Aave, a number one decentralized finance (DeFi) platform, is gearing as much as introduce a charge change mechanism aimed toward boosting its financial mannequin.

This step aligns with broader efforts to make sure long-term sustainability and ship worth to the Aave ecosystem.

Aave’s Charge Swap Initiative

On January 4, Stani Kulechov, Aave’s founder, hinted at plans to activate a charge change initiative. This proposal goals to boost the platform’s income administration by enabling the Aave DAO to regulate how charges are collected and distributed.

Such mechanisms are frequent in DeFi platforms and sometimes reward token holders and stakers via transaction charge redistribution.

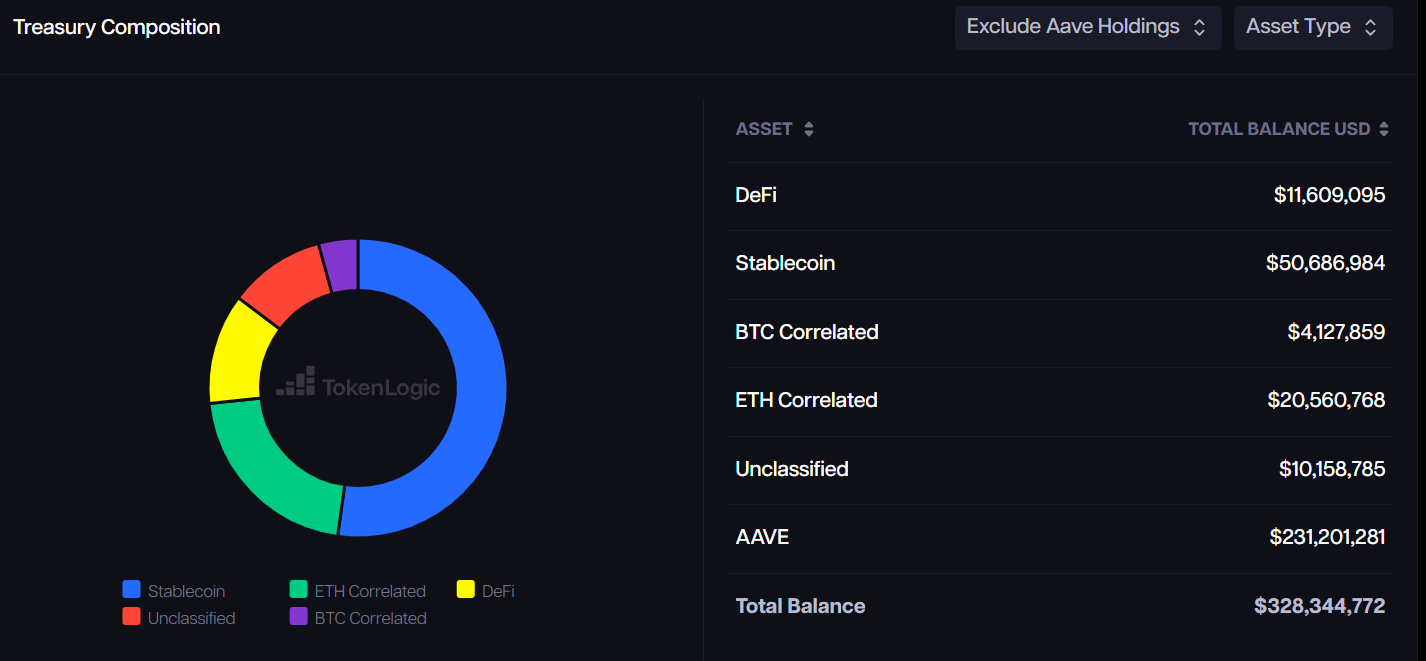

Aave’s sturdy monetary standing helps this initiative. Its treasury holds almost $100 million in non-native property, together with stablecoins, Ethereum, and different cryptocurrencies. When factoring in AAVE tokens, this determine exceeds $328 million, based on TokenLogic.

Marc Zeller, founding father of Aave Chan, first launched the concept of a charge change final yr and emphasised its inevitability earlier this yr. Based on Zeller, Aave’s web income considerably surpasses its operational bills, making the transfer not simply viable however strategic.

“When your protocol treasury appears like this, and DAO web income is greater than twice the Opex (incentives included), The Charge Swap isn’t an if; it’s a when,” Zeller acknowledged.

Aave is the most important DeFi lending protocol, offering customers with decentralized borrowing and lending choices. Based on DeFillama knowledge, greater than $37 billion price of property are locked on the platform.

Aave’s USDe-USDT Proposal Sparks Criticism

In the meantime, the Aave group can also be evaluating a extra contentious proposal to hyperlink Ethena’s USDe, an artificial stablecoin, to Tether’s USDT.

This variation would align USDe’s value with USDT utilizing Aave’s pricing feeds, changing the prevailing Chainlink oracle. The aim is to mitigate dangers related to value fluctuations and unprofitable liquidations.

USDe stands out from conventional stablecoins like USDT attributable to its reliance on derivatives and digital property like Ethereum and Bitcoin somewhat than fiat reserves. USDe is the third-largest stablecoin, behind USDT and USDC, based on DeFillama knowledge.

Regardless of important help for the proposal, some group members have argued that it may create conflicts of curiosity, as advisors concerned in drafting the proposal have ties to Aave and Ethena. Critics, like ImperiumPaper, have recommended that these advisors recuse themselves to make sure impartiality.

“LlamaRisk is on Ethena’s Threat Committee, which comes with month-to-month compensation. Ethena employed Chaos early on to assist design and develop the danger frameworks utilized by Ethena. Each ought to recuse themselves from any oversight of USDe parameters,” Imperium Paper acknowledged.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.