Whereas the crypto group is anticipating a robust 2025 after Donald Trump’s return to the Oval Workplace, new studies present that the Trump-led rally may face roadblocks.

As 2025 begins, the crypto buying and selling atmosphere exhibits combined traits following the December FOMC assembly and the festive vacation season.

Bitcoin Rally Dangers Dropping Momentum Regardless of Trump’s Assist

In response to 10x Analysis, Q1 2025 may not witness the identical stage of momentum that late January to March 2024 or late September to mid-December confirmed.

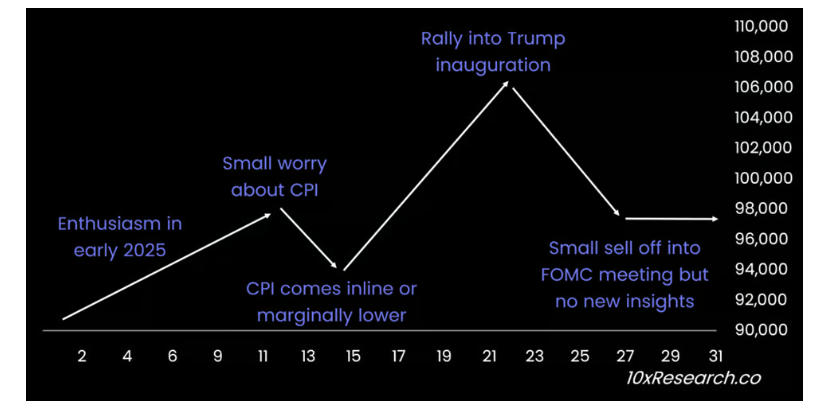

The discharge of the Client Value Index (CPI) knowledge on January 15 is a key occasion to look at. A pullback ought to be anticipated main into the CPI knowledge launch, and the market may rally once more if there are favorable outcomes.

“A positive inflation print may reignite optimism, fueling a rally into the Trump inauguration on January 20,” 10x founder Mark Thielen wrote.

Nonetheless, the momentum generated by such a rally could also be short-lived. Thielen added that the market will seemingly retreat forward of the FOMC assembly on January 29. He projected that Bitcoin will probably be within the $96,000 to $98,000 vary by the tip of January.

Bitcoin hit new all-time highs in This autumn 2024 following the Fed’s 25-basis-point rate of interest cuts. The speed cuts in September have been additionally extremely bullish for the crypto market.

Bitcoin Dominance Persists in 2025

One other issue to think about whereas discussing the BTC worth trajectory in 2025 is Bitcoin’s dominance. In response to the 10x report, from January 2024 to mid-November, Bitcoin’s market share surged from 50% to 60%, exerting important strain on altcoins.

As Bitcoin’s dominance rose, many altcoins struggled to achieve traction, making it troublesome for traders to see substantial returns outdoors of Bitcoin.

There was a quick interval when Bitcoin dominance dipped to 53% over a span of three weeks, sparking hopes for an altcoin season. Nonetheless, this dip was short-lived, and Bitcoin dominance rapidly rebounded to just about 58%, settling round 55% as of late 2024. This consolidation across the 55% stage alerts that Bitcoin stays firmly in charge of the market.

For traders, this highlights the significance of carefully monitoring Bitcoin’s dominance. At press time, Bitcoin dominance was round 57% whereas worth was buying and selling at $99,225.

The Bitcoin projections from 10xResearch come as CoinShares head of analysis James Butterfill final week forecasted that Bitcoin may see potential peaks at $150,000 and corrections right down to $80,000 in 2025.

Equally, Bitwise asset administration projected that Bitcoin may attain $200,000 by the tip of the yr.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.