A key indicator of curiosity within the cryptocurrency area inside the US has slumped to a 12-month low, elevating issues concerning the flagship cryptocurrency’s near-term value prospects.

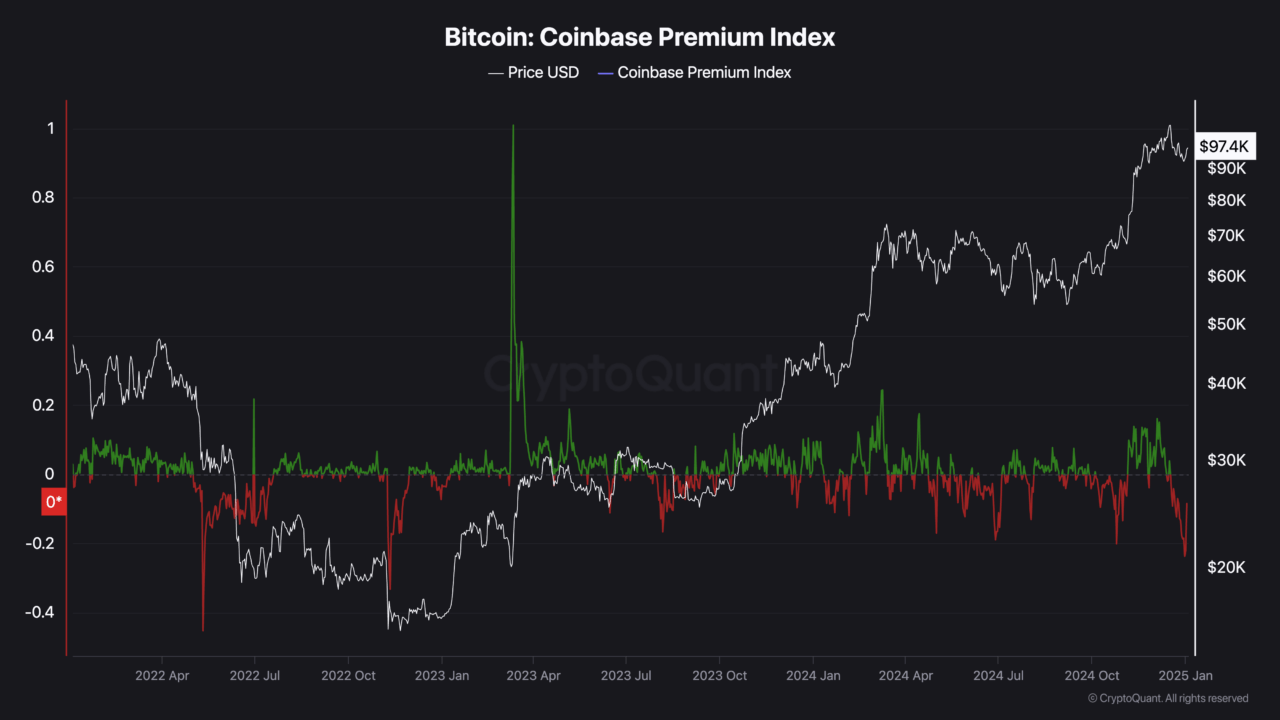

In keeping with a put up from CryptoQuant analyst Burak Kesmeci, the Coinbase Premium Index, which measures the bitcoin value distinction between Coinbase and different main cryptocurrency exchanges, notably Binance, has plunged to a 12-month low.

The index is used to gauge market sentiment and demand amongst U.S. traders, with a constructive determine suggesting robust demand from traders within the nation, and a detrimental index implying bitcoin is cheaper on Coinbase in comparison with Binance over potential promoting stress or decrease demand.

Per the put up, simply earlier than the U.S. elections, the index was at a -0.2 low over heightened uncertainty, however the metric has since dropped additional to -0.237, a 12-month low. The drop, Kesmeci wrote, “not solely indicators a scarcity of institutional demand but additionally underscores the cautious sentiment amongst U.S. traders.”

Whereas traders within the U.S. look like taking a cautious method, main stablecoin issuer Tether has added an extra 7,629 bitcoin to its steadiness sheet after a nine-month hiatus from accumulating the flagship cryptocurrency. The agency’s newest transfer brings its complete holdings to 82,983 BTC price round $7.68 billion.

In keeping with knowledge from Arkham Intelligence, a pockets tagged as belonging to the main stablecoin issuer has been steadily rising its BTC holdings, to the purpose that they’re now its largest holding, above $6 billion price of the main stablecoin.

The pockets additionally holds round $210.5 million price of Tether’s gold-backed cryptocurrency XAUT, in addition to $25.6 million of its discontinued euro-backed stablecoin EURT.

Featured picture by way of Unsplash.