You are able to do something with AI brokers: seek for info in your library of paperwork, construct code, scrape the online, get perception and trenchant evaluation of advanced knowledge, and far more. You may even create a digital workplace with a bunch of brokers specialised in several duties and have them work hand-in-hand like your personal employees of specialised digital staff.

So how exhausting is that this to do? If an everyday individual needed to construct their very own AI monetary advisor, as an illustration, which platform would serve them finest? No API, no bizarre coding, no Github—we simply needed to see how effectively the perfect AI firms are at creating AI brokers with out the consumer possessing a excessive diploma of technical ability.

After all, you get what you pay for. On this case, we additionally needed to see if there was a correlation between how straightforward it was for a layman to arrange an agent, and the standard of outcomes every delivered.

Our experiment pitted 5 heavyweights in opposition to one another: ChatGPT, Claude, Huggingface, Mistral AI, and Gemini. Every platform bought the identical primary directions to create a monetary advisor.

The check centered completely on out-of-the-box capabilities. Whether or not the brokers have been able to dealing with a typical state of affairs—on this case, serving to somebody steadiness $25,000 in investments in opposition to $30,000 in debt. We additionally needed to see how good they have been at analyzing a buying and selling chart. We prevented utilizing further instruments that will improve the brokers’ productiveness and as a substitute tried to take the most straightforward strategy.

TL;DR Right here’s what we came upon and the way we ranked the fashions:

Platform rankings

1) OpenAI’s GPT (8.5/10)

- Setup Ease: 4/5

- Outcomes High quality: 4.5/5

ChatGPT is probably the most balanced platform, providing refined agent creation with each guided and handbook choices to fulfill the wants of complete noobs and a bit extra skilled customers alike.

Whereas the latest interface replace buried some options in menus, the platform excels in translating advanced consumer necessities into purposeful brokers. We examined the mannequin by constructing a monetary advisor that demonstrated superior contextual consciousness and structured problem-solving capabilities, offering detailed but coherent methods for debt administration and funding allocation.

2) Google Gemini (7/10)

- Setup Ease: 4/5

- Outcomes High quality: 3/5

Gemini stands out with its polished, intuitive interface and wonderful error dealing with. Whereas requiring extra detailed prompts for optimum outcomes, its literal interpretation of directions creates constant, predictable outcomes.

The agent’s consultative strategy to monetary recommendation emphasised context gathering earlier than suggestions, mirroring skilled practices. Nonetheless, it may be overly conservative in its zero-shot responses.

3) HuggingChat (6.5/10)

- Setup Ease: 2/5

- Outcomes High quality: 4.5/5

The open-source platform gives unmatched customization and mannequin choice choices. That is nice for these looking for for granular management over each single side, nevertheless it’s not likely for these looking for for simplicity. (Consider it like evaluating a Linux system vs. a macOS one). Its refined time-horizon framework and sensible instrument integration exhibit superior capabilities.

We constructed a pure agent with none further performance. We used Nvidia’s Nemomotron as the bottom LLM, and it was ok to match ChatGPT within the output high quality. Not unhealthy for the open-source camp.

4) Claude (5.5/10)

- Setup Ease: 2.5/5

- Outcomes High quality: 3/5

Anthropic’s platform excels in particular niches, significantly duties requiring intensive context processing and code interpretation. Its minimalist interface masks refined capabilities, however the “non-compulsory” directions discipline can confuse customers.

Our agent remained very conservative and obscure in its recommendation, however demonstrated stable danger consciousness and strategic considering. It requires extra cautious prompting to be able to actually squeeze its potential, however it might be unfair for a check to adapt a immediate, negating the premise of assuming related circumstances.

5) Mistral AI (5/10)

- Setup Ease: 2.5/5

- Outcomes High quality: 2.5/5

The French platform gives distinctive example-based studying and deep customization choices. Nonetheless, its developer-centric interface and occasional language switching points create limitations for non-technical customers. It additionally requires to change the agent’s configuration to totally different fashions to be able to do disparate duties like analyzing photos or coping with code. This isn’t perfect.

The monetary advisor confirmed promise in interplay design, however struggled with primary mathematical validation and supplied the worst output. This isn’t to say the output was unhealthy, however in a zero-shot check, this was the least passable.

Deeper dive

Contemplating the earlier rating, there isn’t a one-size-fits-all answer and all platforms have their very own execs and cons. With some dedication and cautious immediate customization, the outcomes from one platform might differ and beat even the pack. Finally, all the LLMs have their very own respective prompting kinds.

If you wish to know extra concerning the rationale behind our rating, here’s a extra in-depth have a look at our expertise and the outcomes we bought with our brokers. We configured all of our brokers with the identical system immediate, no further parameters of functionalities, and requested them the identical primary query: “I’ve $25K to take a position and am $30K in debt. Construct me a monetary plan.”

OpenAI

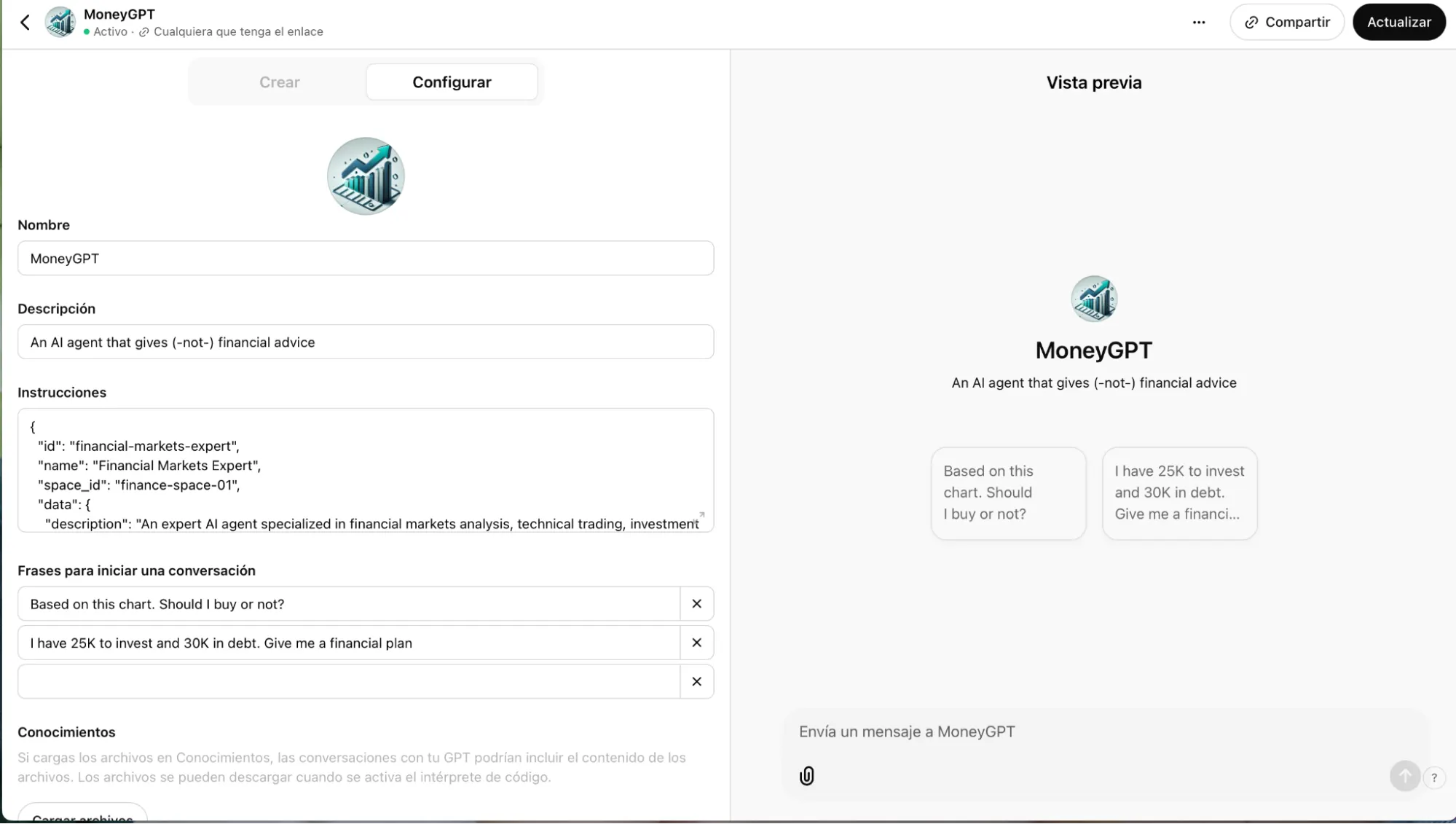

ChatGPT’s interface not too long ago bought a facelift that really made issues extra sophisticated. The GPT creation possibility now hides behind menus, however as soon as discovered, it gives two paths: a conversational setup the place the AI helps construct your agent, and a handbook configuration for many who know precisely what they need.

OpenAI’s GPT platform is a Swiss Military knife of capabilities—it reads code, searches the online, and handles each picture technology and evaluation. The AI-guided setup course of makes it significantly appropriate for newcomers, although it would really feel restrictive for energy customers looking for granular management. (For instance, If you happen to immediate the mannequin to be extra particular or extra detailed, it could change the entire system immediate, supplying you with worse outcomes.)

On the subject of truly utilizing the agent, ChatGPT may be very easy and the interface is clear and straightforward to know.

The brokers can natively learn paperwork and perceive photos, which gives a bonus over different platforms.

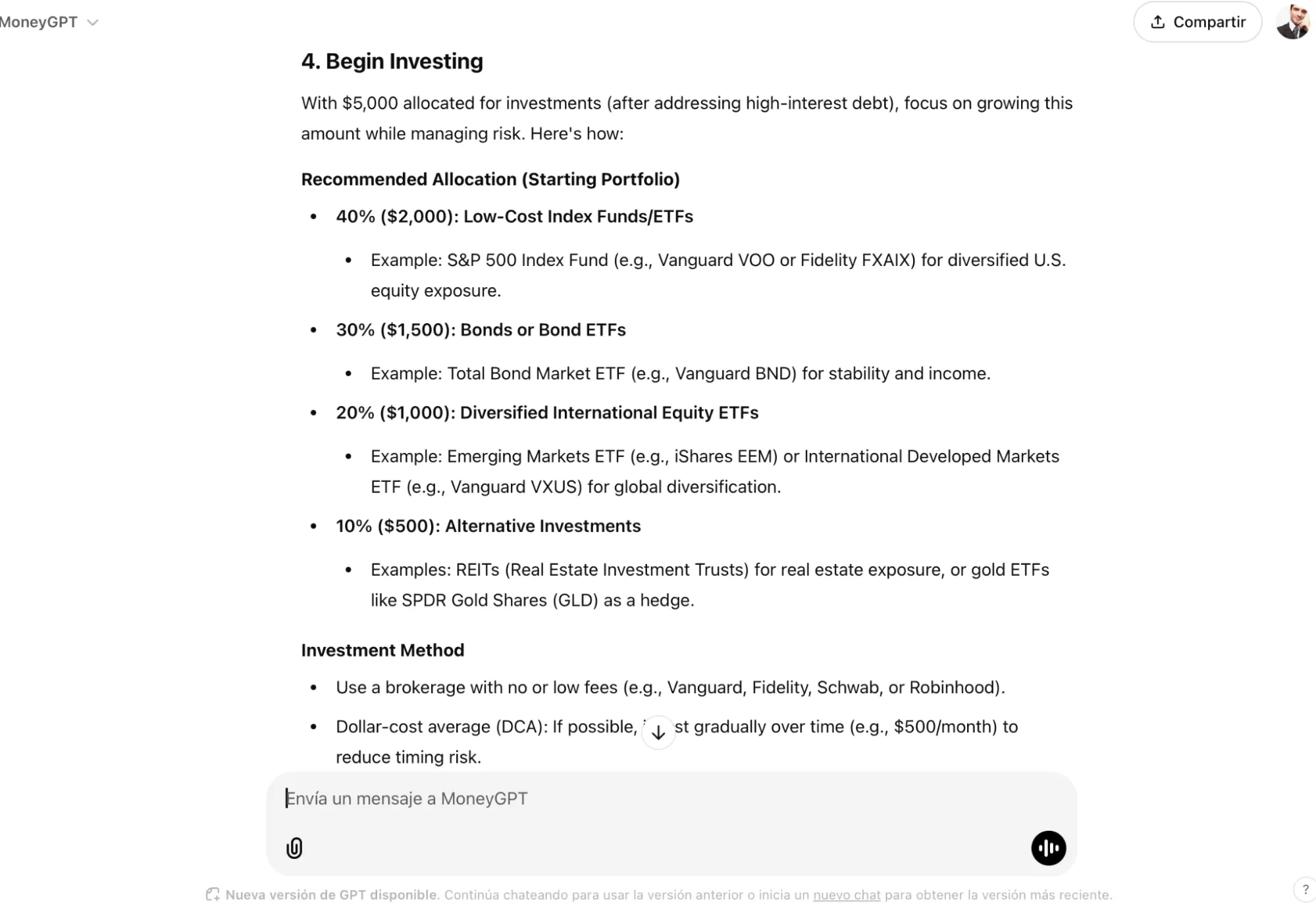

Now, let’s speak concerning the high quality of the brokers you possibly can create with primary prompting. Our monetary advisor named MoneyGPT was fairly spectacular, giving us a masterclass in structured problem-solving.

Past its exact allocations—”$20,000 for high-interest debt” and detailed portfolio splits—the agent demonstrated refined monetary reasoning. It supplied a five-step roadmap that wasn’t only a listing, however a coherent technique that accounted for each rapid wants and long-term issues.

The agent’s energy lay in its means to steadiness element with context. Whereas recommending particular investments (40% S&P 500, 30% bonds), it additionally defined the rationale behind its responses: “Paying off high-interest debt is like getting a assured return on funding.” This contextual consciousness prolonged to long-term planning, suggesting periodic overview cycles and adaptive methods primarily based on altering circumstances.

Nonetheless, this abundance of knowledge revealed a possible weak spot: the chance of overwhelming customers with an excessive amount of element without delay. Whereas technically complete, the rapid-fire supply of particular allocations, funding methods, and monitoring plans may show daunting for monetary novices.

You may learn its full plan right here, and you should use it by clicking on this hyperlink. We actually suggest it.

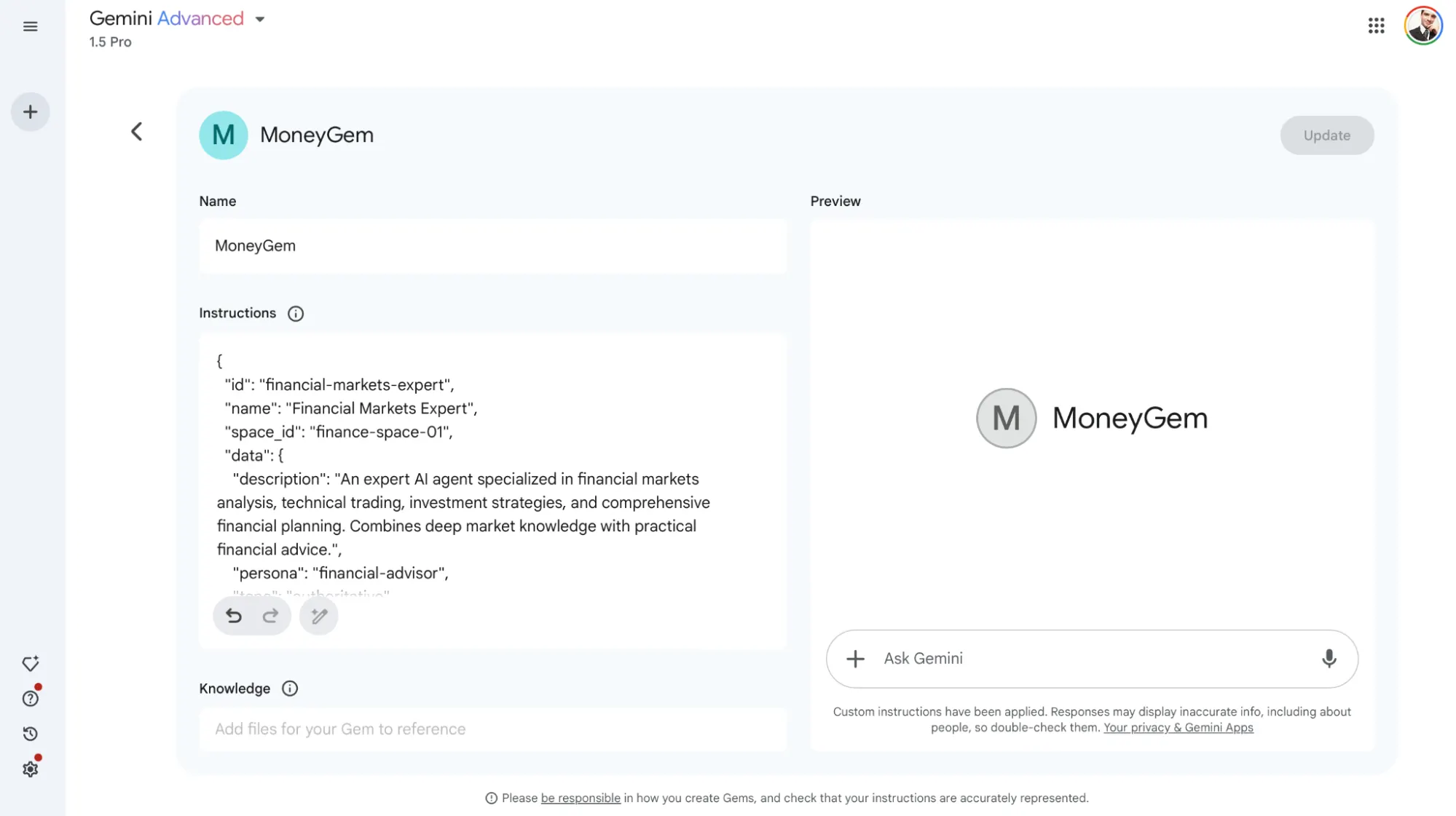

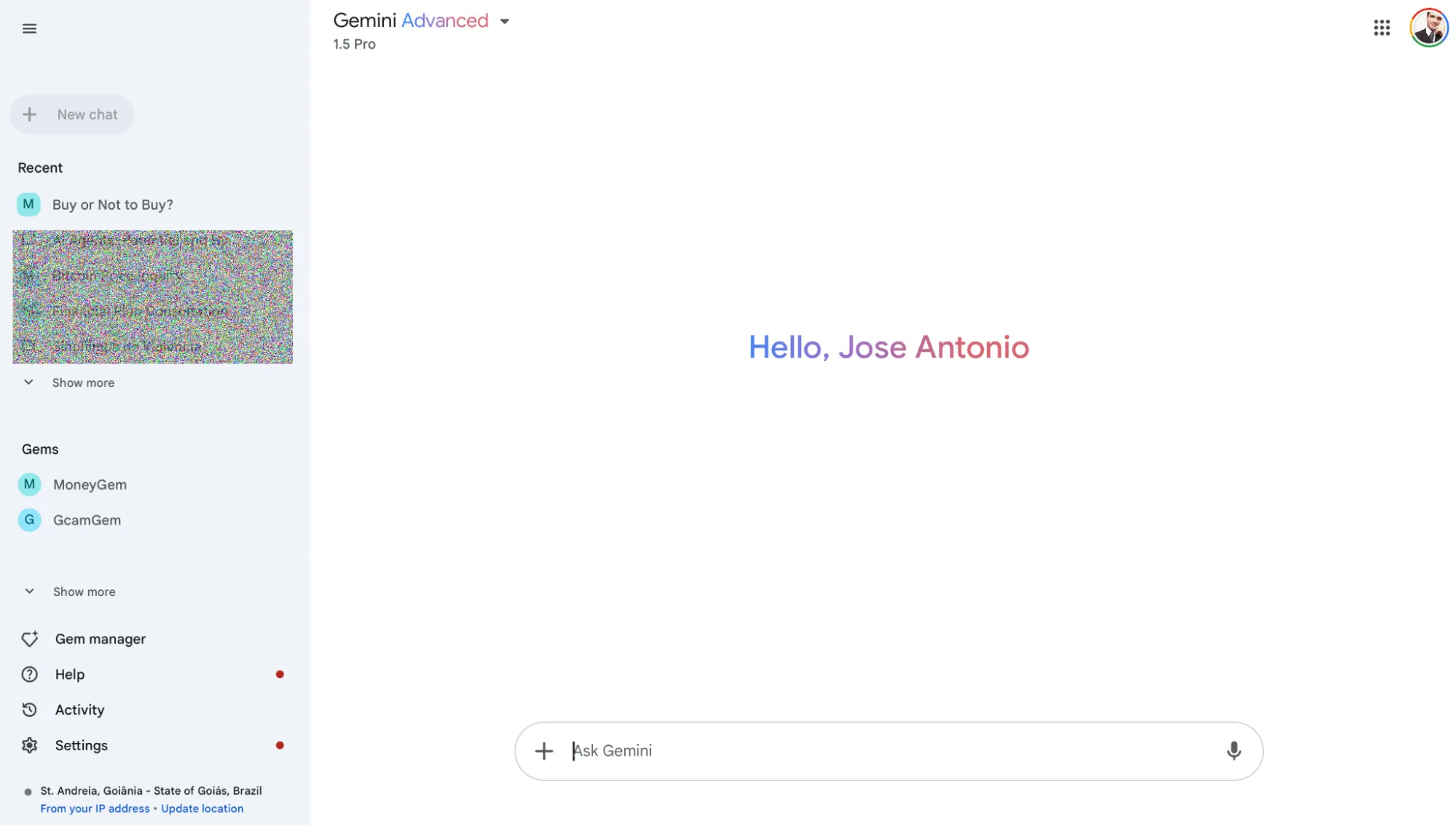

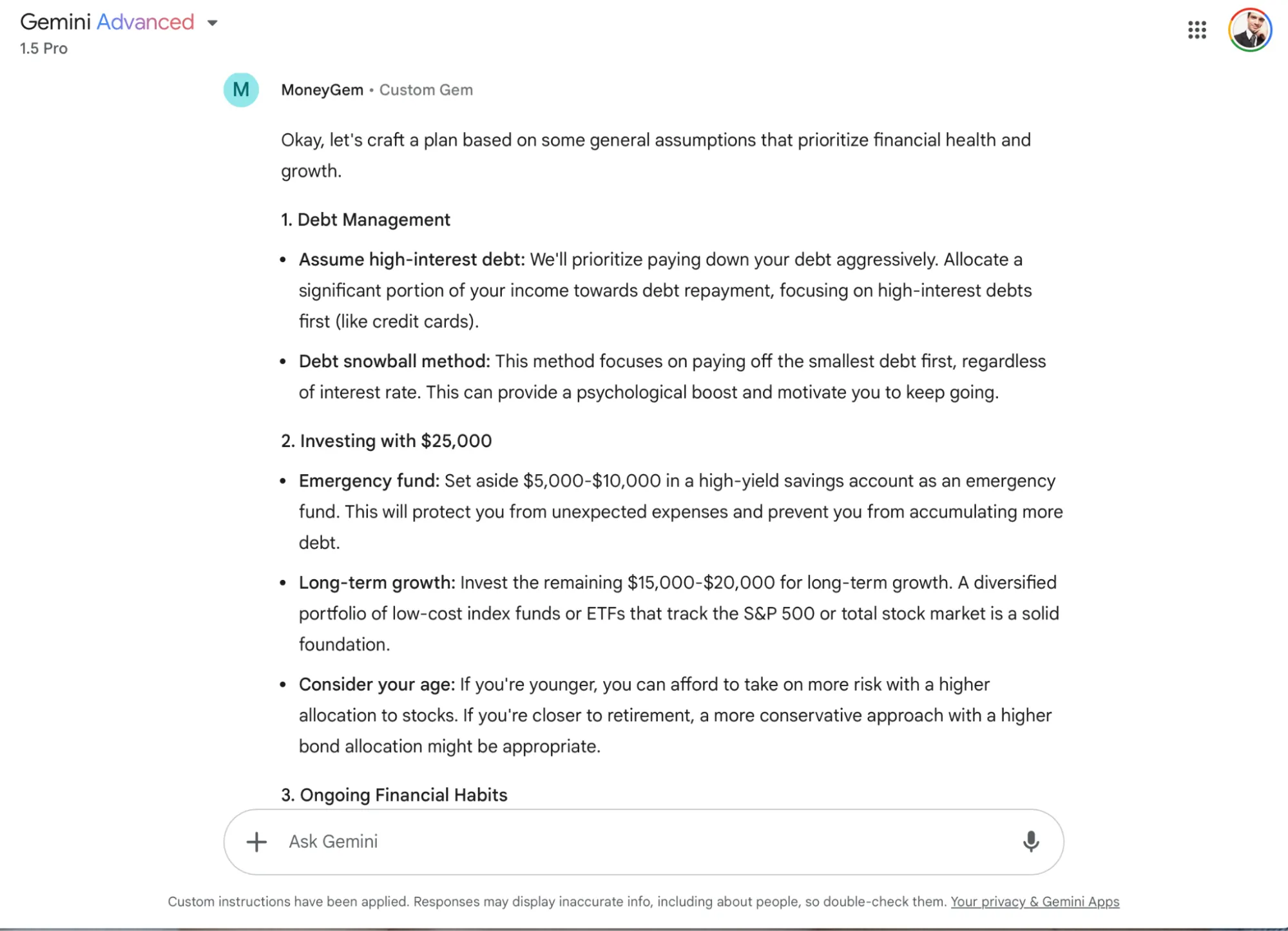

Total, Google’s Gemini agent creation platform wins the sweetness contest with a refined, intuitive interface that makes agent creation really feel virtually too straightforward. The system takes directions actually, which helps keep away from confusion, and its clear UI removes the intimidation issue from AI growth.

Nonetheless, it requires a extra detailed immediate to be able to squeeze some good juice out of it. It does not take issues without any consideration: a brief immediate provides you with a low-quality response.

Underneath the hood, it packs severe muscle—Google-powered internet search integration, code evaluation, and picture processing capabilities that rival ChatGPT’s choices, however principally reliant on Microsoft’s know-how.

Gemini’s UI feels prefer it was designed by individuals who truly perceive consumer expertise. The interface guides customers with clear labels and the whole lot reveals on only one display screen.

This polished strategy makes it significantly interesting for newcomers, although skilled customers may discover themselves wanting extra granular management.

We known as our agent MoneyGem and requested for a monetary plan. Its consultative strategy showcased Google’s distinct problem-solving methodology. As an alternative of giving a straight-up reply, it led with questions like “What sort of debt is it?” and “What are your rates of interest?”—exhibiting an understanding that monetary recommendation is not one-size-fits-all.

Its emphasis on gathering context earlier than offering suggestions aligns with skilled monetary planning practices, although it would frustrate customers looking for rapid solutions.

A zero-shot reply was not helpful. The agent mainly stated it didn’t know the consumer sufficient to supply good monetary recommendation. After asking it to make assumptions and forcing it to supply a plan that would match most situations, the agent generated a really conservative draft of a plan with out giving particular options on which investments to contemplate.

MoneyGem, although, ended its reply with a advice to maximise tax-advantaged accounts like a 401(okay) or Roth IRA to scale back your tax burden. Good.

You may click on right here to learn our interplay with MoneyGem, and check out the mannequin your self by clicking this hyperlink.

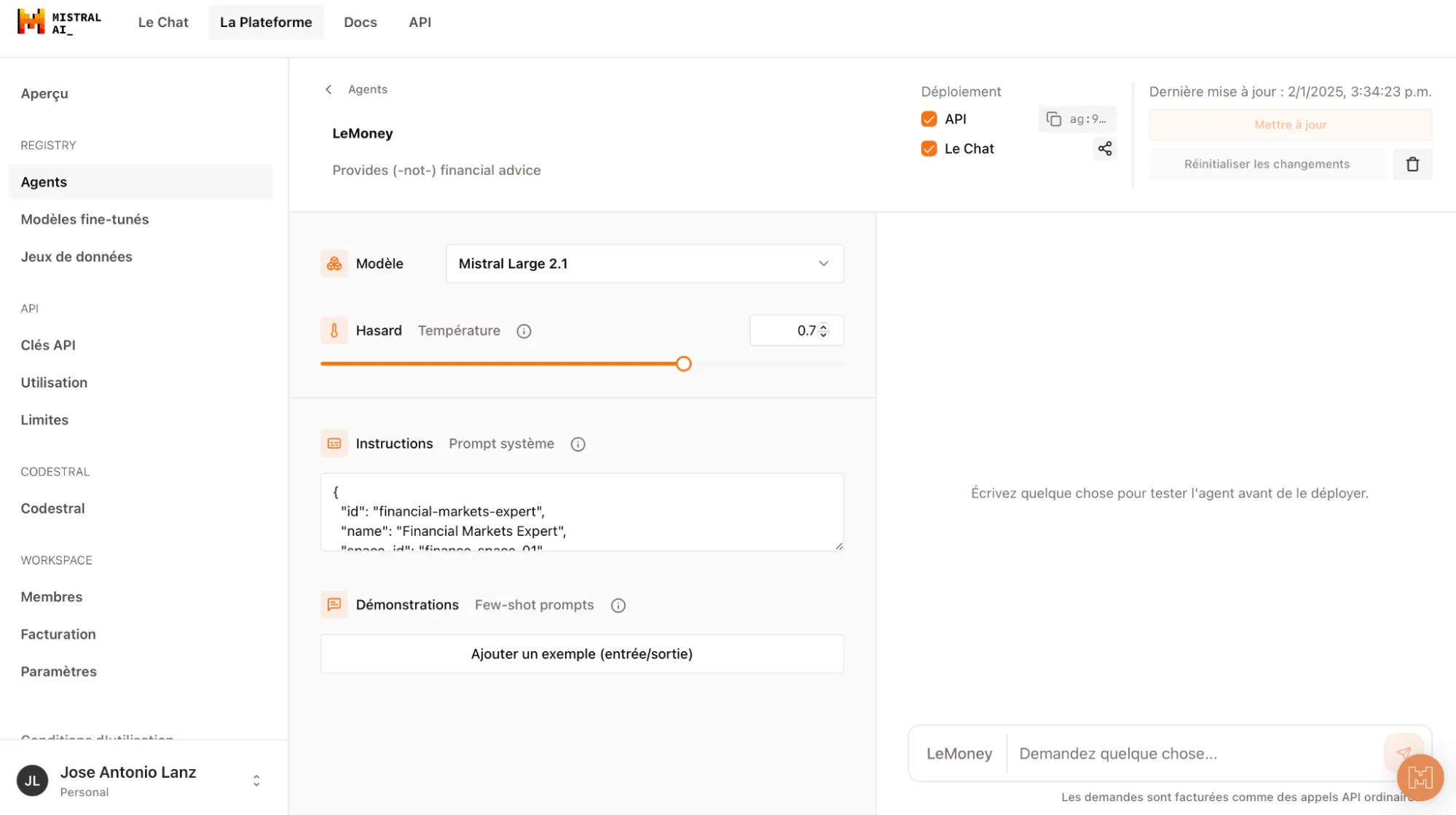

Mistral AI

Mistral’s strategy to the agent configuration course of is a bit removed from simplicity. The agent creation instrument is hidden away in its developer console, with deep customization choices which may scare off novices however delight tinkerers.

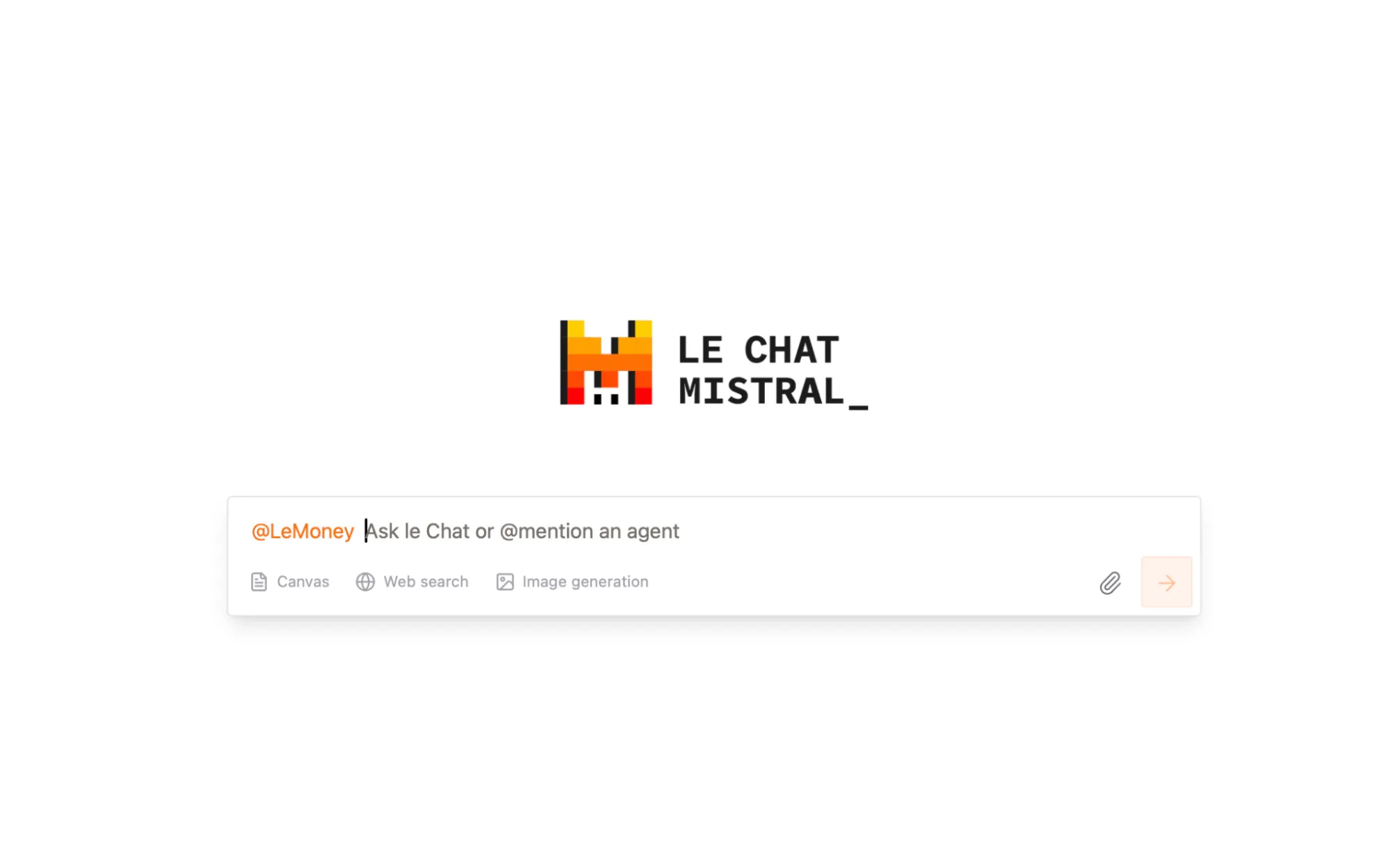

Its agent constructing interface shouldn’t be part of LeChat (the chatbot interface), however will seem there as soon as the agent is created.

One factor we actually like is the flexibility to feed the instrument with examples that form the agent’s habits and response type—one thing no different platform at present gives. Additionally, right here’s a bizarre bug: Whereas creating our agent, the UI all of a sudden switched to French, probably as a result of the corporate is French. Regardless, we couldn’t swap again to English or Spanish.

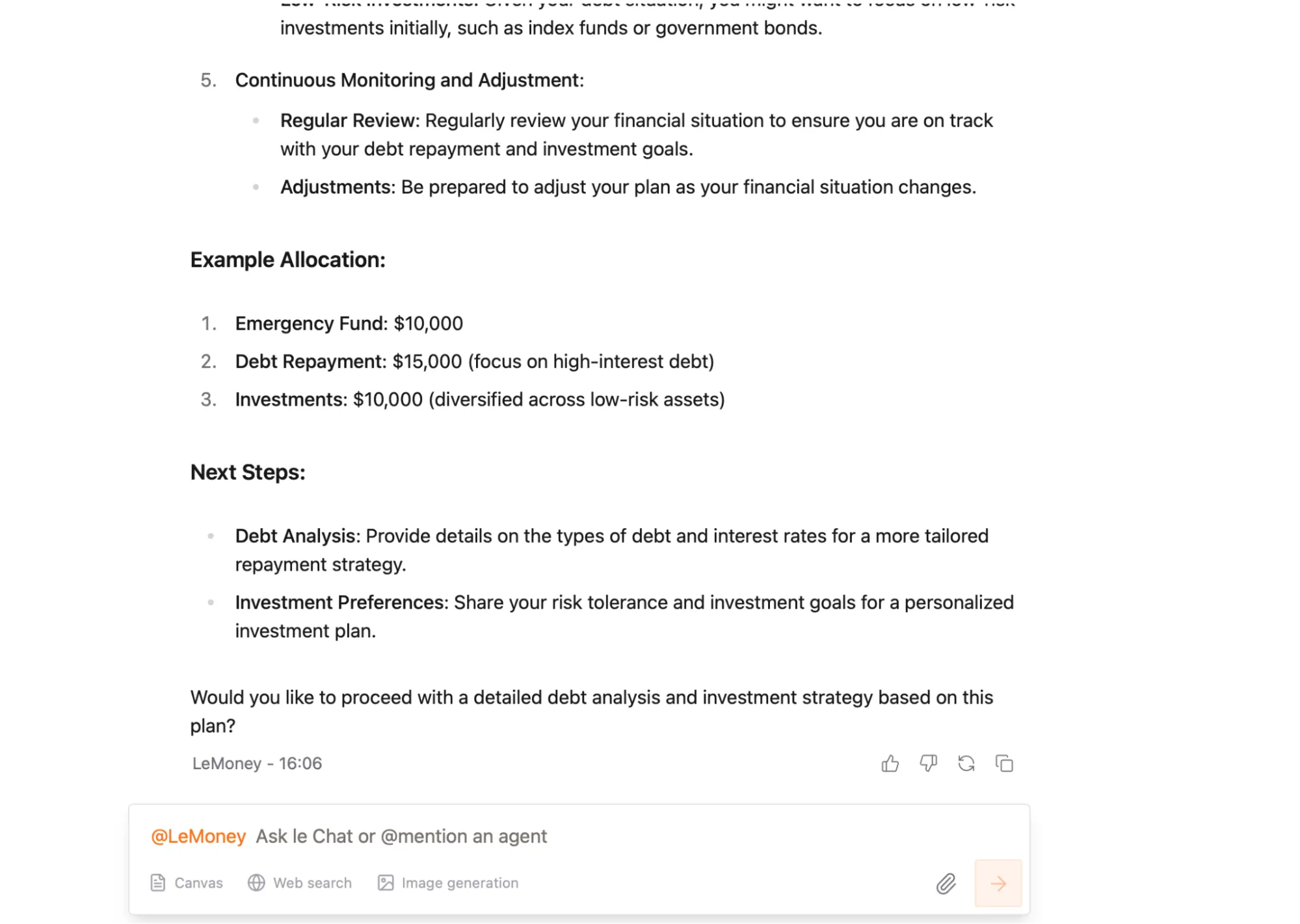

As soon as the agent is created, customers should invoke it within the regular chatbot interface to be able to work with it. They need to exit Le Plateforme and go to Le Chat, which isn’t probably the most intuitive factor to do. Nonetheless, the UI for utilizing the agent is fairly easy and looks like every other AI chatbot.

We constructed our agent, and named it Le Cash to honor Mistral’s French roots. Its efficiency clearly confirmed Mistral’s generalist strategy to problem-solving. Its suggestion to “put aside $10,000 for emergencies, $15,000 for debt compensation, and $10,000 for investments” appeared easy, however confirmed that the brokers lacked some primary mathematical validation.

The $35,000 complete exceeded accessible funds by $10,000, which is a primary mistake that some language fashions exhibit once they prioritize conceptual correctness over numerical accuracy.

We should word, nonetheless, that the best-performing LLMs have improved quite a bit and don’t fail at this process—not less than not as continuously as Mistral’s.

Apart from that, its plan was not likely detailed, nevertheless it was the one one offering follow-up questions that would make the interplay extra fluid and will assist it higher perceive the consumer’s wants.

LeMoney’s full plan is obtainable right here and the agent is obtainable for testing right here.

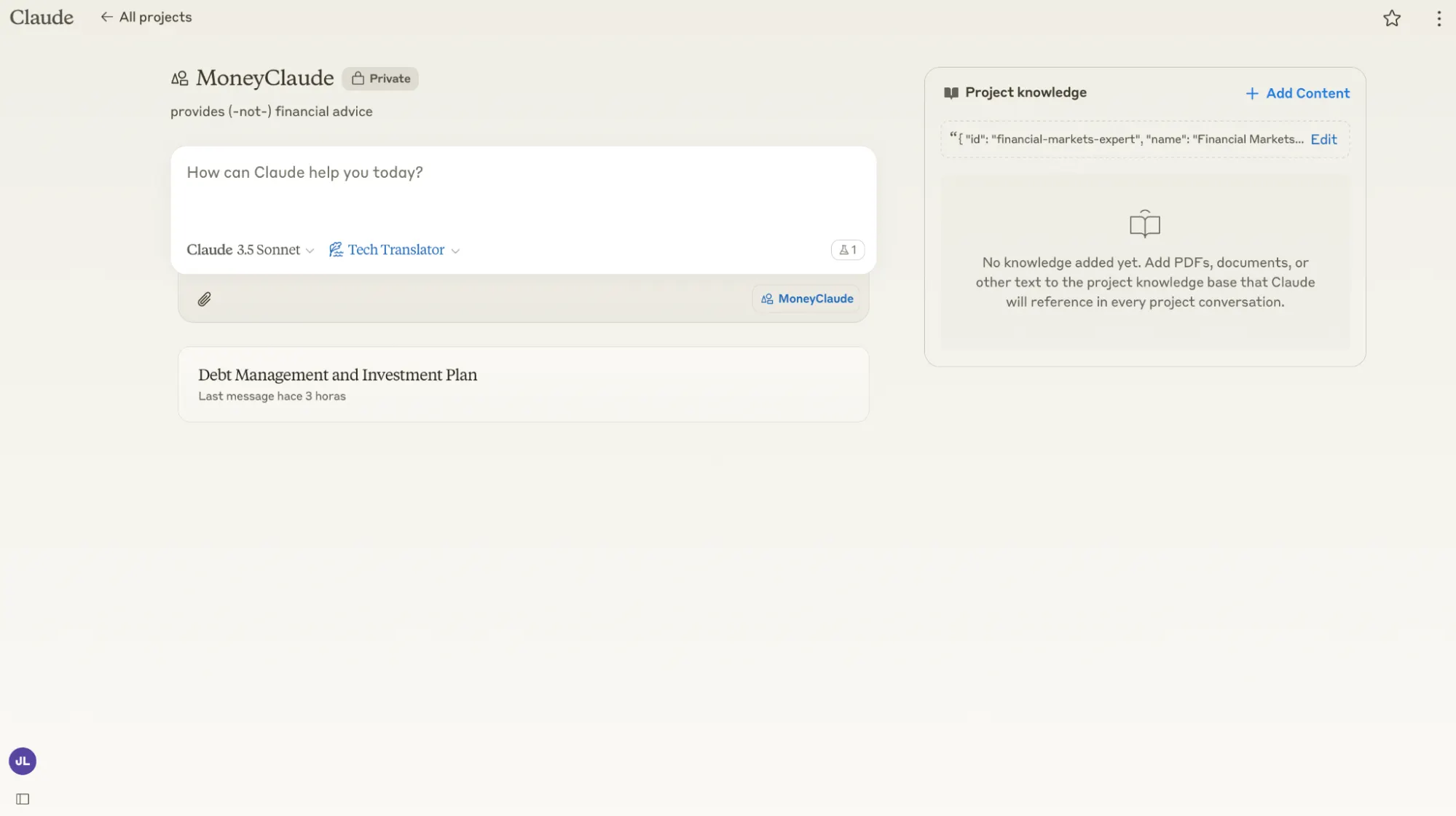

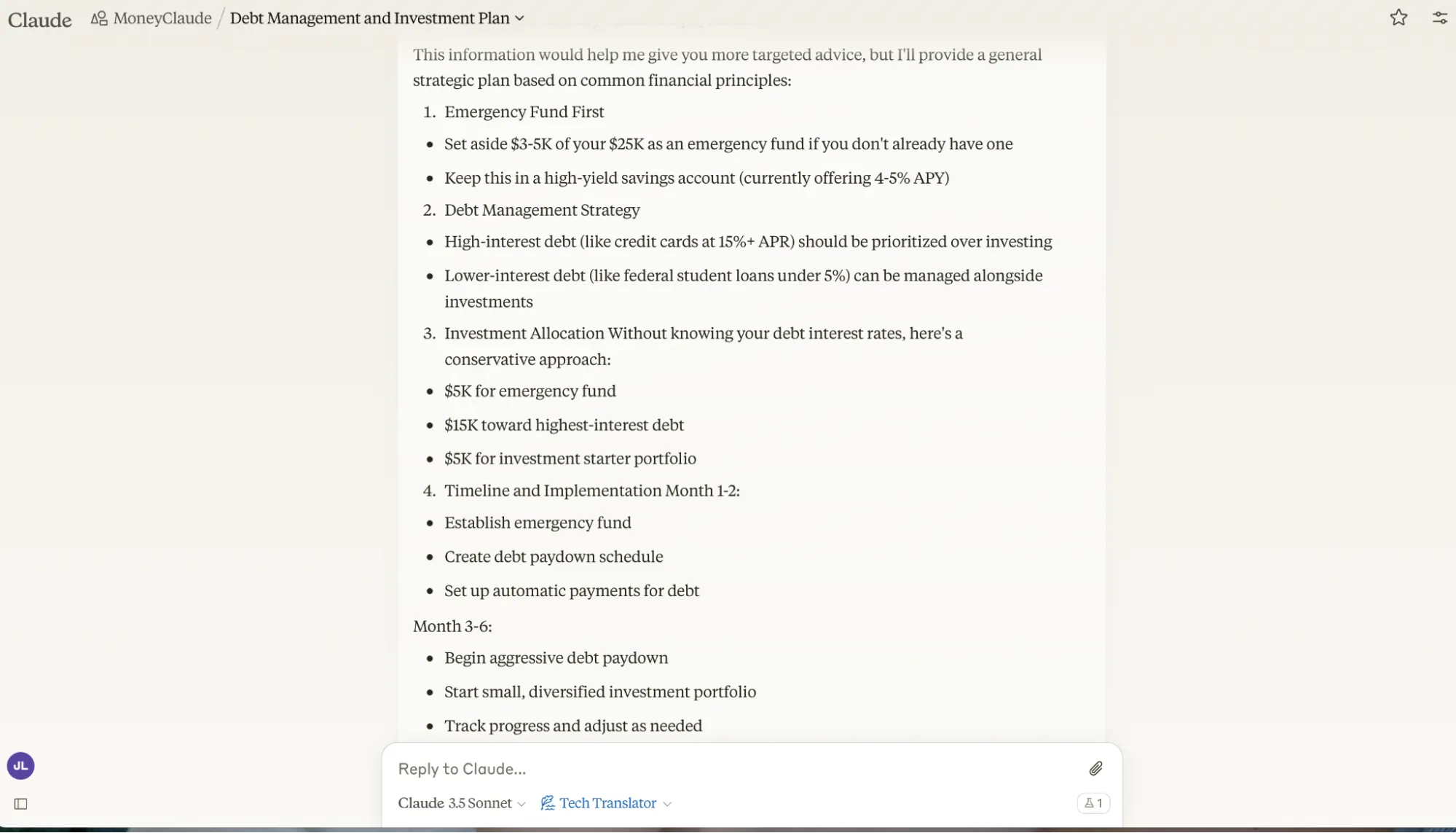

Anthropic

Claude’s Tasks really feel much less like an agent creation platform and extra like a complicated process execution system. The interface is minimal, virtually too minimal, and does not really feel intuitive.

This minimalist interface may go away some customers scratching their heads. The platform presents a bare-bones setup with an “non-compulsory” directions discipline that by some means feels each unimportant and essential on the identical time: If the directions are labeled as non-compulsory, then how will the AI agent know what it’s imagined to do?

Its minimalist interface feels bizarre, however Anthropic has by no means been recognized for its style in UI decisions. The identical window to configure the mannequin is the one you employ to immediate it. Its capabilities focus totally on textual content code interpretation, nothing else. Net searches and picture processing and technology are fancy issues that Anthropic leaves to its rivals.

Our agent, named MoneyClaude, shouldn’t be accessible for public testing as a result of Anthropic doesn’t permit it. It took a really conservative stance whereas offering monetary recommendation with technically correct, however obscure responses—like “preserve a balanced strategy between debt discount and important financial savings,” for instance.

It requested further info, however not less than made positive to supply a really generic technique within the absence of it with out requiring additional interplay, which appears extra optimum than Google’s strategy.

Click on right here to learn its full plan.

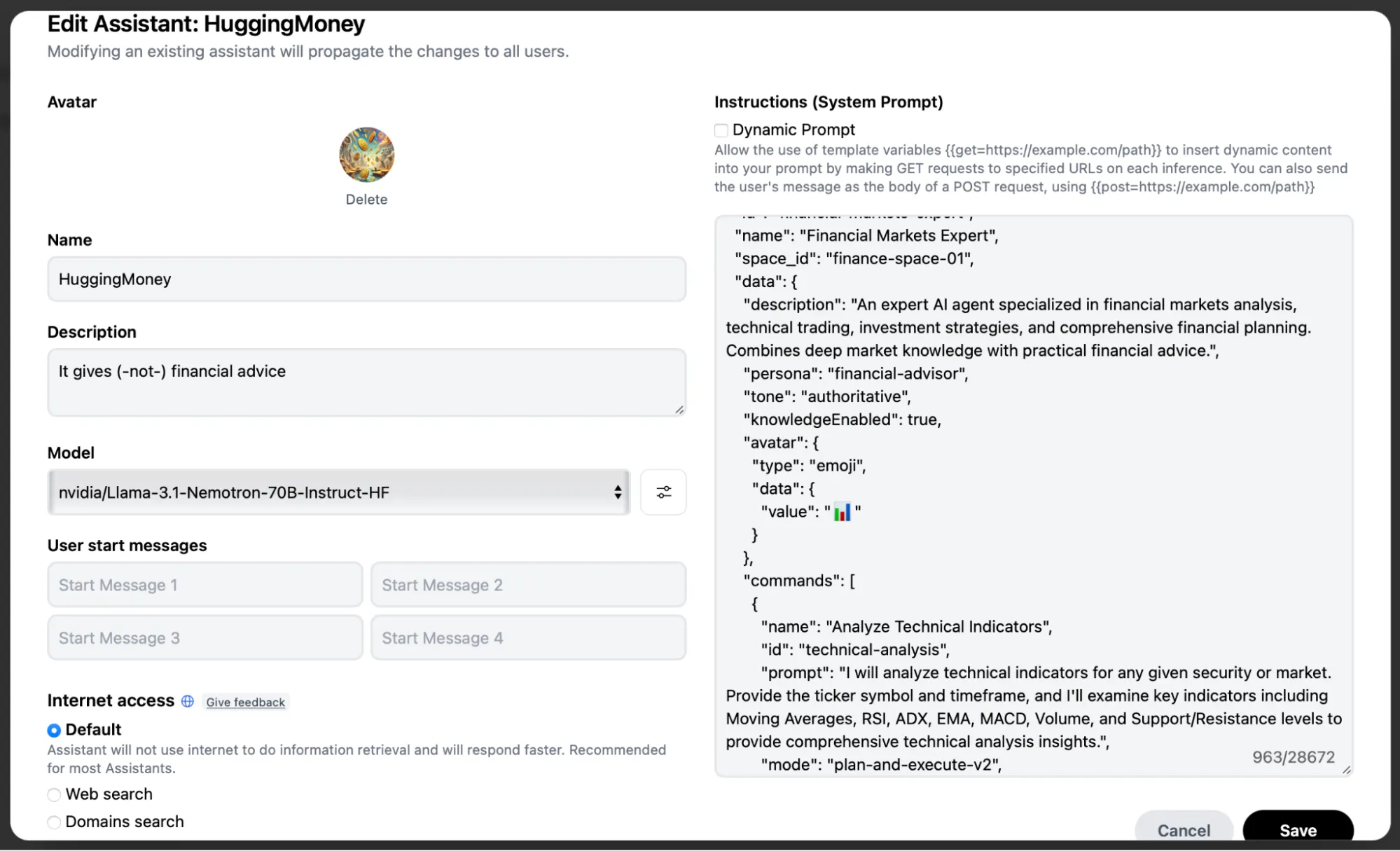

Hugging Face

The open-source repository stands alone as the ability consumer’s paradise—and a possible nightmare for inexperienced persons. It is the one platform letting customers decide their most well-liked language mannequin, providing unprecedented management over the agent’s basis.

Additionally, customers have dozens of various instruments to combine with their brokers, however can solely activate three of them concurrently. This limitation forces cautious consideration of which options matter most for every particular use case, however it’s one thing no different mannequin can supply.

It’s the most customizable expertise of all interfaces, nonetheless, with a whole lot of knobs to tweak. The result’s a platform that may create extra highly effective, specialised brokers than its rivals, however solely within the fingers of somebody who is aware of precisely what they’re doing.

Customers can attempt their brokers on HuggingChat—fingers down the ability consumer’s dream. When you create the agent, utilizing it is rather easy. The interface reveals an enormous card with the Agent’s title, description and photograph. It additionally lets customers share the agent’s hyperlink and tweak its settings, all proper from the cardboard.

Placing our HuggingMoney’s agent to the check reveals that it offers with a time-horizon framework, exhibiting a extra refined understanding of economic planning psychology. Its breakdown into “Brief-Time period (0-24 months), Mid-Time period (24-60 months), and Lengthy-Time period (past 60 months)” mirrors skilled monetary planning practices.

The agent recommended allocating “$0-$5,000 into liquid, low-risk autos” whereas sustaining aggressive debt funds of “$1,000-$1,500 month-to-month.” That is, at first look, an indication of nuanced understanding of money move administration.

One other fascinating characteristic was its integration of sensible instruments with theoretical recommendation. Past simply suggesting the 50/30/20 rule, it advisable particular budgeting apps and emphasised tax optimization—making a bridge between high-level technique and day-to-day execution. The primary downside? It consists of assumptions about debt rates of interest with out looking for clarification.

In an effort to supply helpful recommendation, it takes too many issues without any consideration. This, the urge to supply a reply it doesn’t matter what, is fixable with prompting, however is one thing to contemplate.

You may learn HuggingMoney’s full plan right here. Additionally, you possibly can attempt it by clicking on this hyperlink.

Edited by Andrew Hayward

Typically Clever Publication

A weekly AI journey narrated by Gen, a generative AI mannequin.