Phishing assaults by crypto pockets drainers reached alarming heights in 2024, with an estimated $500 million stolen. Over 330,000 addresses have been affected, demonstrating the widespread affect on crypto customers.

This represents a pointy 67% rise from 2023, highlighting the growing sophistication of those malicious schemes, in line with Rip-off Sniffer.

Ethereum Leads in Crypto Phishing Losses as Assaults Evolve

The thefts occurred in distinct waves. The primary quarter (Q1) of 2024 was essentially the most damaging, with $187.2 million misplaced and 175,000 victims reported. March was significantly devastating, recording $75.2 million in losses, making it the very best month-to-month determine of the 12 months.

The second and third quarters (Q2 and Q3) collectively accounted for $257 million in losses from 90,000 addresses. A notable decline in each the variety of victims and the whole losses was noticed within the fourth quarter (This autumn), which noticed $51 million stolen from 30,000 victims. This discount suggests enhancements in person consciousness and safety measures towards the top of the 12 months.

Giant-scale thefts remained a big downside, with 30 incidents exceeding $1 million every, collectively accounting for $171 million. The primary half of the 12 months primarily concerned smaller-scale thefts starting from $1 million to $8 million per incident.

Nonetheless, the second half witnessed bigger assaults, with August and September seeing main losses of $55 million and $32 million, respectively. These two months alone contributed to over half of the 12 months’s whole from large-scale incidents.

Ethereum suffered essentially the most vital losses, adopted by Arbitrum, Base, Blast, and BNB Chain. Concerning focused belongings, staking and restaking tokens skilled the heaviest affect, adopted by stablecoins, Aave collateral, and Pendle yield-bearing belongings.

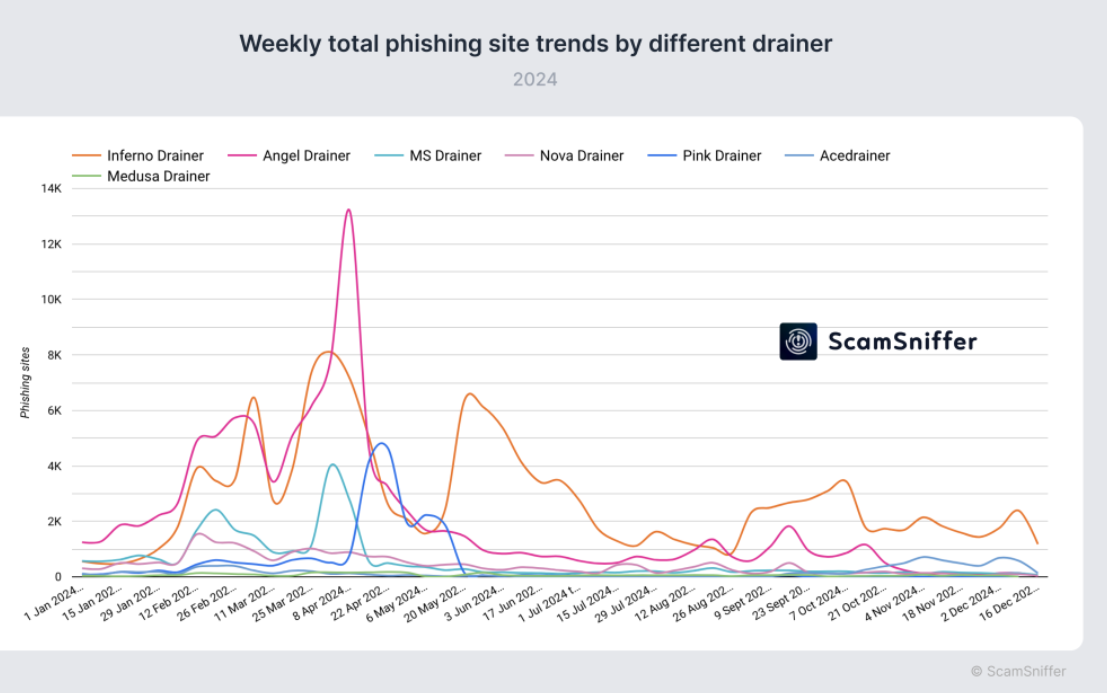

In the meantime, the panorama of pockets drainers advanced all year long. Within the first half of 2024, three main gamers — Angel, Pink, and Inferno — dominated the scene.

Angel led with 41% market management, whereas Pink and Inferno held 28% and 22%, respectively. In Might, Pink exited the market, leaving Angel and Inferno to vie for dominance. By This autumn, Angel had acquired Inferno, signaling additional consolidation within the area. In the meantime, new entrants emerged, including complexity to the ecosystem.

The sharp rise in phishing assaults and pockets drainers in 2024 underscores the significance of adopting sturdy safety practices and educating customers to mitigate dangers within the ever-evolving crypto panorama.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.