Disclaimer: The opinions expressed by our writers are their very own and don’t symbolize the views of U.Right this moment. The monetary and market info supplied on U.Right this moment is meant for informational functions solely. U.Right this moment just isn’t responsible for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your individual analysis by contacting monetary consultants earlier than making any funding choices. We consider that each one content material is correct as of the date of publication, however sure gives talked about might now not be accessible.

Buying and selling exercise across the main meme cryptocurrency of the market, Dogecoin (DOGE), lately noticed irregular exercise. Particularly, because it grew to become recognized because of information from CoinGlass, an epic imbalance emerged in liquidations of DOGE perpetual futures positions, when the quantity of quick liquidated overtook the determine for lengthy positions by 400%.

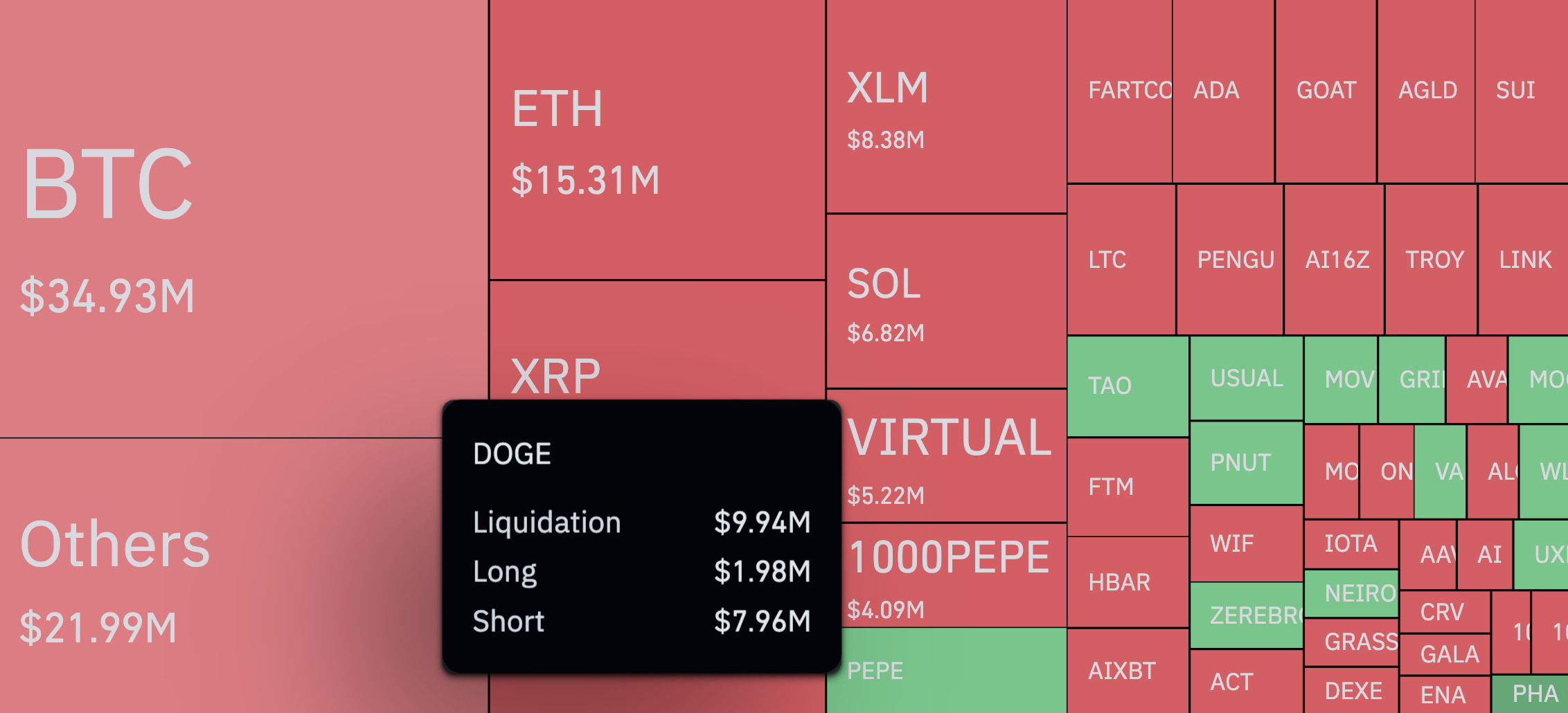

Thus, if the overall quantity of Dogecoin positions liquidated amounted to $9.94 million, $1.98 million out of it had been longs, and $7.96 million shorts. Such an imbalance is defined by the 6% value surge demonstrated by Dogecoin over the course of 24 hours.

Because it seems not many believed the favored meme coin may pull such a strong transfer and positioned their bets on the bearish aspect.

The tendency of shorts getting extra ache than longs just isn’t restricted to DOGE solely and seen as a broader market pattern with out of $201.55 million liquidated in 24 hours, $139.74 million are quick positions and $61.81 million are longs.

Bulls in management

That is most likely as a result of value rebounds and spikes that nobody noticed coming and reveals that buying and selling cryptocurrencies, particularly perpetual futures, is dangerous proper now. Merchants must be cautious originally of the brand new 12 months because the market can abruptly change and result in massive monetary losses.

The very fact is that it’s nonetheless a skinny market with many individuals having fun with their weekend and never watching digital asset charts.

From the opposite standpoint, it’s clear that at the least proper now the imaginative and prescient of most market individuals leans towards bull market continuation. After what occurred in November, it appears logical many anticipate the identical for January as spherical two.