Disclaimer: The opinions expressed by our writers are their very own and don’t signify the views of U.As we speak. The monetary and market info offered on U.As we speak is meant for informational functions solely. U.As we speak just isn’t responsible for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your personal analysis by contacting monetary specialists earlier than making any funding selections. We consider that each one content material is correct as of the date of publication, however sure provides talked about could now not be obtainable.

Bitcoin (BTC) is displaying true management within the digital foreign money ecosystem amid its hovering worth. Present market information pegs the worth of BTC at $99,399.18, up by 1.6% prior to now 24 hours. For Bitcoin, progress because the begin of the 12 months stays linearly bullish, with rather a lot volatility to match.

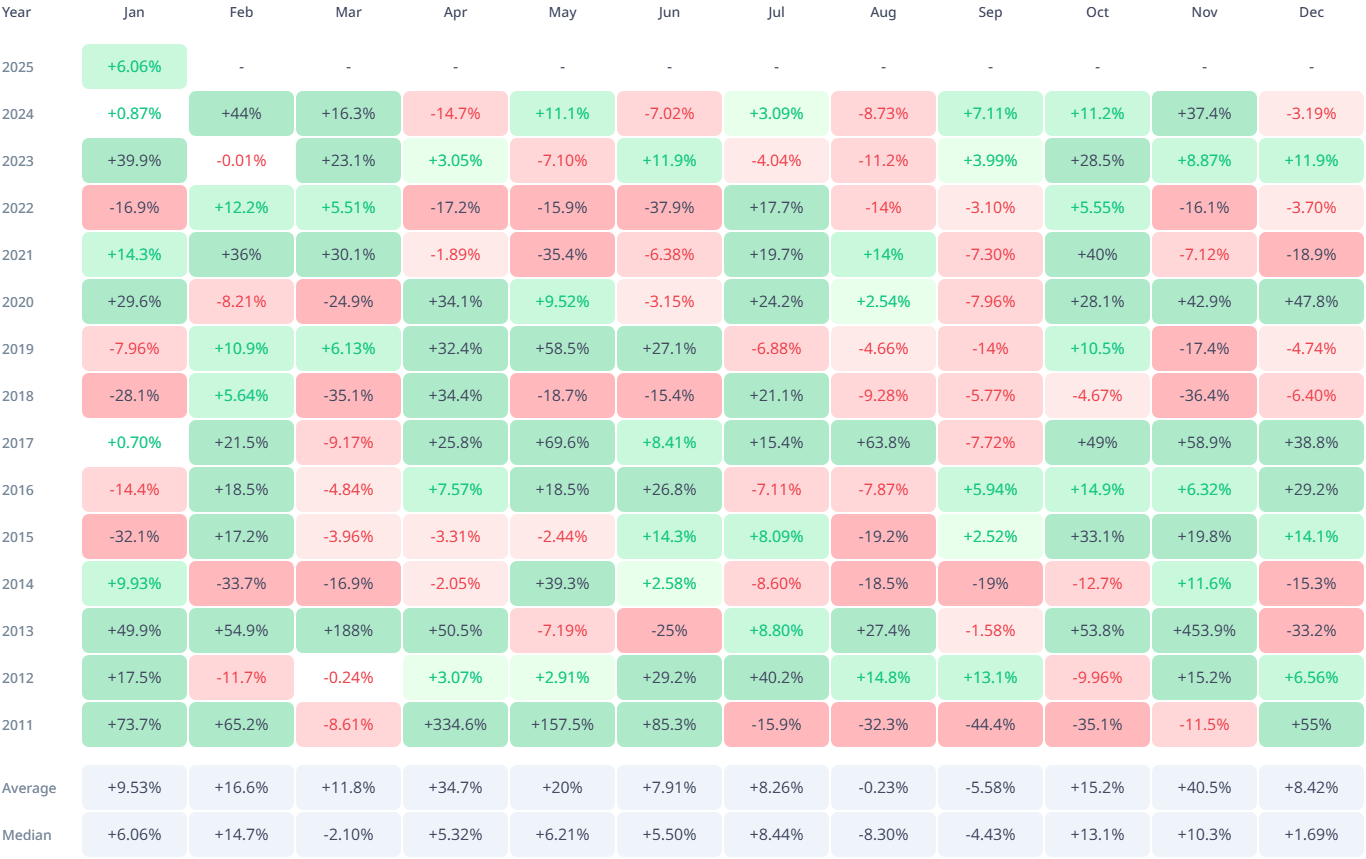

Bitcoin worth beating historical past

Information from Cryptorank showcases what this month holds for the worth of Bitcoin. Traditionally, January stays a mildly bullish month for the coin. Bitcoin’s worth had a mean progress fee of 9.55% in January.

Simply six days into the month, Bitcoin has already jumped by 6.32%, setting a bullish tempo. If this momentum is sustained, chances are high the coin may hit a historic excessive, as final seen in January 2023, when it jumped 39%.

The expansion of BTC is tied to many components, together with the extent of adoption of spot Bitcoin ETF merchandise and the impression of Bitcoin whales. So far, each courses of patrons have taken cautious approaches to the coin, because the coin retains flashing the overbought sign.

Whereas companies like MicroStrategy have intentions to maintain shopping for Bitcoin, making a pure demand amid the restricted every day provide, some pessimists stay who consider the coin’s worth may slip quickly.

In the meantime, this pessimistic view just isn’t mirrored within the coin’s present worth because it brandishes 5.76% progress week-to-date (WTD).

Profitability stays main issue

The value of BTC maintains sturdy resilience regardless of the extraordinary volatility that masks its progress.

Whereas merchants stay not sure concerning the short-term prospects of the coin, 94.82% of all BTC addresses, or 51.21 million wallets are in revenue, making the prospects of a sell-off low. The cautious sentiment may stay because the coin confronts a light promote wall across the $100,000 worth.

If Bitcoin information a constructive every day shut round this vary, it’d reclaim its $108,000 all-time excessive (ATH).