BlackRock’s iShares Bitcoin Belief (IBIT) ETF has recorded its largest outflow since launching a 12 months in the past, marking a major second within the Bitcoin ETF market.

The most recent outflow surpassed the earlier report of $188.7 million, which occurred on December 24, 2024.

Bitcoin ETF Outflows Hit $242 Million as IBIT Bleeds

In accordance with information from SoSoValue, the fund noticed a report $330.8 million exit on January 2, equal to greater than 3,500 BTC. After IBIT’s report exodus, the whole every day internet outflows of BTC ETFs hit $242 million.

January 2 additionally marks the third consecutive day of outflows for IBIT, setting one other new report. In accordance with information from Farside Traders, BlackRock’s Bitcoin Belief has skilled a complete outflow of $391 million over the previous week alone.

On the similar time, the Constancy, Ark, and Bitwise BTC ETFs recorded internet inflows of $36.2 million, $16.54 million, and $48.31 million, respectively, on January 2.

The IBIT outflows come as Bloomberg ETF analyst Eric Balchunas famous in December that IBIT is the best of all ETFs launched. He stated this as BlackRock shot up extra rapidly than any ETFs throughout the worldwide markets.

“IBIT’s development is unprecedented. It’s the quickest ETF to achieve most milestones, sooner than another ETF in any asset class. On the present asset degree and an expense ratio of 0.25%, IBIT can anticipate to earn about $112 million a 12 months,” claimed James Seyffart, one other main ETF analyst.

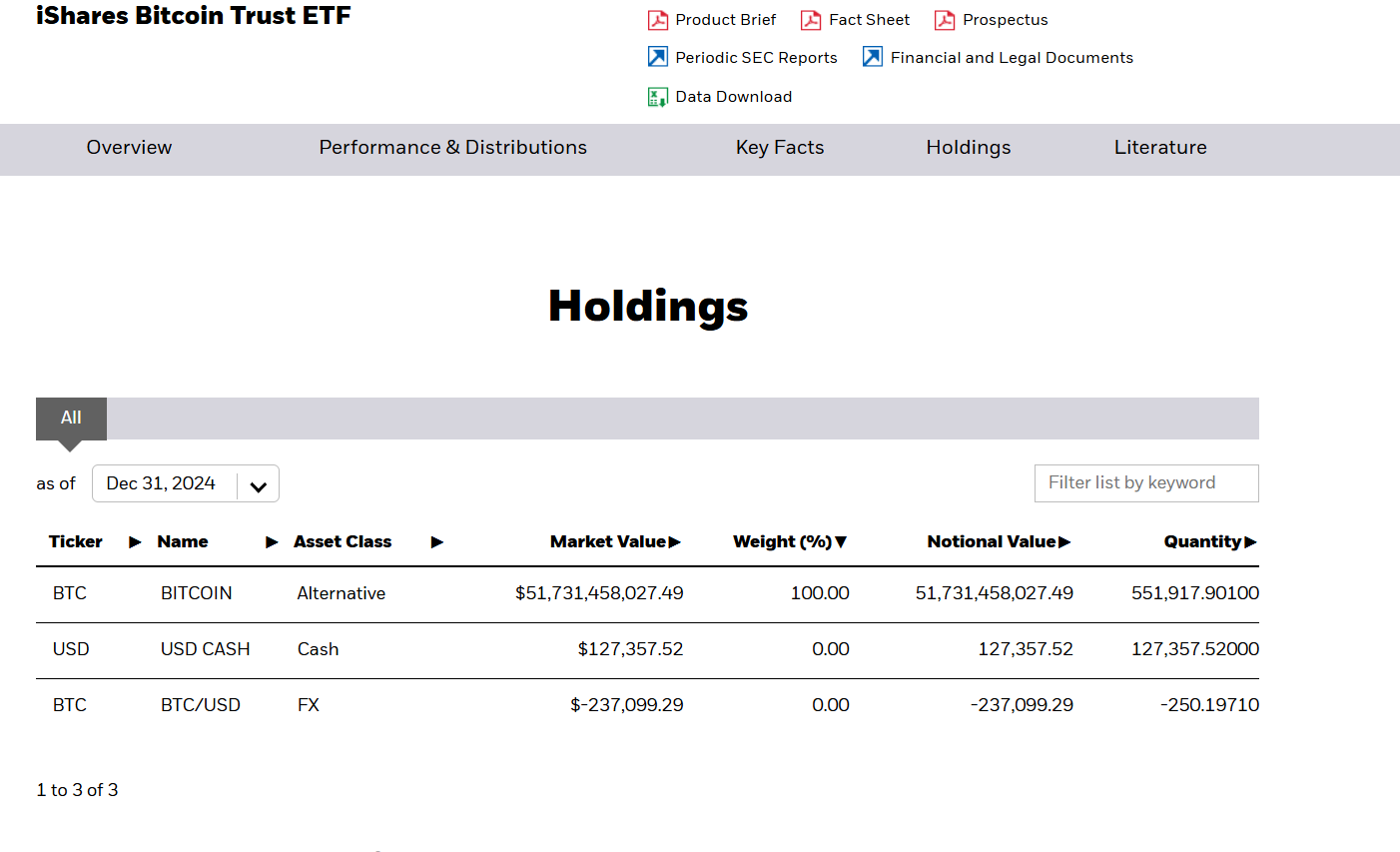

As of December 31, IBIT holds ove 551,000 BTC. Because the launch of IBIT, BlackRock has acquired over 2.38% of all Bitcoin that can ever exist.

BlackRock’s confidence in Bitcoin was evident when it stated the agency doesn’t plan to launch any new altcoin-focused ETFs, focusing solely on BTC and ETH.

In December, Jay Jacobs, the top of BlackRock’s ETF division, emphasised the corporate’s intention to focus on increasing the attain of its present Bitcoin and Ethereum ETFs, which have carried out exceptionally nicely thus far. Apparently, BlackRock analysts additionally prompt lately that Bitcoin ought to comprise 1% to 2% of conventional 60/40 funding portfolios.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.