Disclaimer: The opinions expressed by our writers are their very own and don’t characterize the views of U.At present. The monetary and market data offered on U.At present is meant for informational functions solely. U.At present shouldn’t be accountable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your personal analysis by contacting monetary specialists earlier than making any funding selections. We imagine that every one content material is correct as of the date of publication, however sure affords talked about might now not be accessible.

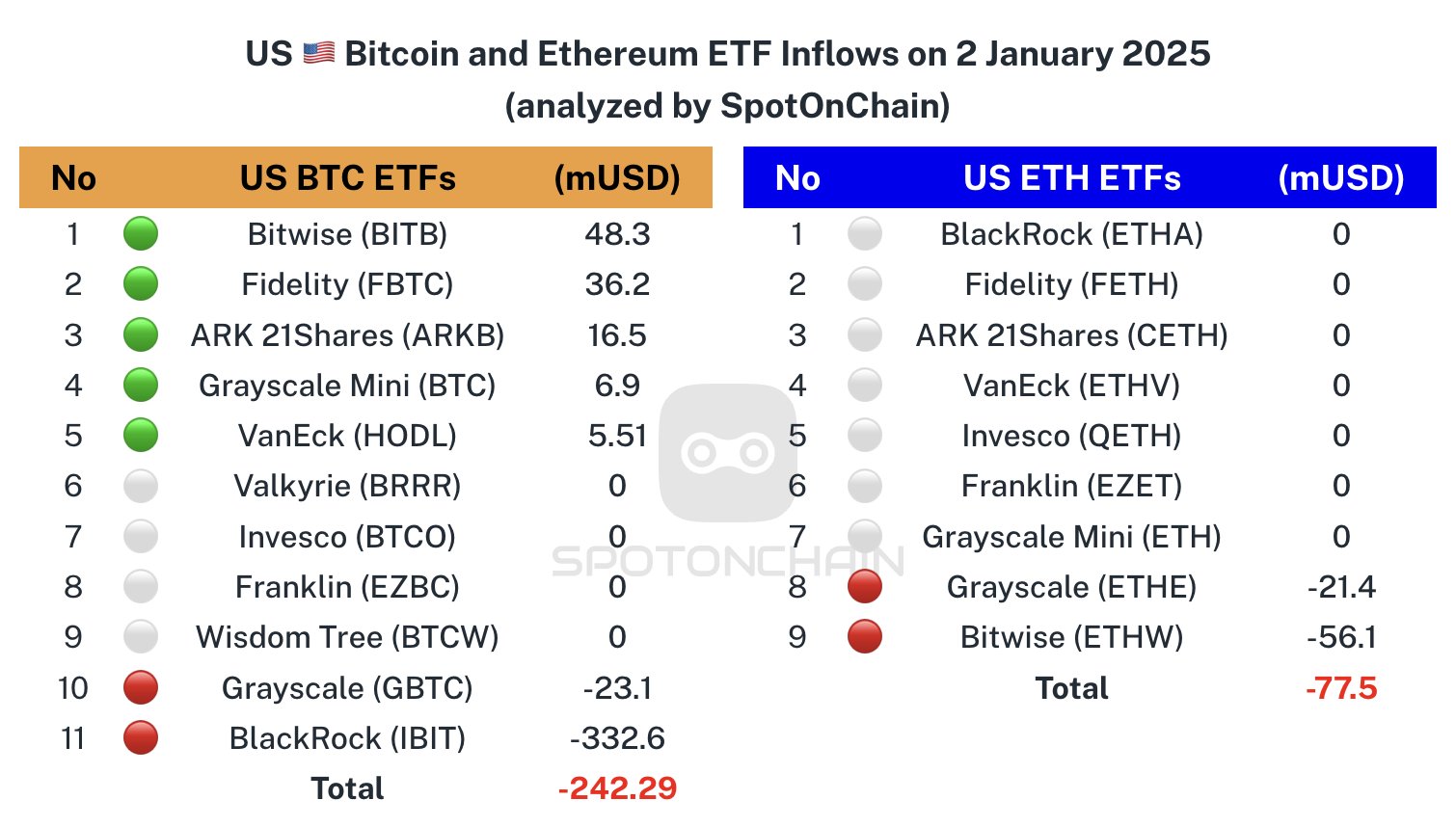

BlackRock’s iShares Bitcoin Belief (IBIT) began 2025 with a giant outflow of $332.6 million, which is about 3,413 BTC. That is the ETF’s greatest single-day outflow because it began, greater than the earlier low of $188.7 million, equal to 1,933 BTC, on Dec. 24, 2024.

Even with the early hiccups within the new yr, IBIT had a stable run in 2024, pulling in a complete of $37.2 billion in inflows. BlackRock’s Ethereum ETF (ETHA) additionally had some severe investor curiosity, raking in $3.53 billion throughout the identical time.

As of now, BlackRock has about 548,505 BTC value $52.81 billion and round 1,071,415 ETH value $3.68 billion.

Cryptocurrency market reacts with unfavorable

How this can have an effect on the broader cryptocurrency market stays to be seen. However, as we will see proper now, the quotes of digital property expertise stress at the moment and a dip. This can be attributable to the truth that Bitcoin noticed a bear response from the $97,700 zone, which proper now serves as main resistance for the value of the main cryptocurrency.

There’s an outlook for Bitcoin, that now there’s an try and kind a traditional visible sample “head-shoulders,” which shall be activated on the breakdown of the neckline — round $92,000.

If that occurs, from right here we will count on a deep correction to the world of $80,000-$70,000. This may mark a 30% decline from the related all-time excessive for BTC, which is a wholesome textbook correction wanted for continuation of the upward trajectory.