- Ethereum Q1 beneficial properties trace at parallels with its historic surges in 2017 and 2021

- On-chain developments and staking development could sign renewed momentum, regardless of macroeconomic uncertainties

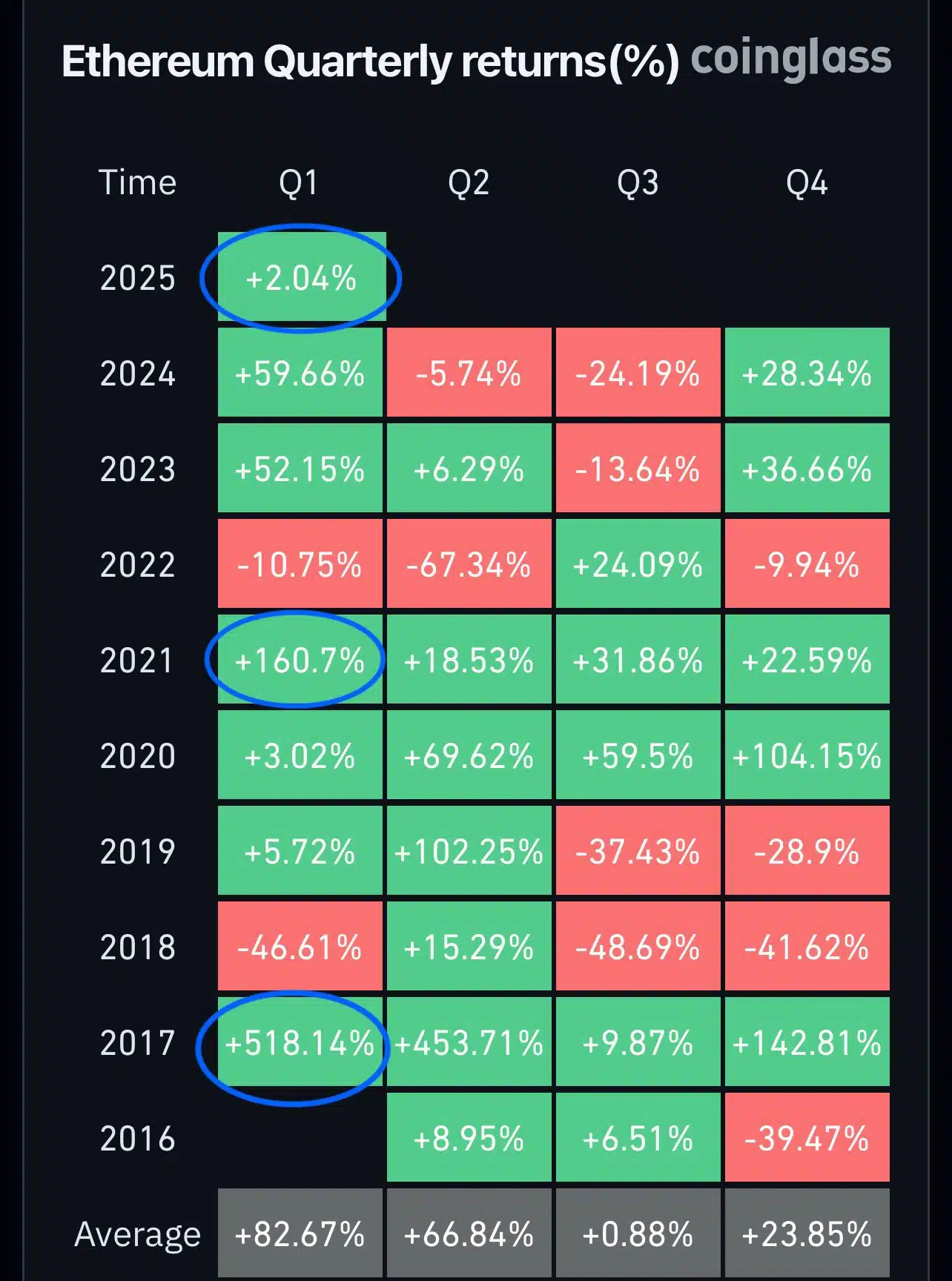

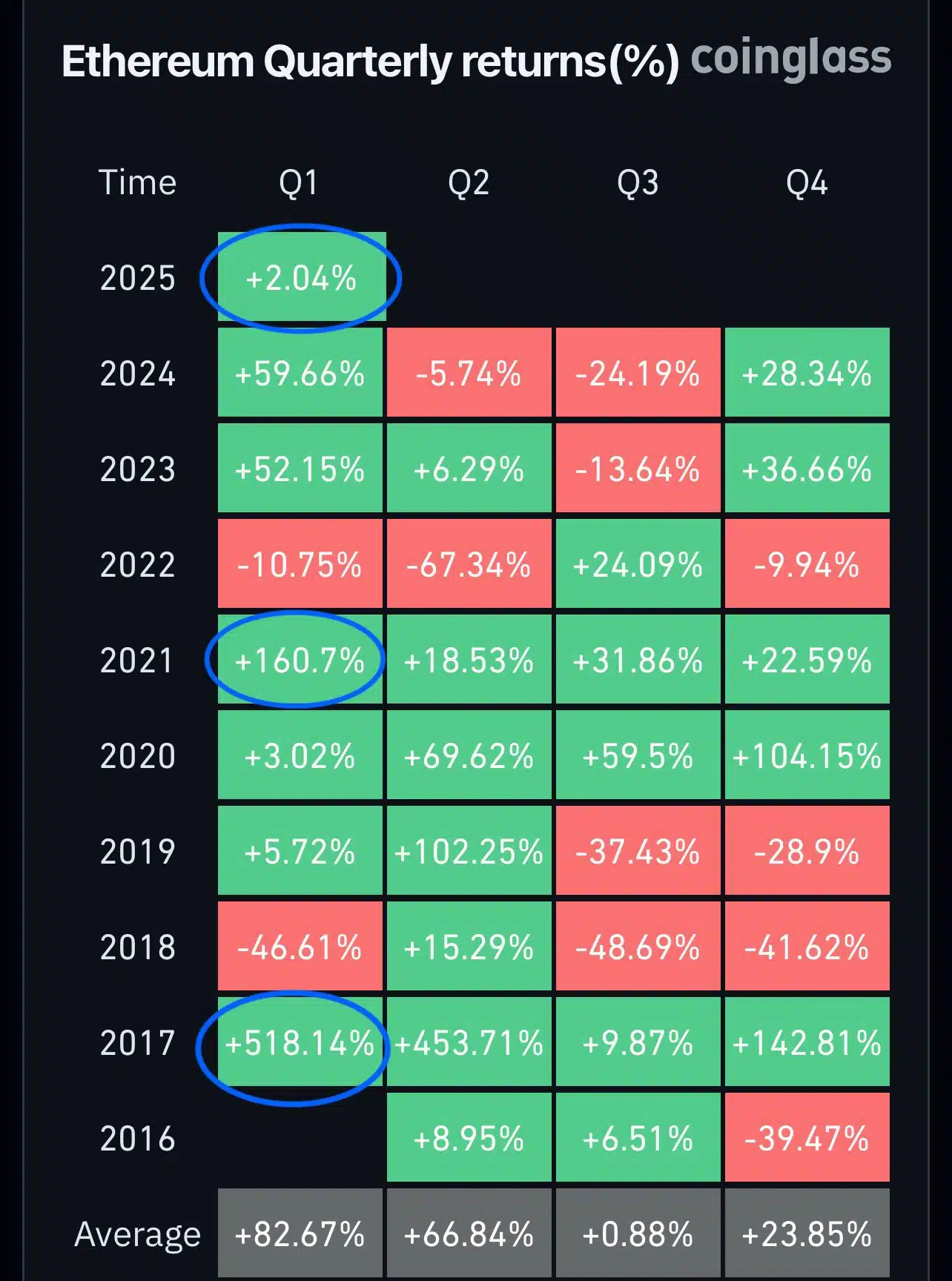

Ethereum’s [ETH] early efficiency typically units the tone for its yearly trajectory, and 2025 isn’t any exception. With modest 2.04% beneficial properties in Q1 to this point, traders are drawing parallels to pivotal years like 2017 and 2021, the place early rallies preceded monumental surges.

Nevertheless, as optimism builds, the query stays – Is Ethereum poised to reflect these bullish patterns, or will macroeconomic headwinds and evolving on-chain dynamics chart a unique course this time?

Ethereum: Historic developments and key knowledge factors

Ethereum’s efficiency in Q1 has typically served as a precursor to its yearly trajectory. In 2017, Ethereum gained by an astounding 518.14% throughout Q1, fueled by the ICO frenzy and rising recognition of its sensible contract capabilities.

In 2021, the Q1 rally of 160.7% coincided with a surge in institutional adoption and the explosion of DeFi initiatives, showcasing Ethereum’s versatility and dominance in decentralized finance. In 2023, a extra measured 52.15% Q1 rise mirrored rising confidence in Ethereum’s post-Merge ecosystem, pushed by its shift to proof-of-stake and the potential for enhanced scalability and sustainability.

All of those rallies have a recurring theme – Technological milestones, higher adoption, and favorable market cycles typically coincide with Ethereum’s strongest quarterly performances.

Will 2025 comply with go well with?

In 2025, Ethereum’s efficiency can be influenced by each macro and microeconomic elements. On the macro facet, the Federal Reserve’s extra hawkish place on rates of interest could cut back investor urge for food for threat belongings like Ethereum. Clearer regulatory steerage, together with the approval of spot ETH exchange-traded merchandise, is already driving institutional curiosity and shaping the market.

On the micro degree, Ethereum is about to see extra staking participation, with projections suggesting over half of its circulating provide can be staked by year-end. Layer-2 options like Arbitrum and Optimism can even increase scalability, decreasing transaction prices and attracting extra customers to Ethereum’s DeFi ecosystem. These elements current each alternatives and challenges for Ethereum in 2025.

Ethereum – On-chain developments

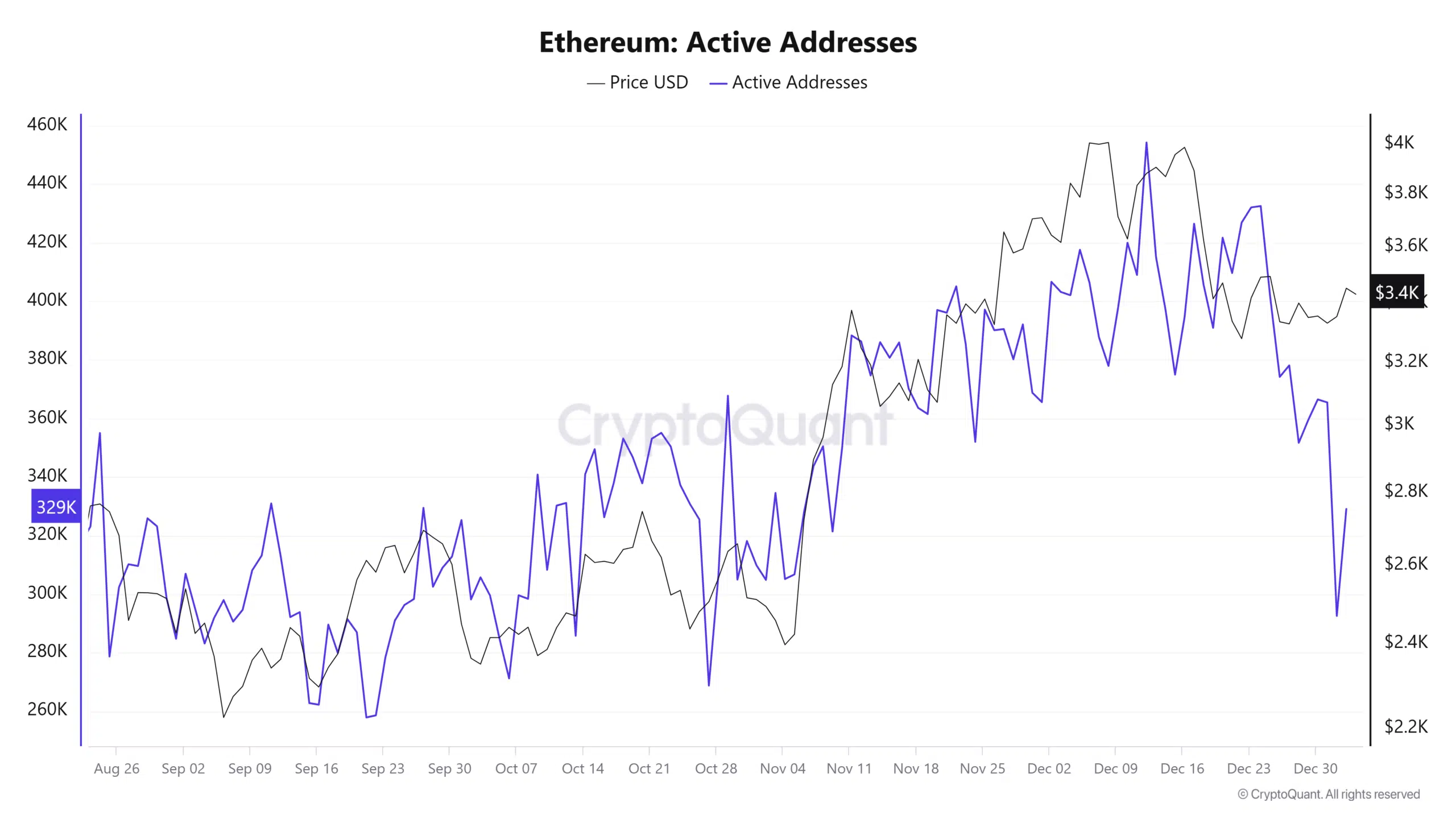

Ethereum’s lively addresses peaked at over 400,000 in late November 2024, however declined to round 329,000 by year-end – Mirroring a value drop from $3,800 to $3,400. This advised decreased retail exercise, typically linked to profit-taking or market uncertainty.

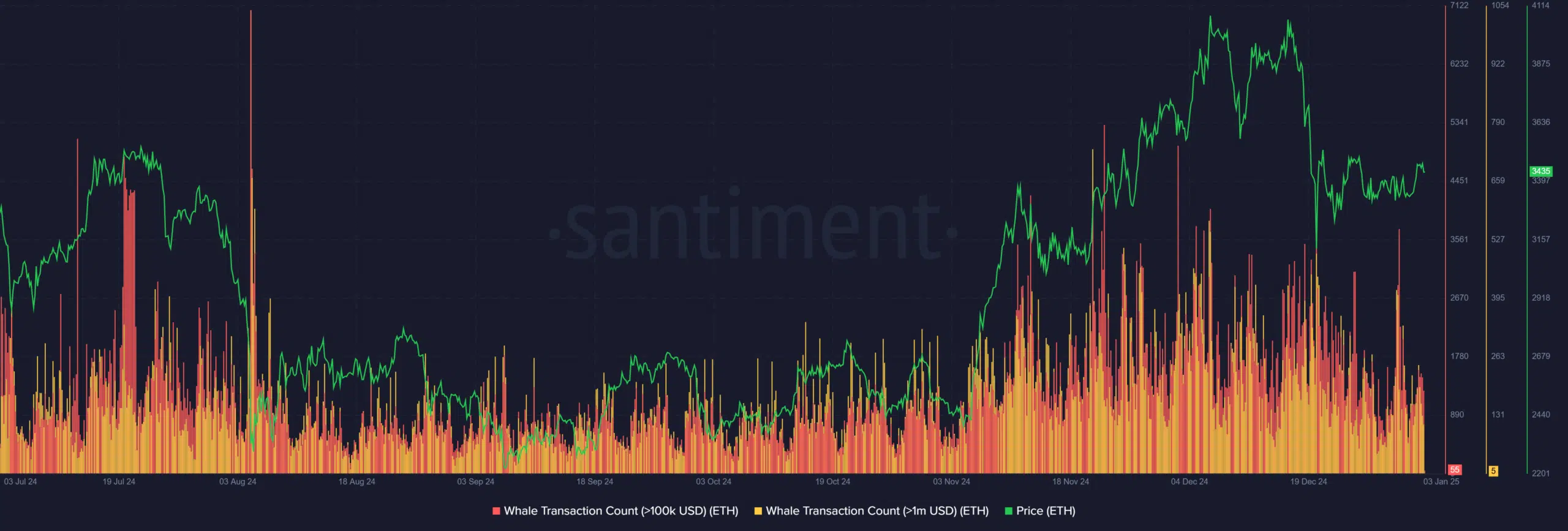

Whale transactions spiked throughout Ethereum’s climb – reflecting institutional curiosity – however decreased with value corrections, indicating cautious sentiment.

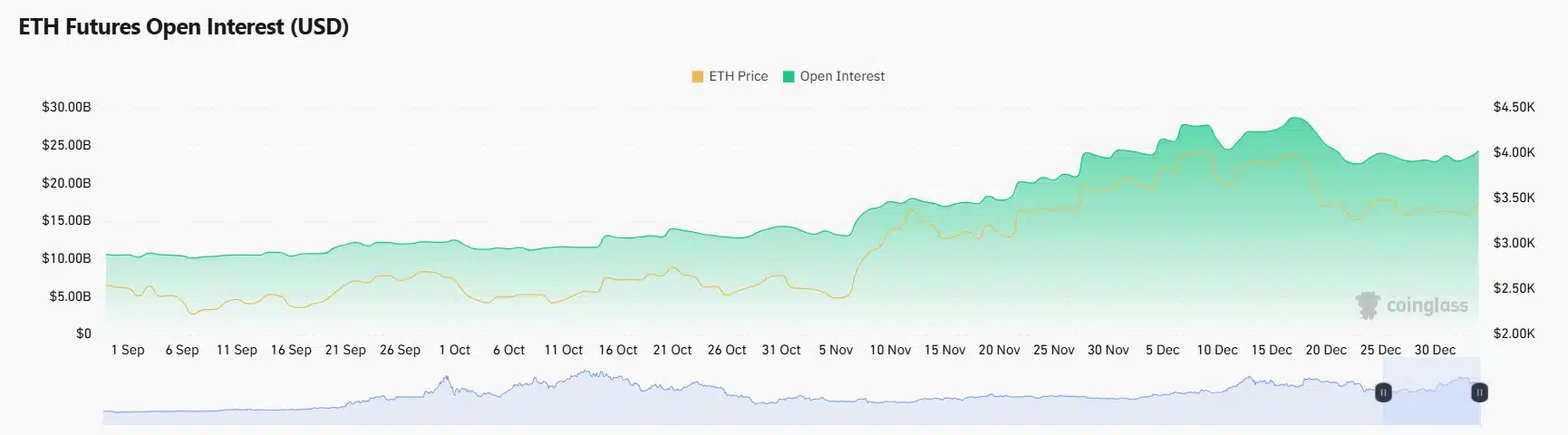

In the meantime, Ethereum Futures’ Open Curiosity surpassed $30 billion by December – An indication of robust confidence in Ethereum’s mid-to-long-term potential.

Stabilized costs round $3,400 and measured leverage alluded to strategic positioning by market individuals.

Heading into Q1 2025, revitalizing retail exercise and sustained institutional curiosity may drive momentum. Progress in Ethereum’s DeFi ecosystem and staking participation could present a basis for a renewed rally within the coming months.

Sentiment and group alerts

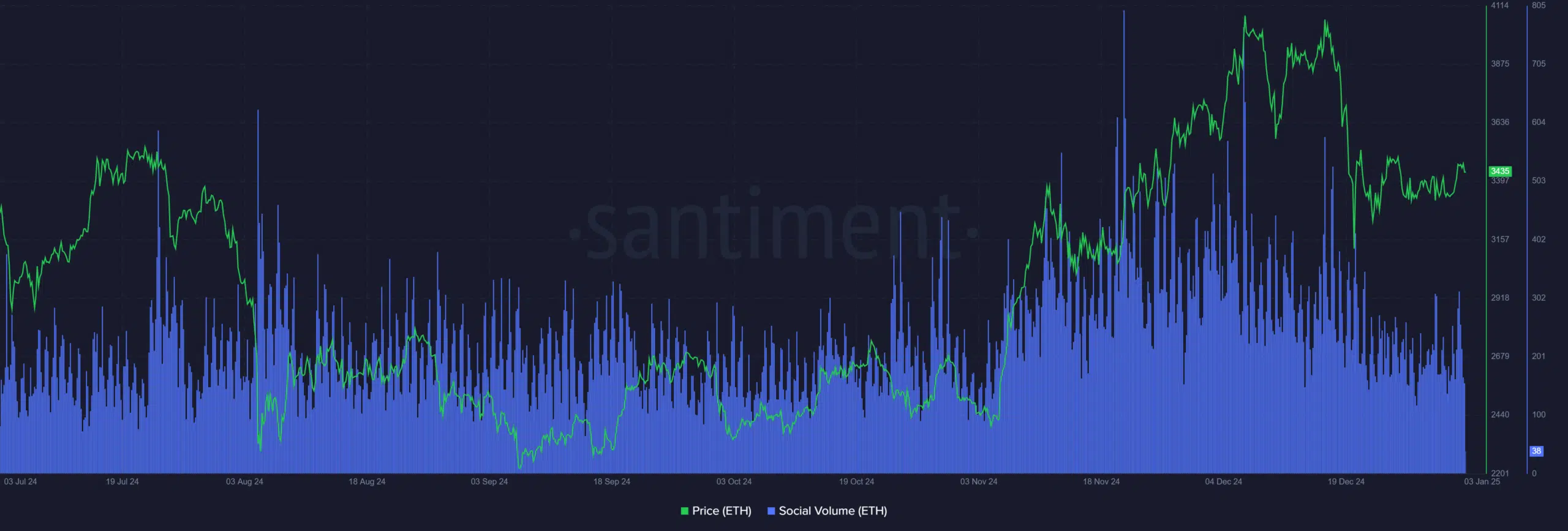

Ethereum’s social quantity revealed a robust correlation with its value dynamics, as seen within the uptick by late 2024. Spikes in group engagement typically coincide with value surges, reflecting heightened investor optimism.

Nevertheless, social exercise has remained elevated, regardless of December’s value correction. It is a signal of sustained curiosity and confidence inside the Ethereum group.

Subsequent: Solana: Will SOL’s $1B USDC influx gas a rally to $10K?