Stellar (XLM) worth has surged 34% over the previous seven days, demonstrating robust bullish momentum. The coin is buying and selling between vital ranges, with resistance at $0.47 and help at $0.41, as buyers await its subsequent transfer.

Whereas current features have been pushed by a golden cross formation, indicators from the CMF and DMI point out the uptrend could also be dropping steam. If XLM can break resistance at $0.47, it may goal $0.51 and even $0.60, however failure to carry help at $0.41 might lead to a pointy correction.

XLM Stays in an Uptrend, however Sellers Could Take Over

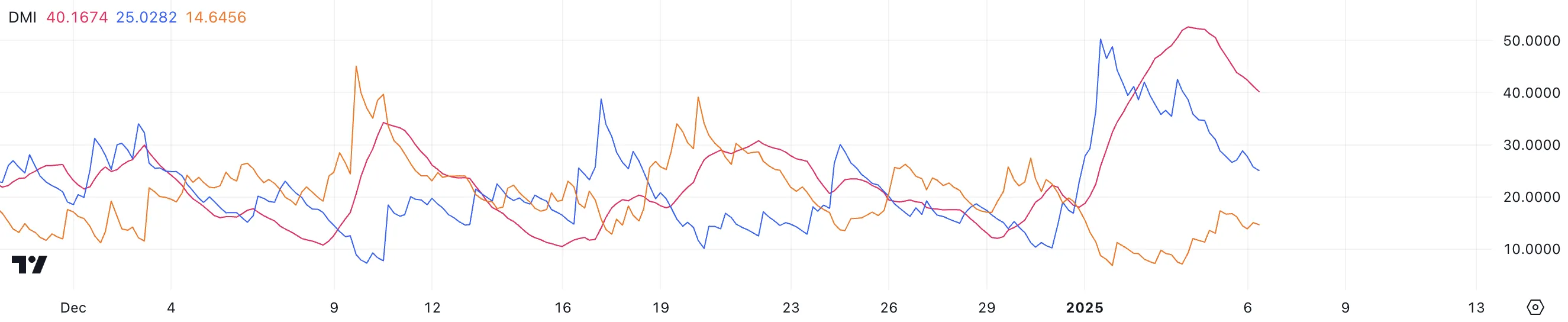

The Common Directional Index (ADX) for XLM at present stands at 40.1, reflecting a powerful pattern, though it has declined from 52.6 two days in the past. The ADX measures the power of a pattern on a scale from 0 to 100, with values above 25 indicating a powerful pattern and people beneath 20 signaling weak or absent momentum.

Regardless of the decline, the ADX stays firmly above the 25 threshold, confirming that Stellar continues to be in an uptrend, although the momentum seems to be easing.

The +DI, representing shopping for strain, has dropped to 25 from 40.3 two days in the past, whereas the -DI, which tracks promoting strain, has risen to 14.6 from 7.9.

This shift means that whereas patrons nonetheless keep management, their dominance is waning as sellers step by step achieve floor. If the pattern continues, XLM uptrend may weaken additional, doubtlessly resulting in consolidation or a reversal until shopping for momentum strengthens.

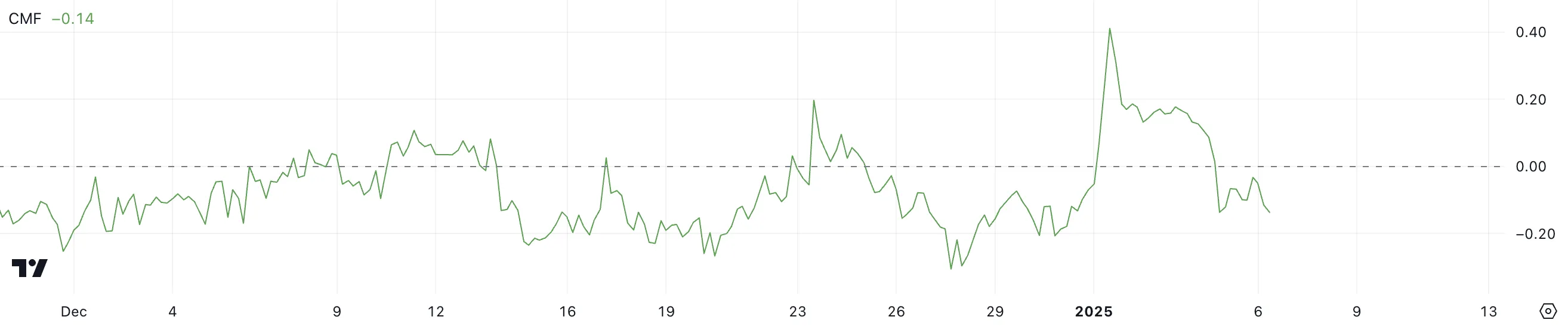

Stellar CMF Is Down From Its Highest Worth In One Yr

The Chaikin Cash Move (CMF) for XLM is at present at -0.14, marking a big shift from its peak of 0.41 on January 1, its highest worth in a single 12 months. The CMF measures the circulate of cash into and out of an asset primarily based on worth and quantity, with values above 0 indicating web shopping for strain and values beneath 0 suggesting web promoting strain.

Stellar transfer into destructive territory highlights a transition from robust inflows to elevated outflows, signaling a shift in market sentiment.

This decline means that promoting strain has overtaken shopping for exercise, which may weigh on XLM’s worth within the quick time period. With the CMF falling from 0.17 simply two days in the past to its present degree, the pattern factors to a lack of confidence amongst buyers.

If the CMF stays destructive or continues to drop, XLM worth may face further downward strain. Nonetheless, a restoration again into constructive territory may sign renewed curiosity and doubtlessly stabilize or raise the worth.

XLM Worth Prediction: Can Stellar Reclaim $0.60 In January?

XLM’s EMA strains spotlight the golden cross that shaped on January 1, which drove current worth features. At the moment, XLM is buying and selling between a resistance at $0.47 and a help at $0.41, with the resistance appearing as a barrier in previous makes an attempt.

If the $0.47 resistance is damaged, Stellar worth may rise to $0.51 and doubtlessly check $0.60 if bullish momentum strengthens.

Nonetheless, indicators from the CMF and DMI counsel that the uptrend could also be weakening. If the help at $0.41 fails, XLM worth may face a big pullback, doubtlessly dropping to $0.35 and even $0.31.

Disclaimer

According to the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.