Solana (SOL) worth has seen a 9% improve previously seven days, bringing its market cap again above the $100 billion mark, presently sitting at $103 billion. Regardless of this development, SOL’s buying and selling quantity has decreased by 34% within the final 24 hours, standing at $2.4 billion.

Constructive indicators reminiscent of its CMF and a current golden cross assist the bullish momentum. Nevertheless, whether or not SOL can keep its upward trajectory or face a correction is dependent upon its means to carry the essential $211 assist stage.

Solana CMF Nonetheless Excessive, But Exhibits Drop from Its Peak Ranges

The Chaikin Cash Circulation (CMF) for Solana is presently at 0.23, reflecting optimistic capital inflows into the asset. The CMF measures the circulate of cash into and out of an asset over a given interval, primarily based on worth and quantity. Values above 0 recommend web shopping for stress, whereas values under 0 point out web promoting stress.

SOL CMF surged from practically 0 on January 1 to 0.33 yesterday, signaling a powerful inflow of shopping for momentum throughout this era.

At 0.23, SOL CMF stays in optimistic territory, indicating sustained shopping for curiosity, albeit at a barely lowered depth in comparison with its current peak. This decline from 0.33 could recommend that purchasing stress has cooled off barely, probably hinting at a interval of consolidation or slower upward momentum for the worth.

For SOL to keep up its bullish trajectory, the CMF would wish to stabilize or rise once more, reflecting renewed confidence amongst traders. Nevertheless, a continued decline might sign weakening demand, rising the probability of a worth correction within the quick time period.

SOL Sellers Present Indicators of Restoration

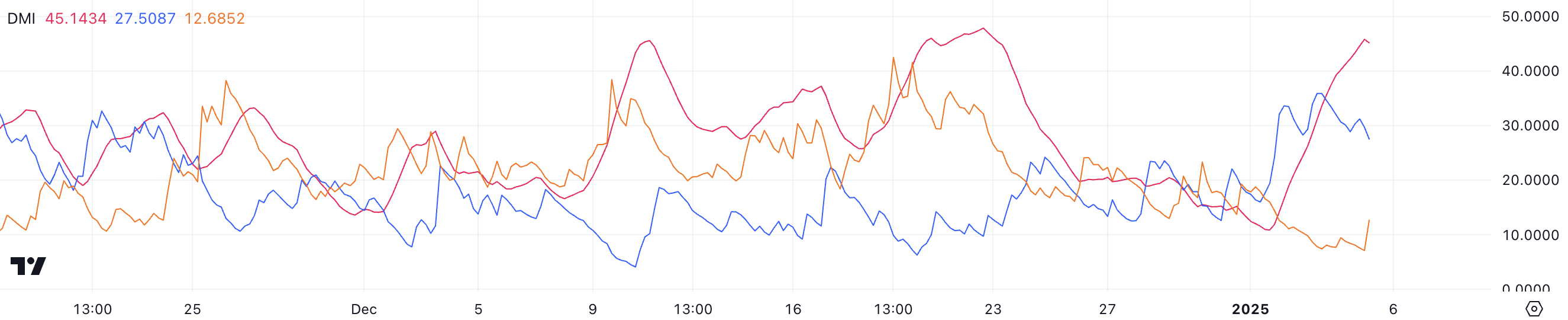

The Common Directional Index (ADX) for SOL has surged to 45, rising sharply from 10.8 simply 4 days in the past, signaling a powerful pattern formation. The ADX measures the energy of a pattern on a scale from 0 to 100, the place values above 25 point out a powerful pattern, whereas values under 20 recommend weak or absent momentum.

This sharp improve in ADX confirms that SOL is presently in a strong uptrend, reflecting sturdy market exercise and confidence in its worth path.

The directional indicators present additional perception into the present pattern. The +DI, which represents shopping for stress, is at 27.5, though it has declined from 35.8 yesterday, signaling a slight discount in bullish momentum. In the meantime, the -DI, indicating promoting stress, has elevated to 12.6 from 8.6, displaying that bearish exercise has risen barely.

Regardless of these shifts, the uptrend stays intact, because the +DI continues to be considerably greater than the -DI, supported by the sturdy ADX. Nevertheless, the reducing +DI means that Solana bullish momentum could be stabilizing, and the market might enter a consolidation section except shopping for stress reignites.

SOL Value Prediction: Can It Return to $246 Quickly?

Solana worth motion hinges on whether or not it might probably keep the important $211 assist stage. If this assist is misplaced, SOL could enter a downtrend, with $203 as the following key stage to observe.

A failure to carry above $203 might speed up the decline, probably pushing the worth again to $185, reflecting a major bearish shift in sentiment.

Conversely, the EMA strains stay bullish, signaling optimism for a possible upward motion. A golden cross shaped simply two days in the past, reinforcing the opportunity of sustained momentum.

If the $211 assist holds, SOL worth might rise to problem the resistance at $221. Breaking by means of this stage may pave the best way for additional beneficial properties to $229. If the bullish momentum strengthens, Solana worth might goal $246, representing a 16% upside from present ranges.

Disclaimer

In keeping with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.