Bitcoin (BTC) is trying to get better its $2 trillion market cap as bullish momentum builds. Current technical indicators, such because the DMI and RSI, counsel the uptrend is gaining power but additionally spotlight the necessity for sustained shopping for exercise to keep up upward stress.

In the meantime, BTC’s EMA traces trace at a doable golden cross, which might propel the worth to check vital resistance ranges close to $98,870 and past. Nevertheless, failure to interrupt these ranges may lead to a pullback, with key help zones at $90,700 and $88,000 coming into focus.

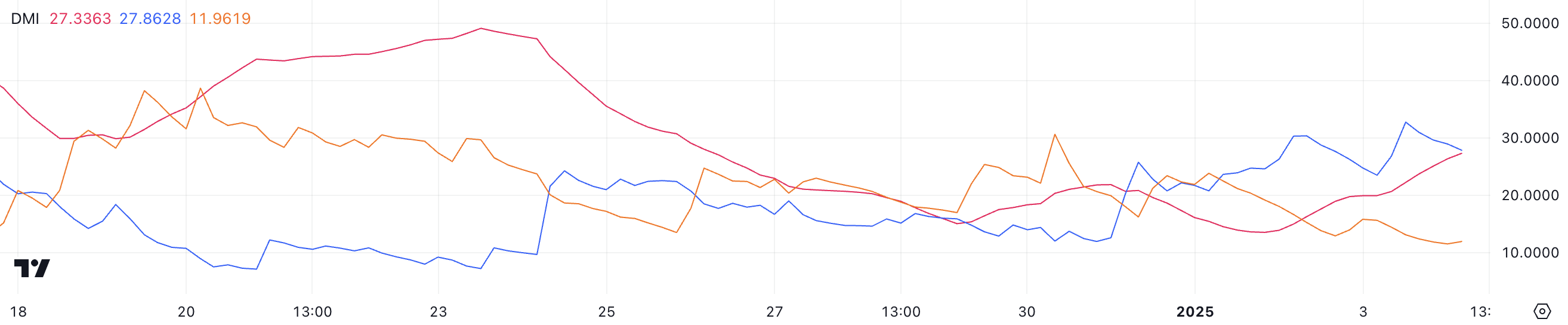

Bitcoin DMI Reveals the Uptrend Is Right here

The DMI chart for Bitcoin signifies that its ADX is at the moment at 27.3, marking a major rise from 13.6 three days in the past. The ADX, or Common Directional Index, measures the power of a development on a scale from 0 to 100, with values above 25 signaling a powerful development and values beneath 20 indicating weak or absent momentum.

BTC’s ADX crossing 25 means that the uptrend has gained substantial power, reflecting elevated market confidence within the present worth course.

The directional indicators present additional context, with the +DI at 27.8, barely down from 32.7 yesterday, and the -DI at 11.9, a minor lower from 13.1. This configuration highlights that purchasing stress stays considerably stronger than promoting stress, although the slight decline within the +DI suggests some cooling in bullish momentum.

Within the brief time period, BTC’s worth is prone to stay in an uptrend, however sustaining additional features might require renewed shopping for exercise to maintain the +DI elevated and the ADX rising.

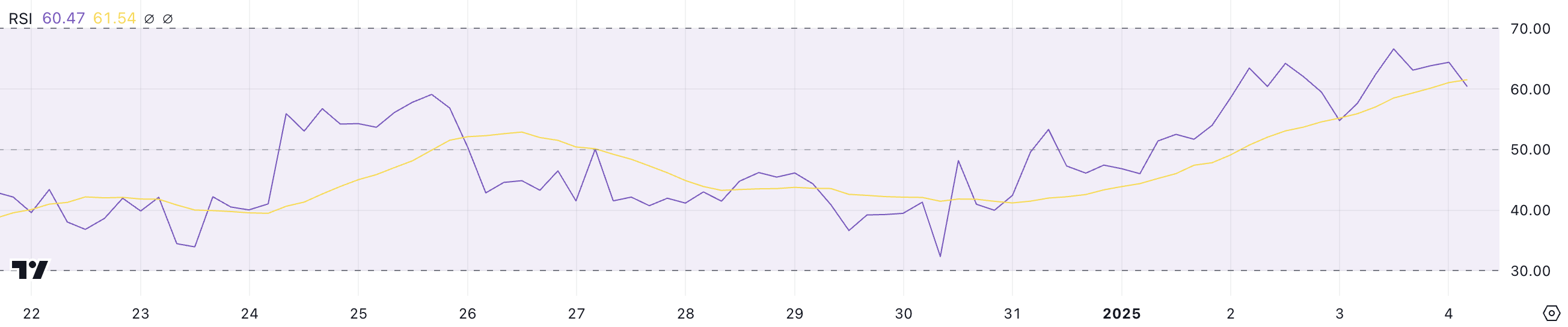

BTC RSI Has Been Above 50 Since January 1

Bitcoin RSI is at the moment at 60.47, sustaining its place above the impartial 50 stage since January 1. The Relative Power Index (RSI) measures the pace and magnitude of worth modifications on a scale from 0 to 100, offering insights into overbought or oversold situations.

Values above 70 usually point out overbought situations, suggesting a possible pullback, whereas values beneath 30 signify oversold situations, usually signaling a restoration.

Bitcoin RSI just lately peaked at 66.6 earlier than cooling to its present stage of 60.47. This decline displays a moderation in shopping for stress after a interval of sturdy momentum.

Whereas the RSI stays firmly in bullish territory above 50, the pullback means that BTC worth might consolidate or expertise restricted upward motion except recent shopping for exercise emerges to push the RSI nearer to the overbought zone. This present stage offers room for reasonable worth features whereas protecting the danger of overextension in test.

BTC Worth Prediction: Bitcoin Must Break These Resistances to Rise to $110,000

BTC EMA traces are displaying indicators of a possible sturdy uptrend because the short-term EMA is crossing above the longer-term ones. This bullish crossover usually alerts a rise in momentum, which might push Bitcoin worth to check the resistance at $98,870.

A profitable breakout above this stage might pave the way in which for additional features, doubtlessly reaching $102,590 and even testing $110,000 for the primary time, relying on the development’s power. That will occur days after Bitcoin celebrated its sixteenth birthday.

Nevertheless, if BTC worth fails to interrupt above the resistance and the development reverses, it might face draw back stress. On this state of affairs, BTC might retest the $90,700 help stage, with a break beneath this opening the potential for additional declines to $88,000.

Disclaimer

In keeping with the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.