quick time period.

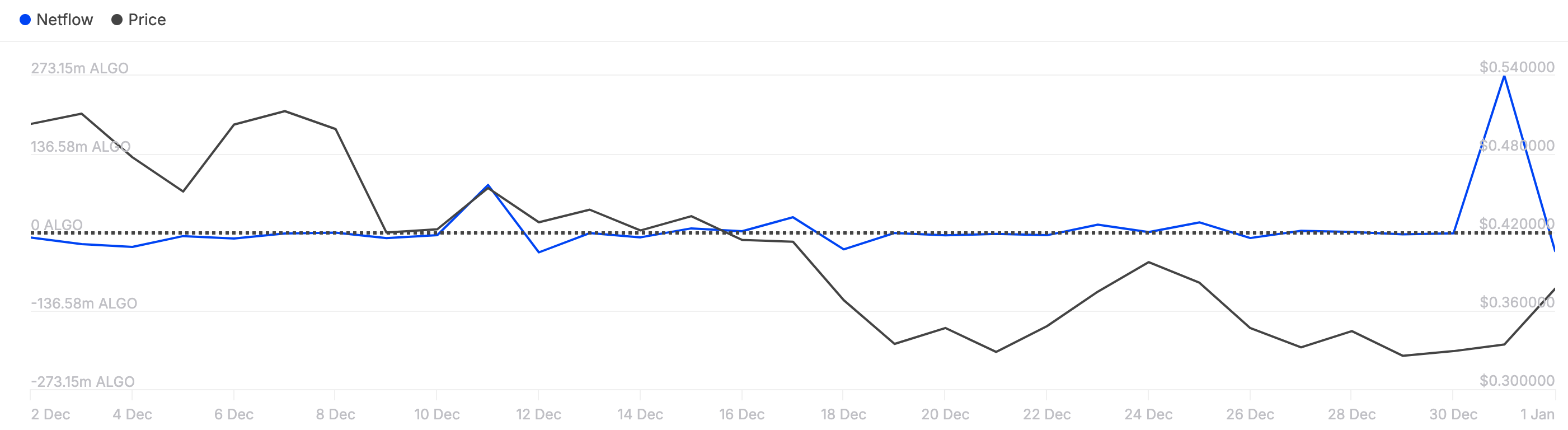

One metric that aligns with this bias is the big holders’ netflow. Based on IntoTheBlock knowledge, the netflow, a key metric measuring the steadiness of shopping for and promoting by addresses holding 0.1% to 1% of Algorand’s circulating provide, has turned detrimental.

When giant holders’ netflow is constructive, it signifies that almost all are accumulating extra tokens than they’re promoting. Conversely, a detrimental studying signifies distribution, with holders offloading greater than they’re shopping for.

This shift signifies these ALGO holders are promoting greater than shopping for. If this pattern persists, ALGO’s worth, at the moment at $0.40, may face vital draw back strain.

ALGO Value Prediction: Retracement Possible

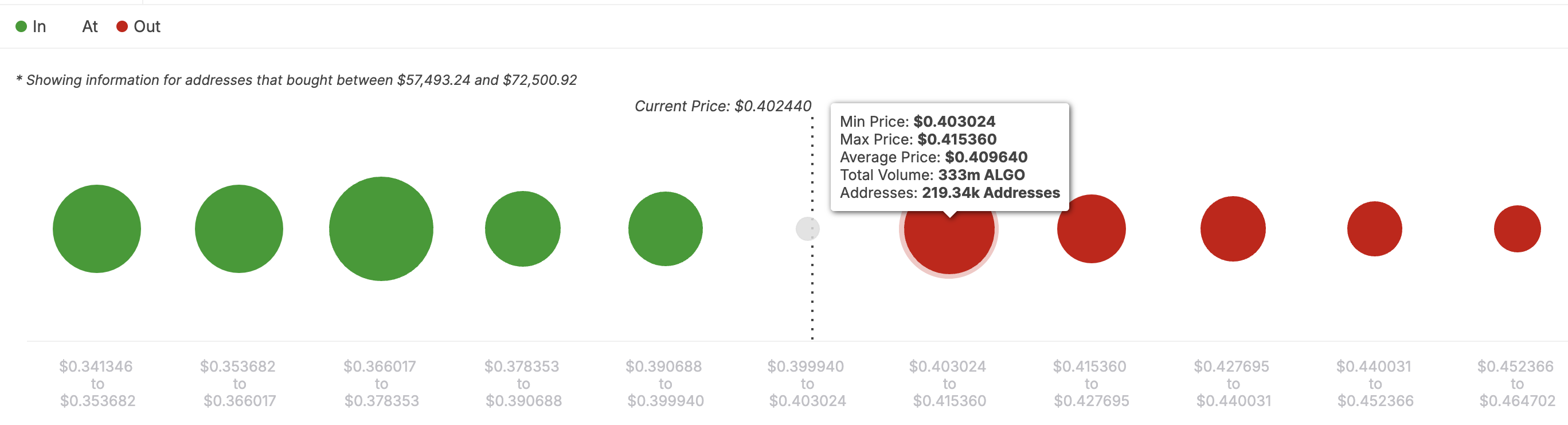

From an on-chain perspective, the In/Out of Cash Round Value (IOMAP) exhibits that ALGO’s worth is much less prone to commerce larger. The IOMAP categorised addresses based mostly on these within the cash, on the breakeven level, and others out of the cash.

Utilizing this knowledge, one can spot assist and resistance. Usually, the upper the amount or addresses, the stronger the assist or resistance. At press time, 146,530 addresses maintain 48.64 million ALGO within the cash, bought at a mean worth of $0.40.

However at $0.42, 219,340 addresses maintain 333 million ALGO and are out of the cash. This means that Algorand’s worth faces vital resistance, which may push it again.

If this stays the case, ALGO may pull again to $0.35. Nevertheless, if Algorand buying and selling quantity rises with intense accumulation, the worth may soar towards $0.50.

Disclaimer

According to the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.