Coinbase, the biggest cryptocurrency alternate in america, is contemplating providing tokenized shares of its COIN inventory to home customers by way of its Ethereum Layer-2 community, Base.

This transfer might mix conventional shares with blockchain know-how, placing Coinbase forward in monetary innovation.

Regulatory Readability Key to Coinbase’s Tokenized Shares Rollout within the US

Jesse Pollak, Base’s lead developer, revealed that Coinbase continues to be within the early phases of exploring this initiative. He acknowledged that regulatory compliance is the first impediment.

Pollak emphasised that Coinbase is dedicated to addressing these challenges to make sure a safe and lawful rollout of tokenized belongings.

“We’re in an exploratory section and dealing to know what must be unlocked from a regulatory perspective to carry belongings like $COIN to Base in a protected, compliant, future-looking approach,” Pollak said.

At present, tokenized COIN shares can be found solely to worldwide customers by way of decentralized platforms. Pollak said that increasing this entry inside the US hinges on clearer regulatory tips. Furthermore, such developments might open the door for blockchain-based monetary techniques to a broader viewers.

In the meantime, Pollak hinted that the tokenized COIN shares may very well be the primary of many such merchandise on the Base community. Over the previous yr, the Ethereum Layer-2 community shortly gained traction and have become a big participant within the business, with over $3.84 billion in whole worth locked (TVL).

Pollak expressed confidence within the platform’s potential to achieve $1 trillion in managed belongings. In keeping with him, this might additional cement Base’s function as a hub for next-generation monetary options.

“We’re going to carry $1 trillion belongings to Base and it’s going to occur sooner than anybody expects,” Pollak added.

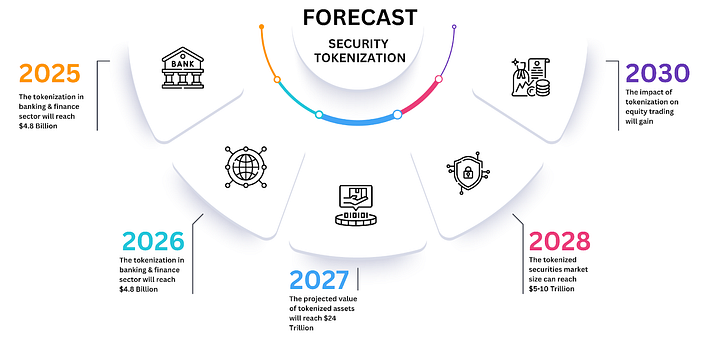

In the meantime, Coinbase transfer towards tokenization isn’t a surprise, contemplating the sector’s speedy development over the previous yr. Business leaders, together with Bitwise CEO Hunter Horsley, imagine tokenization might reshape fairness markets by making a extra inclusive capital market system.

Horsley highlighted that tokenization might allow smaller companies to entry fairness markets with out the huge scale historically required for public choices.

“As we speak, there are round 4,600 corporations within the US which are in a position to entry the general public fairness markets. The NAICs estimates there are over 200,000 corporations within the US doing over $10M in income. Not all corporations need to be public in fact; however many merely can’t as a result of it requires immense scale. Enter tokenization, a brand new democratized capital market,” Horsley said.

Certainly, Coinbase is the primary publicly traded crypto alternate within the US, with a market capitalization of round $70 billion. Austin Campbell, an adjunct professor at Columbia Enterprise College, lately praised the agency for its pivotal function in resisting what he referred to as extreme regulatory overreach towards the crypto business within the US.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.