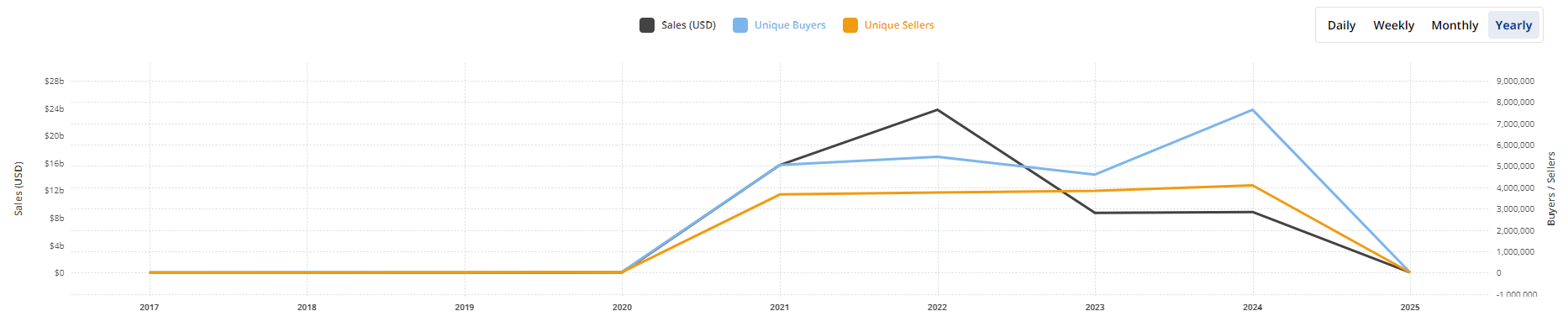

NFTs recorded a complete gross sales quantity of $8.8 billion in 2024, marking a slight improve of $100 million from the earlier 12 months.

This 1.1% year-on-year development displays each the potential and challenges throughout the digital collectibles market.

NFT Gross sales Present Indicators of Restoration Amidst a Difficult Yr

Ethereum and Bitcoin emerged because the main blockchains for NFT gross sales, every producing $3.1 billion all year long. Solana ranked third, recording $1.4 billion in gross sales quantity.

Cumulatively, Ethereum maintains its dominance with $44.9 billion in all-time NFT gross sales. Solana follows with $6.1 billion, whereas Bitcoin-based NFTs have amassed $4.9 billion in whole gross sales.

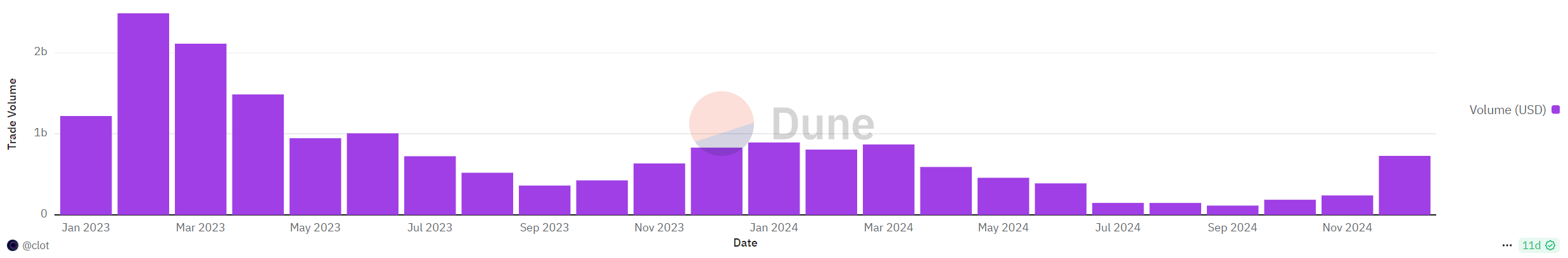

The market confronted important hurdles in 2024, together with a seven-month downturn. September noticed the bottom gross sales volumes since 2021, reflecting diminished speculative curiosity and an oversaturated market.

Nevertheless, a rebound started in October, with NFT gross sales rising to $353 million, an 18% soar from the earlier month.

Momentum continued in November, with $562 million in gross sales, marking a six-month excessive. December closed the 12 months on a powerful word with $877 million in gross sales, its fifth-best month of 2024.

Ethereum collections contributed considerably, producing $482 million in December alone.

Market Developments and Setbacks

Outstanding collections like Pudgy Penguins led the market, reaching a gross sales quantity of $115 million. Platforms reminiscent of Magic Eden and Pudgy Penguins launched their very own tokens, signaling innovation within the house.

Moreover, Legendary Video games and FIFA introduced FIFA Rivals, a cell soccer sport incorporating NFTs. The sport is doubtlessly scheduled for launch in the summertime of 2025.

Regardless of these developments, challenges endured. In November, Kraken shut down its NFT market to concentrate on different tasks. Customers have till February 27, 2025, to withdraw their property.

Oversaturation additionally plagued the market. Roughly 98% of NFT collections noticed minimal, or no buying and selling exercise, and solely 0.2% of NFT drops had been worthwhile. Most collections misplaced over 50% of their worth inside days, reflecting waning speculative demand.

Whereas the NFT market confirmed indicators of resilience with late-year good points, the broader challenges spotlight a shift away from speculative buying and selling towards extra utility-driven purposes.

As platforms innovate and adapt, 2025 will reveal whether or not NFTs can maintain development amid altering investor sentiment.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.