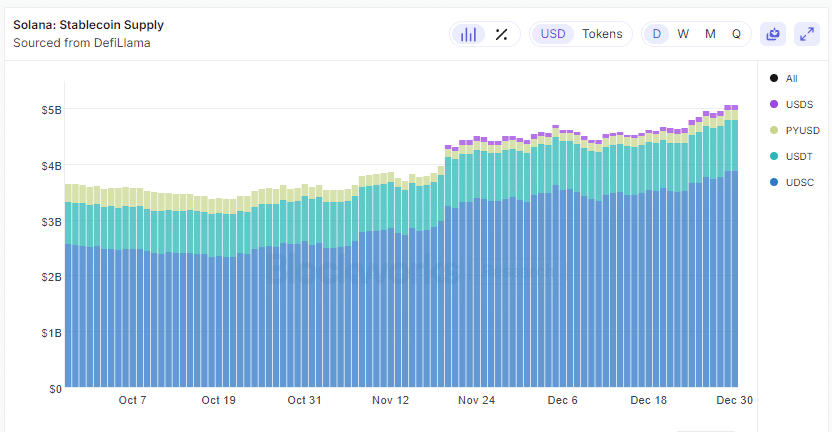

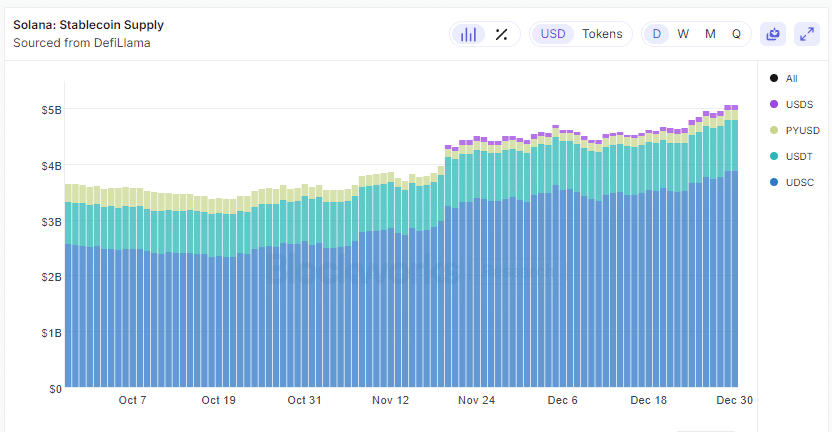

- Solana noticed a large inflow of USDC, creating a main alternative for traders to swap stablecoins for SOL.

- Might a $10K goal for SOL be wishful considering, or is it turning into an actual risk?

Solana [SOL] has surged previous $200 within the final 24 hours, pushed by a virtually double-digit bounce. This time, the lengthy inexperienced candlestick on its chart indicators sturdy shopping for momentum, setting this rally aside from earlier makes an attempt.

Whereas some could view it as a ‘momentary’ blip, particularly with Bitcoin exhibiting indicators of restoration, there’s extra at play. The inflow of liquidity, highlighted by over $1 billion in USDC deposits, is noteworthy.

Buyers appear all-in for Solana’s subsequent huge transfer

As proven within the chart under, Solana skilled a major $1 billion surge in stablecoins final December, led by USDC. This surge signifies that traders are capitalizing on Solana in varied methods, whether or not by benefiting from the “dip” or staking for greater returns.

Supply : DefiLlama

Extra USDC means extra alternatives for savvy traders to swap it for SOL and earn stable yields by staking, lending, or liquidity swimming pools.

With the Whole Worth Locked (TVL)now hovering to $58.2 million, a determine not seen in two years, Solana’s DeFi ecosystem is turning into a hotspot for these chasing excessive yields.

Nevertheless it doesn’t cease there. With all this liquidity flowing in, there’s a buzz constructing that SOL might be on observe to hit a $10,000 price ticket. Its fame because the “Ethereum Killer” is rising stronger annually, and traders are taking discover.

And it’s not simply speak. Regardless of a number of dips, Solana closed out 2024 with a powerful 80% progress, far surpassing Ethereum’s 44%.

Clearly, with extra USDC flowing in, Solana is turning into the go-to platform for sooner transactions and better yields. At this fee, that $10K goal for SOL is beginning to appear like an actual risk.

However fundamentals shouldn’t be neglected

Since November, Solana’s Open Curiosity (OI) has remained regular between $4 billion and $6 billion. As compared, Ethereum’s OI has soared to $30 billion, indicating that Solana nonetheless has room to develop on this space.

On the intense aspect, this decrease OI meant fewer bets on SOL, which could be seen as much less dangerous for traders. Nonetheless, with buying and selling quantity nonetheless within the single-digit billions, it’s clear Solana has some catching as much as do.

Learn Solana (SOL) Value Prediction 2025-26

Solana’s latest surge above $200 has supplied hope to HODLers who’ve been holding regular. Due to the USDC inflow and rising DeFi exercise, buying and selling quantity jumped 28% to $7.12 billion, forcing $6 million briefly positions to shut.

So, what’s subsequent for Solana? Its blockchain has change into a key participant in stablecoin flows, pushed by stable know-how. Nonetheless, reaching the $10K goal would require extra than simply momentum—it must meet up with Ethereum’s fundamentals.

2025 might be a pivotal yr for Solana, with its year-to-date progress already 50% greater than Ethereum’s. To make $10K a actuality, Solana would want to ramp up its progress by at the very least 4 instances. The street forward is promising, however the problem is obvious.