SPX has prolonged its good points and risen by one other 15% on Monday. This double-digit worth hike has made it the market’s high gainer over the previous 24 hours.

Nonetheless, the rising bearish sentiment surrounding the cryptocurrency raises issues a couple of potential worth correction within the coming days.

SPX6900 Sees Surge in Brief Bets

Since January 1, the SPX6900 worth has been on a powerful streak, setting new all-time highs day by day. On January 5, the token’s worth climbed to a brand new all-time excessive of $1.56. With a 15% achieve previously 24 hours, SPX could seem poised to increase its good points.

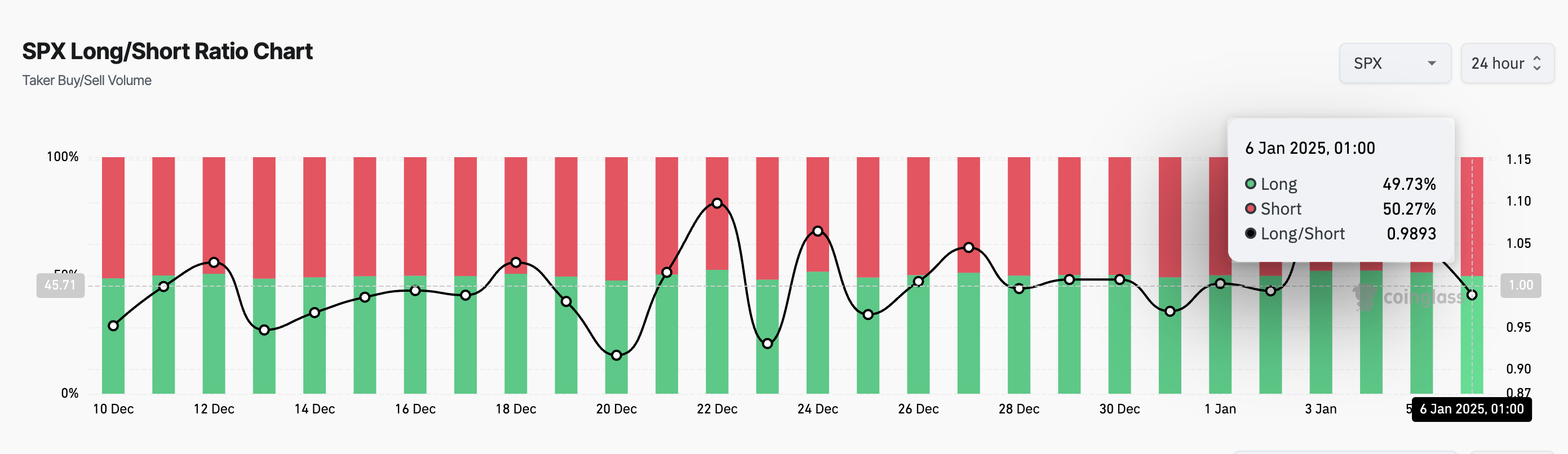

Nonetheless, the rising bearish sentiment towards the altcoin may create roadblocks within the quick time period. Regardless of its worth hike, SPX futures merchants have begun inserting quick bets in anticipation of a worth dip. That is mirrored in its Lengthy/Brief Ratio, which is 0.98 at press time.

An asset’s Lengthy/Brief Ratio compares the variety of its lengthy (purchase) positions to quick (promote) positions in a market. As with SPX, when its worth is beneath one, extra merchants are betting on the worth falling (shorting) reasonably than rising. If quick sellers proceed to dominate, this may create downward stress on the worth.

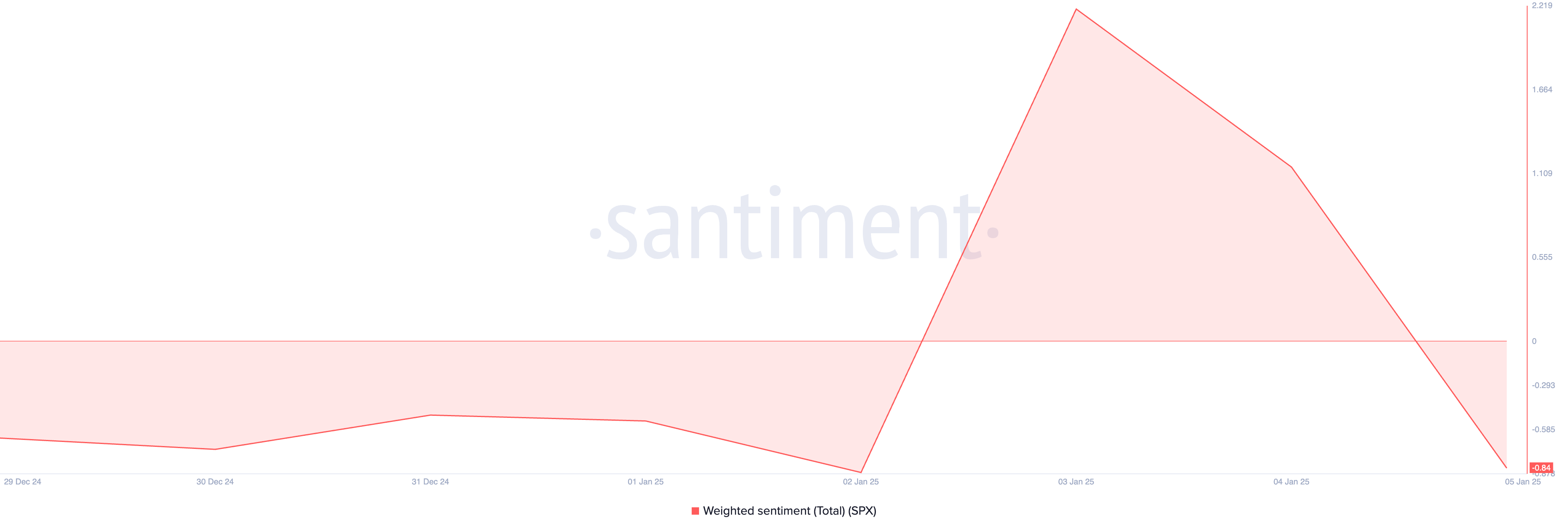

Notably, SPX’s weighted sentiment, which measures the general optimistic or detrimental sentiment in the direction of it, confirms this rising bearish bias. At press time, that is -0.84.

A worth beneath one signifies a detrimental bias within the sentiment surrounding the asset. It means there are considerably extra detrimental mentions than optimistic mentions, which can impression the asset’s worth.

SPX Value Prediction: Correction or New Excessive?

On the day by day chart, SPX is overbought, as mirrored by its Relative Energy Index (RSI), which is at 79.33 as of this writing.

The RSI indicator measures an asset’s oversold and overbought market situations. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. Conversely, values beneath 30 counsel that the asset is oversold and will witness a rebound.

At 79.33, SPX’s RSI signifies that it’s closely overbought, suggesting a possible worth correction or reversal could also be imminent. If this occurs, its worth might dip to $1.18.

Alternatively, if the uptrend continues, the SPX6900 worth may contact a brand new all-time excessive, probably triggering a brief squeeze.

Disclaimer

Consistent with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.