Crypto-related merchandise recorded a outstanding $44.2 billion in inflows final 12 months—nearly 4 occasions larger than the earlier all-time excessive of $10.5 billion set in 2021.

In response to CoinShares’ newest report, this record-breaking efficiency is attributed to the introduction of US spot-based exchange-traded funds (ETFs), which considerably influenced international investments.

Bitcoin ETFs dominate

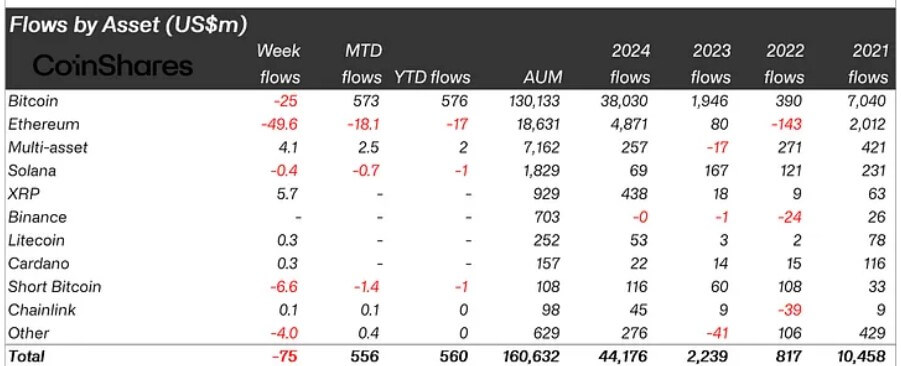

Bitcoin dominated the scene, drawing $38 billion in inflows and accounting for 29% of the entire property underneath administration (AuM).

This important influx additionally resulted in a notable improve in Bitcoin ETFs’ holdings, which surpassed a million BTC in lower than a 12 months of their launch.

Main merchandise like BlackRock’s IBIT and Constancy’s FBTC attracted essentially the most curiosity. Notably, IBIT turned essentially the most profitable ETF launch previously decade by outperforming almost 3,000 different ETFs.

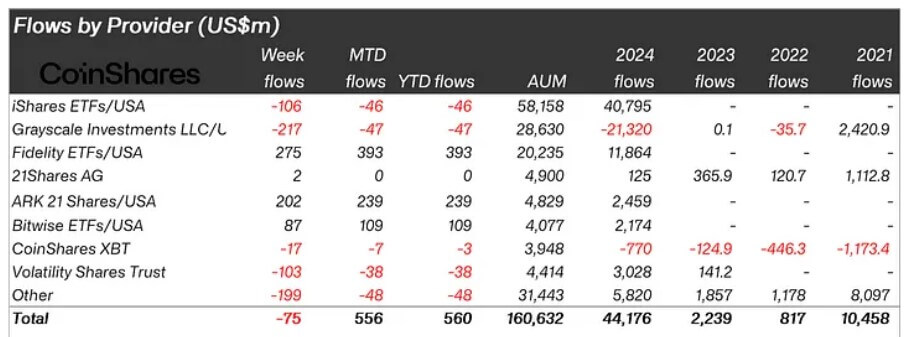

Then again, Grayscale’s GBTC noticed essentially the most outflows final 12 months as buyers withdrew greater than $21 billion from the fund for cheaper options.

Nonetheless, the ETF merchandise’ optimistic flows resulted within the US main international inflows, because it attracted nearly all the $44.4 billion, adopted by Switzerland with $630 million.

Nevertheless, important outflows from Canada and Sweden—totaling $707 million and $682 million, respectively—partially offset these features.

James Butterfill, CoinShares head of analysis, identified that the outflows recommend a shift in investments from these areas to US-based merchandise, underscoring the rising enchantment of the American crypto market.

He additionally famous that Bitcoin climb to a brand new all-time excessive of greater than $100,000 final 12 months resulted in brief BTC merchandise seeing inflows of $116 million.

Ethereum resurgence

Ethereum additionally stood out for its efficiency, particularly for its resurgence within the latter a part of the 12 months.

The digital asset secured $4.8 billion in inflows as its ETH spot-based ETFs ended the 12 months strongly. This influx represented 26% of its AuM, which is 2.4 occasions larger than its 2021 complete and vastly exceeds its 2023 efficiency.

In the meantime, Ethereum’s features outpaced its everlasting rival Solana, which managed $69 million in inflows, representing simply 4% of its AuM.

Different large-cap various cash, akin to Polkadot, Cardano, XRP, and others, collectively attracted $813 million, accounting for 18% of their AuM.

2025 flows

In the meantime, this 12 months has began on a optimistic word for Bitcoin funding merchandise within the US, with inflows reaching $666 million within the first two buying and selling days.

Nevertheless, based on Farside information, Jan. 3 noticed a $908 million influx in a single day, with Constancy main at $357 million, simply forward of BlackRock and Ark Make investments at $253 million and $222 million, respectively.