The Bitcoin market skilled a modest restoration over the previous week following the 15.7% correction within the latter half of December 2024. Amidst this current worth acquire, developments from the short-term holders (STH) exercise have revealed important indications for Bitcoin within the coming days.

Bitcoin STH MVRV At 1.1 With Extra Room To Run

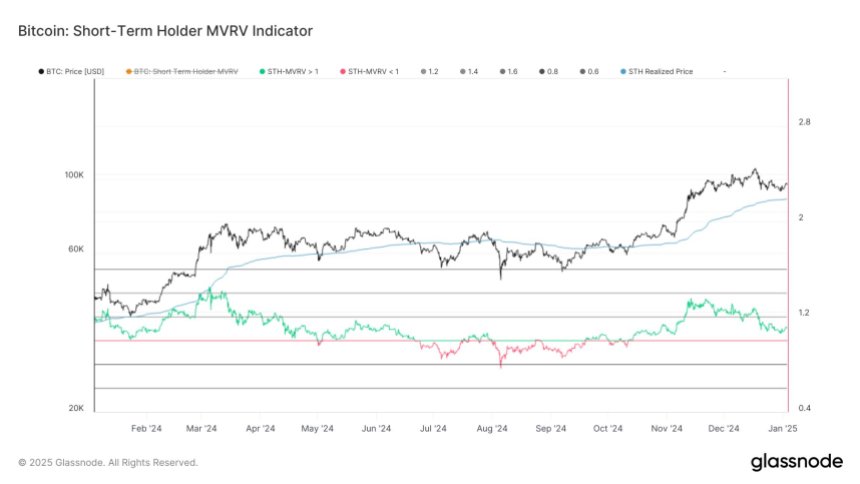

Based on a current X put up, blockchain analytics agency Glassnode shared a knowledge report on the Bitcoin short-term holders’ MVRV ratio in relation to market worth.

In crypto, the market worth to realized worth ratio (MVRV) is a vital evaluation device used to gauge whether or not an asset is overvalued or undervalued. It is usually used to trace the holders’ profitability with values above 1 indicating revenue and under 1 which means a loss.

Based mostly on Glassnode’s report, the Bitcoin STH MVRV ratio at the moment stands at 1.1 suggesting that short-term holders i.e. buyers who acquired Bitcoin throughout the previous 155 days, are on common, experiencing a ten% revenue. Contemplating BTC’s worth fall in current weeks, there is perhaps elevated promoting stress as these holders transfer to comprehend their positive factors, resulting in short-term worth resistance.

Nonetheless, knowledge from Glassnode signifies that the Bitcoin MVRV STH ratio beforehand reached peaks of 1.35 in November 2024, and 1.44 in March 2024. These MVRV values counsel that short-term holders could tolerate larger profitability ranges earlier than triggering a widespread sell-off.

If Bitcoin bulls keep the present worth restoration with rising demand, the STH MVRV ratio may rise nearer to those historic peak ranges, which may sign a affirmation of Bitcoin resuming its market uptrend.

BTC Should Keep away from Fall Under $87,000 – Right here’s Why

In relation to the Bitcoin STH MVRV ratio, it’s understood that 1.0, which signifies no revenue or loss, is a pivotal worth performing as a help throughout bullish traits or resistance in a market downtrend.

Glassnode report reveals that the present STH MVRV ratio exhibits that 1.0 corresponds with the $87,000 worth zone. Based on knowledge from the Cumulative Bid-Ask Delta, there’s an air pocket between $87,000 and $71,000 i.e. there’s low buying and selling exercise or fewer important purchase orders on this worth vary. Subsequently, if the value of BTC slips under $87,000, it’ll hit no important help till $71,000 translating into a serious worth decline.

On the time of writing, the premier cryptocurrency continues to commerce at $98,081 reflecting a 1.02% acquire prior to now day. With a market cap of $1.94 trillion, Bitcoin continues to rank as the most important asset within the crypto market.