MicroStrategy, the world’s largest company holder of Bitcoin, has unveiled plans to boost $2 billion by means of a perpetual most well-liked inventory providing.

This initiative goals to develop the corporate’s Bitcoin reserves and strengthen its steadiness sheet, aligning with its bold development technique.

MicroStrategy Pushes New Limits With Bitcoin Funding Technique

In a January 3 disclosure, MicroStrategy clarified that this providing is separate from its earlier plans to safe $21 billion in fairness and an equal quantity in fixed-income devices.

The perpetual most well-liked inventory may very well be funded by means of varied mechanisms, together with the conversion of sophistication A typical inventory, issuing money dividends, or redeeming shares. The providing would supply traders with common dividends and not using a maturity date, making it a singular device for elevating capital.

Dylan LeClair, Metaplanet’s director of Bitcoin technique, emphasised the revolutionary nature of this transfer. He famous that the providing permits traders to realize publicity to Bitcoin’s inherent volatility whereas offering MicroStrategy with a cheap solution to elevate funds.

LeClair estimated that even when the annual dividend price reaches 6%, the corporate would solely pay $120 million yearly on the $2 billion elevate — a manageable determine for a agency that secured over $15 billion in fairness capital in 2024.

“Volatility is THE product, and BTC Yield is the Key Efficiency Indicator. The indefinite optionality is THE most attention-grabbing product that MSTR can promote to the fastened earnings market,” LeClair acknowledged.

In the meantime, the corporate anticipates launching the providing within the first quarter of 2025, contingent on favorable market situations and different components. Nevertheless, MicroStrategy has not dedicated to continuing with the plan.

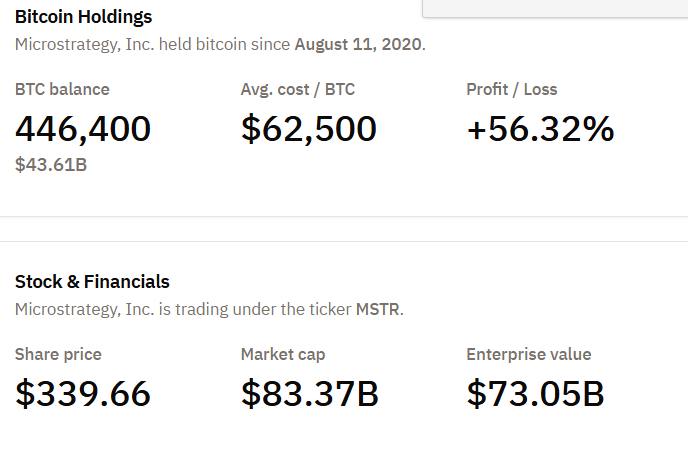

MicroStrategy’s constant Bitcoin purchases have considerably enhanced its market place. The corporate’s share worth has soared and has secured a spot on the Nasdaq 100 index. Furthermore, the agency’s revolutionary method to funding — issuing debt and fairness to finance Bitcoin purchases—has earned it recognition as a pioneering “Bitcoin treasury firm.”

Nevertheless, this technique comes with challenges. Issuing new shares to boost capital dilutes the possession of present shareholders, which might scale back earnings per share. The Kobeissi Letter highlighted this problem in an in depth evaluation, warning {that a} failure to safe extra funding may jeopardize MicroStrategy’s Bitcoin acquisition technique.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.