- Switzerland’s exploration of BTC as a reserve asset aligns with a broader international development

- Can Bitcoin stabilize sufficient to be a real answer for nationwide reserves?

In a current report, AMBCrypto highlighted an rising development – Nations with struggling currencies, weakened by the rising greenback, could quickly flip to Bitcoin [BTC] as a strategic reserve.

Now, Switzerland has joined the dialog, and is now contemplating including Bitcoin to its nationwide reserves. Clearly, the way forward for Bitcoin as a key reserve asset is trying extra doubtless than ever—however will the volatility of 2025 make or break this shift?

For this, we have to take a step again and suppose

After making Bitcoin a key focus of his election marketing campaign, President-elect Donald Trump’s return to the White Home signaled a large shift – The U.S. may quickly be on observe to turn into the world’s ‘crypto capital.’

Nonetheless, it’s not simply in regards to the U.S. A rising record of nations, battered by a surging greenback, are actually exploring Bitcoin as a hedge towards inflation.

Take Japan, for instance. With the Yen plummeting to a five-month low towards the greenback, it’s solely a matter of time earlier than the nation begins scrambling for different shops of worth.

In an identical vein, Switzerland is now exploring a proposal that would see the Swiss Nationwide Financial institution (SNB) embrace Bitcoin, alongside gold, in its reserve belongings.

Why the sudden shift? Two causes are driving this variation – The necessity to deal with mounting commerce and monetary deficits, and the rising institutional backing of Bitcoin.

As main establishments step in, Bitcoin is steadily being seen as a stable monetary asset, not only a speculative gamble.

To construct a BTC reserve, a number of circumstances should align

There’s little doubt that in lower than 20 years, Bitcoin has advanced from an experimental digital foreign money to a globally acknowledged asset. And but, because it strikes nearer to being thought of a reserve asset, it faces a number of important challenges.

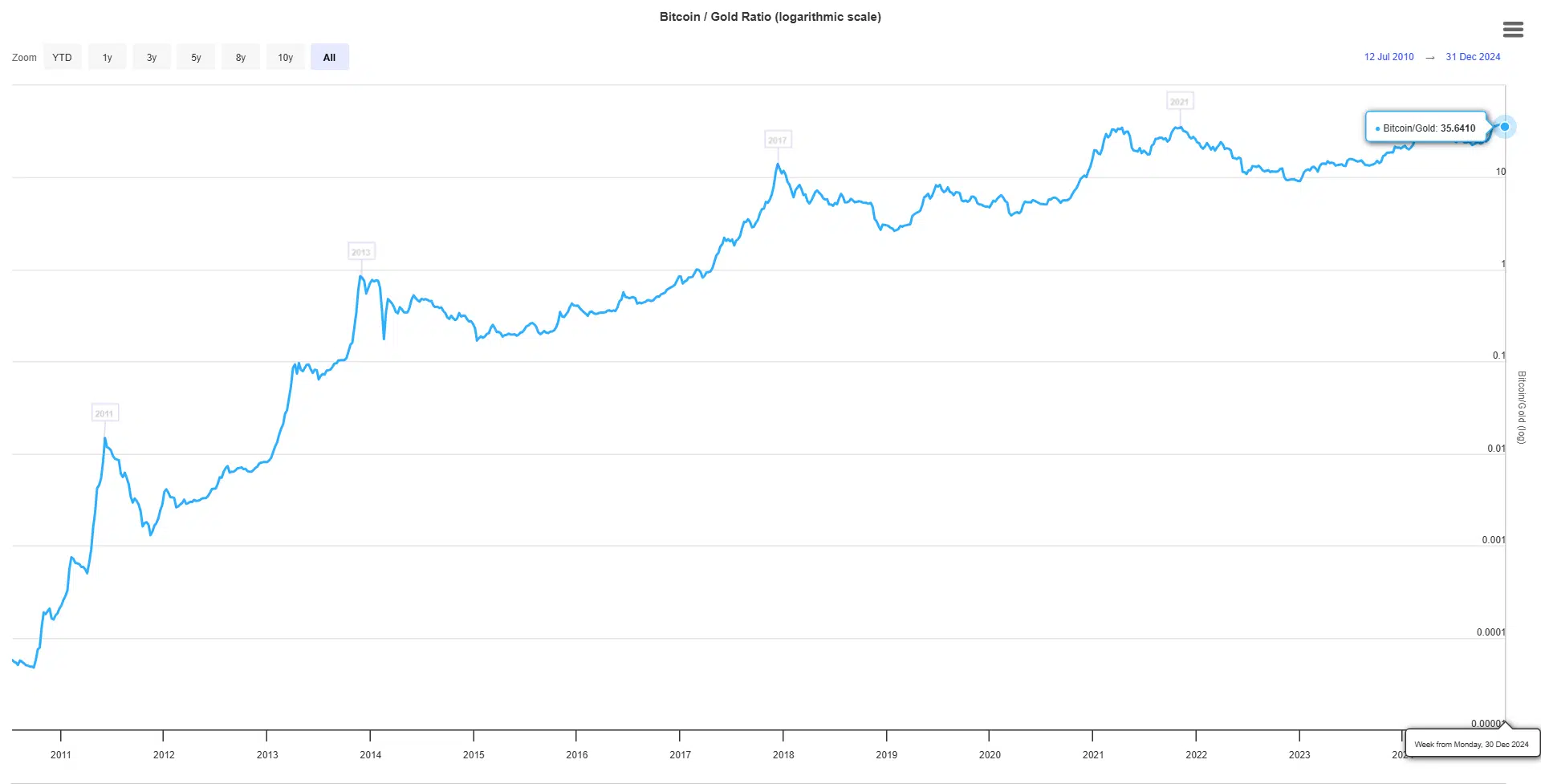

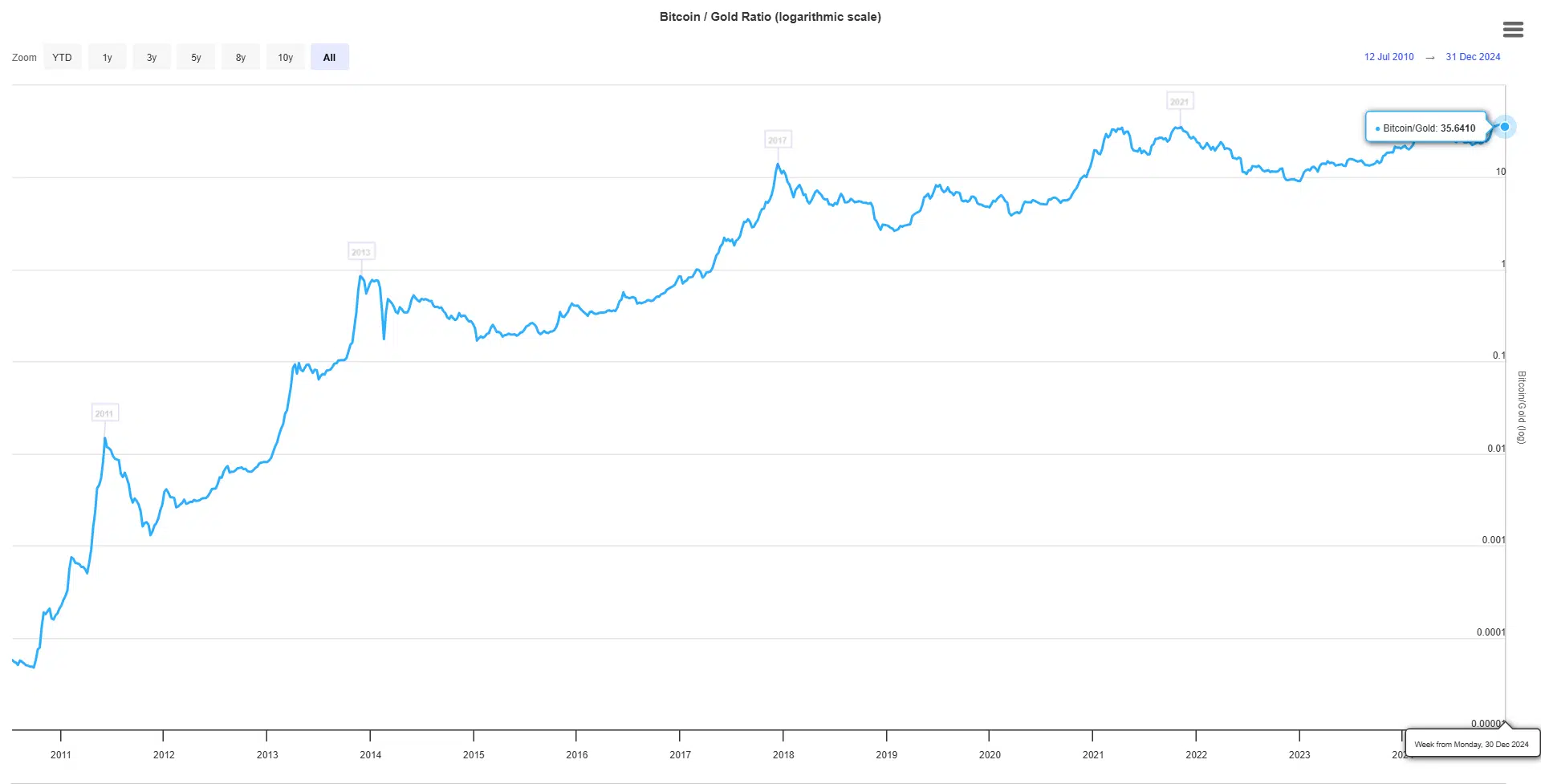

Whereas BTC has closed 2024 with a formidable 140% year-to-date progress, far outpacing gold’s modest 27% rise, gold nonetheless holds the crown because the go-to funding for international economies.

However, may this variation? 2024 has been a milestone 12 months for Bitcoin. Past the historic $100k breakthrough, there’s one other shift quietly unfolding available in the market.

In This autumn, the Bitcoin/Gold ratio broke previous the 30% ceiling for the primary time, suggesting that Bitcoin’s worth is rising quicker than gold’s, with capital flowing from the latter into the previous.

Supply : LongTermTrends

Right here’s the catch although – Bitcoin’s current ‘surprising’ plunge from $108k to $92k in simply three days served as a pointy reminder of its unstable nature. So, while Bitcoin’s progress is simple, gold’s age-old stability and real-world utility nonetheless give it a long-lasting edge.

Learn Bitcoin’s [BTC] Value Prediction 2025-26

Nonetheless, with Bitcoin’s observe file and its rising dominance, the thought of it changing into a strategic reserve asset is slowly transferring from a distant dream to an actual risk.

For this imaginative and prescient to come back to life, establishments should transfer past manipulation and deal with creating true worth. As 2025 kicks off, the greenback’s volatility looms massive.

If it swings upwards, Bitcoin may see its place solidified as a worldwide reserve asset—A shift value watching carefully within the months forward.