- Bitcoin’s 121% surge year-to-date has many traders betting on a fair larger cycle.

- In the meantime, the highest 10 shares within the S&P 500 have accounted for a staggering 59% of the index’s positive aspects since 2022.

2024 was a 12 months of highs and lows. Bitcoin [BTC] soared by 121%, securing its place because the seventh-largest asset with a market cap over $2 trillion.

In the meantime, the U.S. inventory market is now value a whopping $63.8 trillion, close to an all-time excessive.

However the story wasn’t all about positive aspects. The S&P 500 pulled off back-to-back 20%+ positive aspects for the primary time since 1998, whereas Bitcoin confronted a 22% dip from the earlier 12 months.

As we step into 2025, diversification is extra essential than ever. Traders are eyeing excessive returns whereas maintaining an in depth watch on macro tendencies.

So, within the midst of all this, which asset ought to dominate your portfolio within the 12 months forward?

Weighing the dangers and rewards of Bitcoin vs. shares

Only a week into 2025, and the crypto market has already shifted into the greed part. Clearly, Bitcoin’s 121% surge year-to-date has traders all-in, betting on a fair larger cycle forward.

Because of this, BTC is climbing steadily, with consecutive inexperienced candlesticks and each day positive aspects of 1-2%. So, from a psychological standpoint, it’s clear that traders are totally invested within the digital asset.

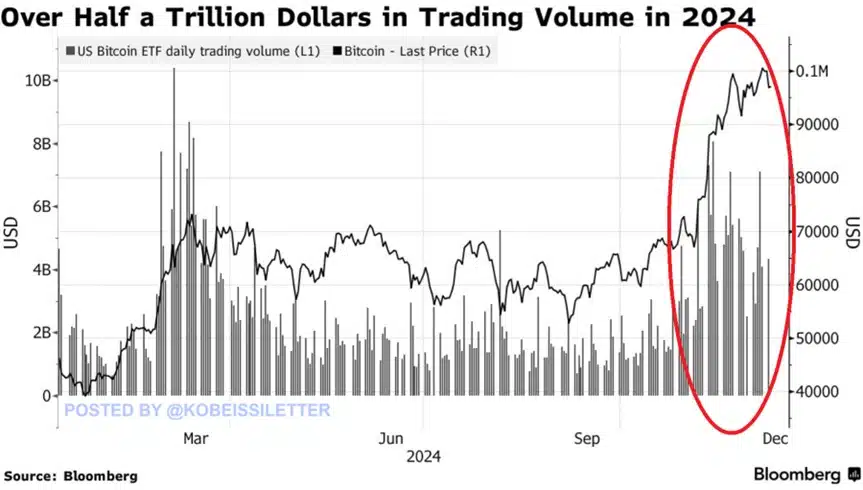

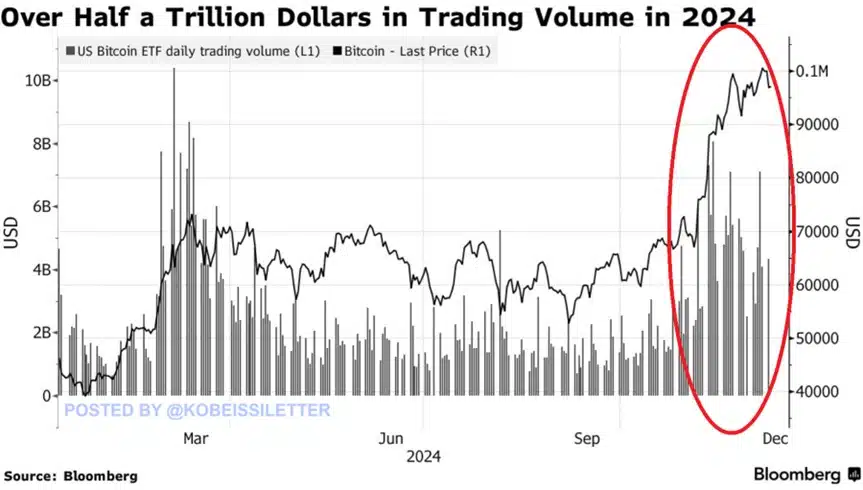

However right here’s the catch: Even with a staggering $500 billion in cumulative each day buying and selling quantity of the U.S. Bitcoin ETFs final 12 months, and $37 billion in web inflows, Bitcoin’s double-digit dip from 2023 nonetheless raises issues.

Supply: Bloomberg

So as to add to the uncertainty, BlackRock’s (IBIT) BTC ETF noticed a staggering outflow of $333 million on the 2nd of January – its largest sell-off ever.

With the U.S. authorities dealing with a large $7 trillion debt compensation this 12 months, it’s no surprise that traders are exercising warning. If this pattern continues, extra outflows might shake up the crypto market even additional.

In the meantime, the S&P 500 index has surged 23.8% year-to-date, following a powerful 24.2% acquire in 2023. And of the highest six property, excluding gold, 5 are dominated by shares.

However right here’s the kicker: this checklist is more and more tech-heavy. In truth, the highest 10 shares within the S&P 500 at the moment are almost 800 occasions bigger than the typical inventory within the index.

So, what does that imply for Bitcoin? Even with the dominance of tech giants, Bitcoin remains to be holding its personal. It’s trailing solely Alphabet (Google) with a market cap of $2.35 trillion.

And if Bitcoin hits $120K this 12 months, it might even make a bounce into the highest 5.

A novel benefit suggestions the size in Bitcoin’s favor

Regardless of their spectacular performances, each Bitcoin and shares are nonetheless thought-about “dangerous” investments – particularly when stacked up towards extra steady choices like bonds or gold.

Nevertheless, there’s one key issue that units Bitcoin aside, positioning it as a more sensible choice when the market turns robust.

Neglect in regards to the flashy YTD returns or the thrill round ETFs and institutional backing. The actual benefit lies in Bitcoin’s rising recognition by governments.

Whereas Bitcoin nonetheless has an extended method to go earlier than matching gold’s $18 trillion market cap, the rising narrative of BTC probably overtaking gold as the final word safe-haven asset sooner or later is highly effective.

With this in thoughts, BTC might probably shut 2025 with triple-digit returns, making it a compelling funding for you.

Learn Bitcoin [BTC] Value Prediction 2025-2026

In distinction, whereas the S&P 500’s high shares shine, the broader market may not be as resilient.

Total, Bitcoin’s rising profile makes it a powerful hedge towards market dangers that different property like shares would possibly battle – particularly as market volatility is anticipated to surge within the coming months.