The primary buying and selling day of the 12 months noticed notable outflows from spot Bitcoin and Ethereum exchange-traded funds (ETFs), totaling over $310 million.

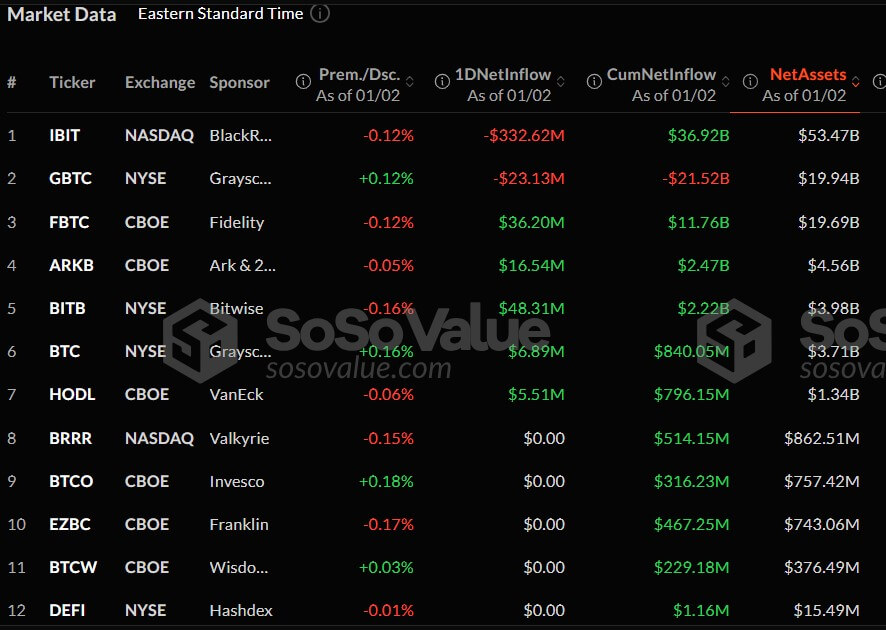

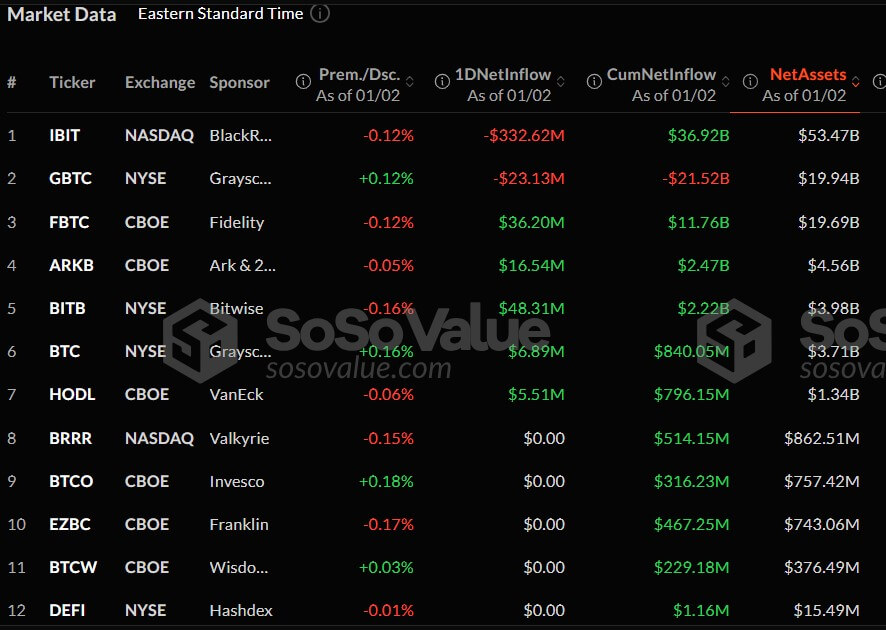

On Jan. 2, information from SoSoValue revealed that Bitcoin-focused ETFs skilled $242.3 million in outflows.

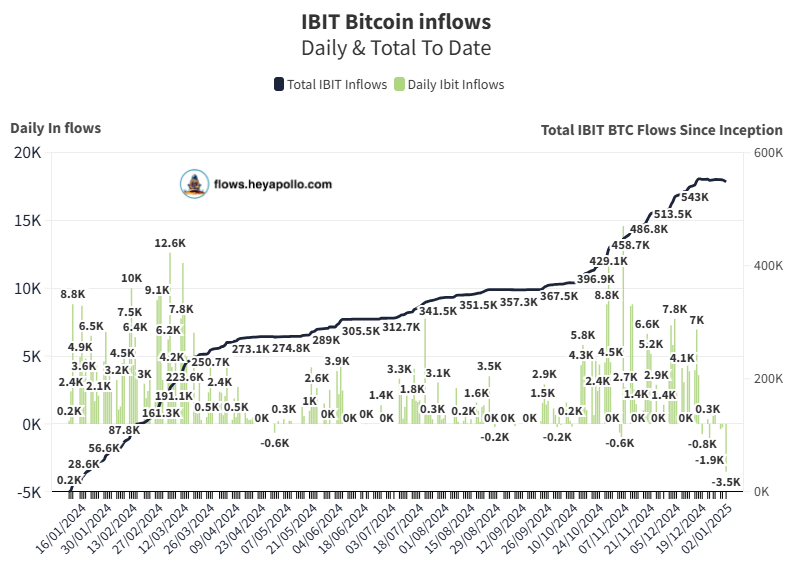

BlackRock’s iShares Bitcoin Belief (IBIT), the biggest Bitcoin ETF, recorded its highest outflow since its inception, dropping $332 million—or greater than 3,500 BTC. This determine surpasses the earlier report of $188 million set in the course of the vacation season final 12 months.

The most recent outflow marks IBIT’s third consecutive buying and selling day of losses, amounting to $392.6 million up to now week. Regardless of these challenges, IBIT stays the main spot Bitcoin ETF, with complete internet inflows of $36.9 billion and property underneath administration nearing $53.5 billion.

Whereas IBIT struggled, opponents confirmed resilience. Bitwise’s BITB, Constancy’s FBTC, and Ark 21Shares’s ARKB reported inflows of $48.3 million, $36.2 million, and $16.5 million, respectively.

In the meantime, Grayscale’s Bitcoin merchandise recorded divergent fates on the day. Per the info, the agency’s smaller Bitcoin Mini Belief attracted $6.9 million in recent capital, although its flagship GBTC fund noticed outflows of $23.1 million.

As of Jan. 2, spot Bitcoin ETFs have a cumulative stream of $35 billion and maintain $109 billion in property.

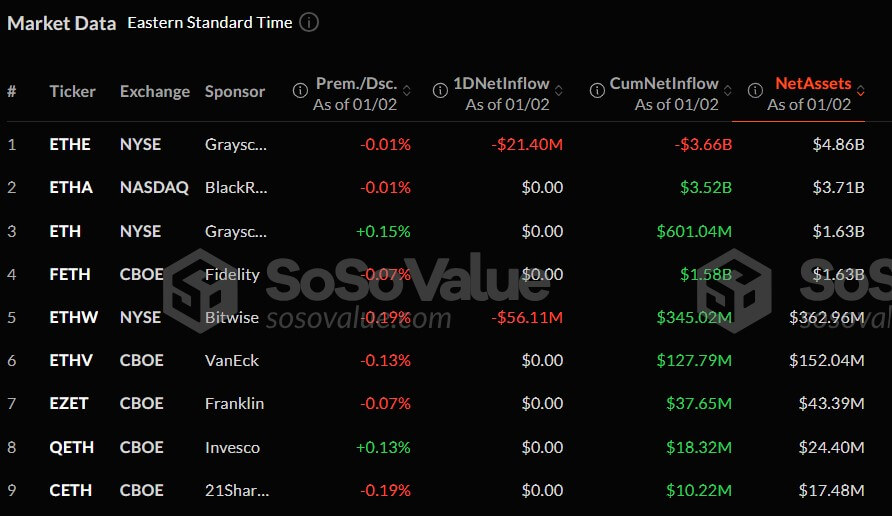

Ethereum ETFs have modest outflows.

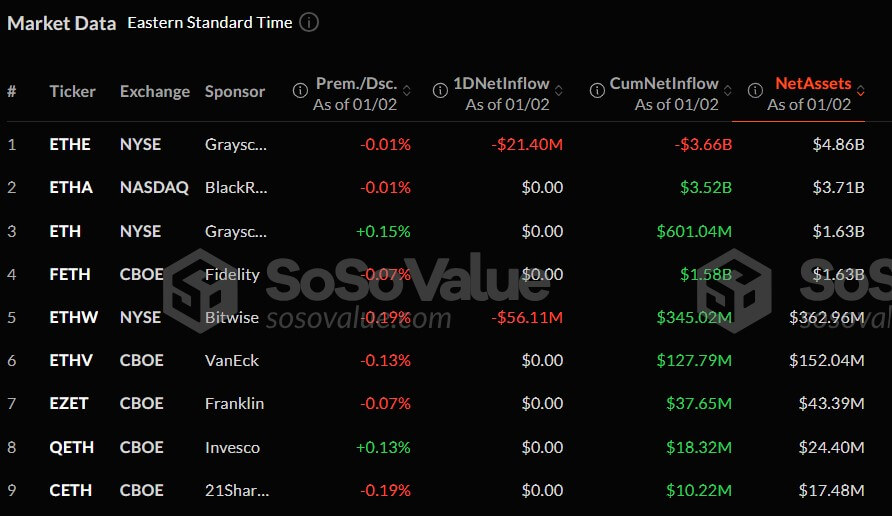

Ethereum ETFs additionally confronted challenges, recording a mixed outflow of $77.5 million.

Bitwise’s ETHW fund led these losses with $56.1 million withdrawn, whereas Grayscale’s ETHE product adopted, shedding $21.4 million.

Different Ethereum-linked ETFs, together with BlackRock’s ETHA, reported no adjustments in fund flows for the day.

Ethereum-focused ETFs held a mixed complete of $2.58 billion in internet inflows, with $12.4 billion in property.