Solv Protocol, a outstanding Bitcoin staking platform, is going through allegations of inflating its whole worth locked (TVL) figures. Business consultants have raised these accusations, which query the platform’s asset-handling practices and the accuracy of its reported metrics.

Nonetheless, the platform’s crew has strongly denied these accusations, labeling them as unfounded and an try to unfold concern and misinformation.

Issues Come up Over SolvBTC’s Asset Dealing with

On January 3, Hanzhi Liu, co-founder of Nubit, introduced consideration to potential irregularities in Solv Protocol’s operations. Liu alleged that blockchain information suggests the platform recycles the identical Bitcoin throughout a number of protocols as a substitute of locking distinctive deposits. This apply, based on Liu, artificially inflates Solv’s TVL figures.

Liu defined that SolvBTC, the platform’s wrapped Bitcoin asset, depends on pre-signed transactions to look in a number of staking protocols concurrently. This technique, he claimed, permits one Bitcoin to be counted a number of instances throughout completely different platforms, creating the phantasm of upper TVL.

For instance, one BTC in SolvBTC might be reported as three BTC by leveraging this duplication throughout varied platforms.

“Solv Protocol isn’t locking distinctive BTC deposits. As a substitute, it’s utilizing pre-signed transactions to “authorize” the identical BTC throughout a number of protocols: 1 BTC in Solv → +1 TVL BTC Identical BTC in Bsquared → +1 TVL BTC (once more) Identical BTC in ??? → +1 TVL BTC (once more) In actuality, 1 BTC = 3 pretend TVL BTC,” Liu said.

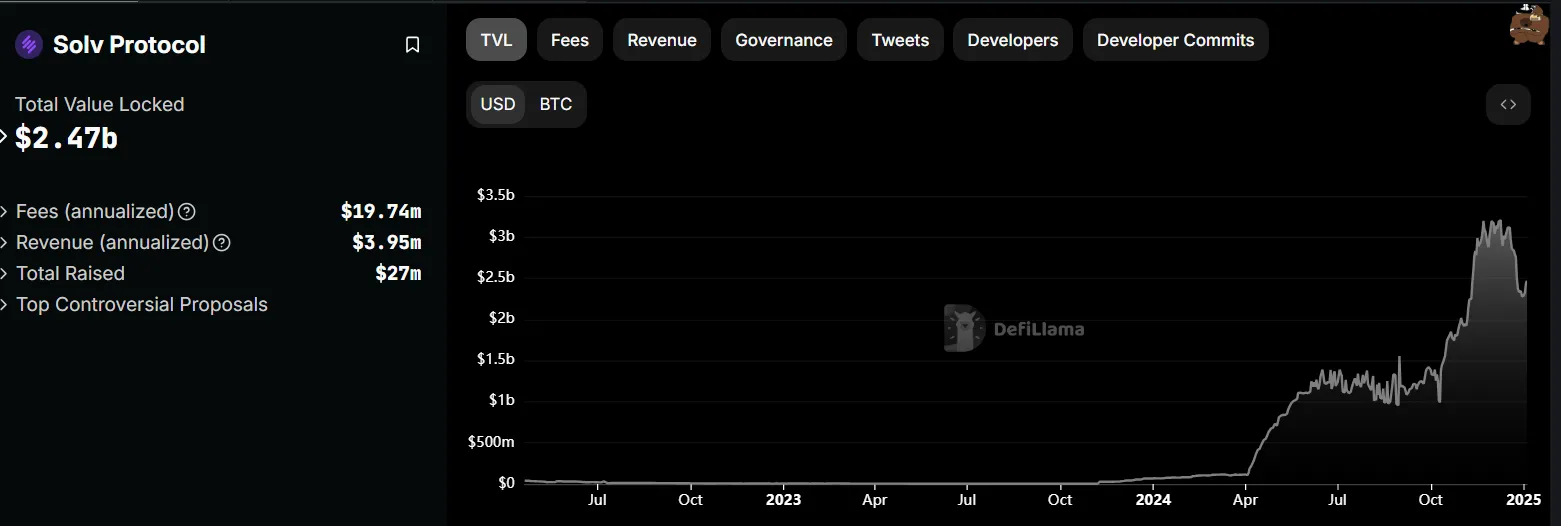

He additionally accused the platform of altering its TVL information on monitoring instruments like DeFiLlama and transferring funds supposedly locked in staking contracts. So, Liu urged customers to withdraw their funds from Solv and confirm whether or not their property are genuinely secured or being reused throughout protocols.

Solv Protocol Responds to the Allegations

Eva Binary, Solv Protocol’s Chief Advertising and marketing Officer, dismissed the allegations, describing them as deceptive and baseless. She clarified that Solv’s TVL metrics align with its commonplace 15-day restaking cycles and are precisely mirrored on DeFiLlama.

Binary additionally attributed TVL fluctuations in particular swimming pools, resembling SolvBTC.BBN, to routine redemption processes, denying any manipulation or “3x BTC” inflation.

Ryan Chow, co-founder of Solv, echoed these sentiments, accusing opponents of orchestrating a coordinated effort to tarnish the platform’s repute. He additionally argued that these claims are a part of a deliberate marketing campaign to disrupt Solv’s operations and undermine its partnerships.

“For months we’re conscious opponents are on the market smearing us to our companions and persuade them ‘don’t work with Solv, work with us as a substitute, [insert accusations above, if not more].’ We now have thus far chosen to disregard and proceed doing us. However no extra. Make no mistake. This can be a smear marketing campaign, coordinated and orchestrated, and going to nice lengths in try to take Solv down,” Chow said.

Solv Protocol makes a speciality of Bitcoin staking and yield technology throughout a number of blockchain networks. In response to DeFiLlama, Solv at present manages roughly $2.5 billion in TVL.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.